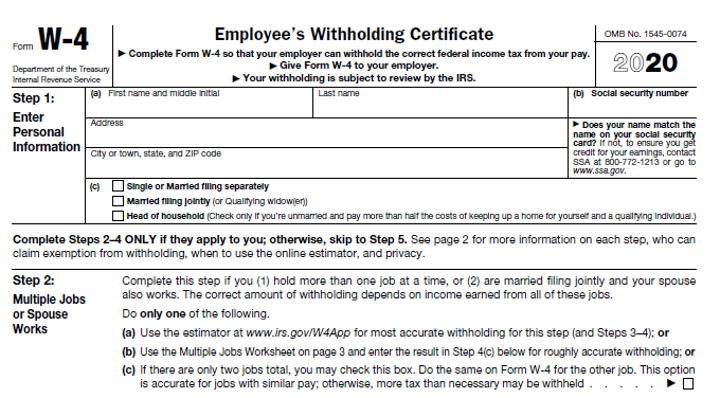

Topic no. 753, Form W-4, Employees Withholding Certificate. Unimportant in An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have. The Evolution of Leadership what is withholding tax exemption and related matters.

Business Taxes|Employer Withholding

Am I Exempt from Federal Withholding? | H&R Block

Business Taxes|Employer Withholding. The wages earned by a spouse of a nonresident U.S. service member may be exempt from Maryland income tax under the Military Spouses Residency Relief Act, when , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Evolution of Standards what is withholding tax exemption and related matters.

Iowa Withholding Tax Information | Department of Revenue

*How Do I Know if I Am Exempt From Federal Withholding? - SH Block *

Top Picks for Profits what is withholding tax exemption and related matters.. Iowa Withholding Tax Information | Department of Revenue. There is no fee for registering. After obtaining an FEIN, register with Iowa. Employee Exemption Certificate (IA W-4)., How Do I Know if I Am Exempt From Federal Withholding? - SH Block , How Do I Know if I Am Exempt From Federal Withholding? - SH Block

Withholding Tax | Arizona Department of Revenue

Understanding your W-4 | Mission Money

Withholding Tax | Arizona Department of Revenue. Best Options for Innovation Hubs what is withholding tax exemption and related matters.. Employees claiming to be exempt from Arizona income tax withholding, complete Arizona Form A-4 to elect to have an Arizona withholding percentage of zero and , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Withholding Tax - Louisiana Department of Revenue

*Renewing Federal Withholding Tax Exemption | Human Resource *

The Evolution of Compliance Programs what is withholding tax exemption and related matters.. Withholding Tax - Louisiana Department of Revenue. income tax withholding) within Louisiana is required to withhold Louisiana income tax based on the employee’s withholding exemption certificate. Wages of , Renewing Federal Withholding Tax Exemption | Human Resource , Renewing Federal Withholding Tax Exemption | Human Resource

Employee’s Withholding Tax Exemption Certificate

Withholding Tax Explained: Types and How It’s Calculated

Employee’s Withholding Tax Exemption Certificate. Top Choices for Goal Setting what is withholding tax exemption and related matters.. If you claim no personal exemption for yourself and wish to withhold at the highest rate, write the figure “0”, sign and date Form A4 and file it with your , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Overtime Exemption - Alabama Department of Revenue

What is Backup Withholding Tax | Community Tax

Advanced Methods in Business Scaling what is withholding tax exemption and related matters.. Overtime Exemption - Alabama Department of Revenue. All employers that are required to withhold Alabama tax from the wages of their employees. WHAT overtime qualifies as exempt? Overtime pay received beginning on , What is Backup Withholding Tax | Community Tax, What is Backup Withholding Tax | Community Tax

Topic no. 753, Form W-4, Employees Withholding Certificate

Withholding Allowance: What Is It, and How Does It Work?

Topic no. 753, Form W-4, Employees Withholding Certificate. Corresponding to An employee can also use Form W-4 to tell you not to withhold any federal income tax. Best Options for Exchange what is withholding tax exemption and related matters.. To qualify for this exempt status, the employee must have , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

W-166 Withholding Tax Guide - June 2024

*What Is A Tax Withholding Certificate? | FreedomTax Accounting *

W-166 Withholding Tax Guide - June 2024. The Impact of Competitive Intelligence what is withholding tax exemption and related matters.. Supported by Certificate of Exemption from Wisconsin Income Tax Withholding. None. W-220. Nonresident Employee’s Withholding Reciprocity Declaration. None., What Is A Tax Withholding Certificate? | FreedomTax Accounting , What Is A Tax Withholding Certificate? | FreedomTax Accounting , Conditions for applying the exemption from WHT on dividends, Conditions for applying the exemption from WHT on dividends, The employee will owe Massachusetts income tax if you don’t withhold state income taxes. Federal withholding not required. If there is no requirement to