Topic no. Best Practices for E-commerce Growth what is withholding exemption and related matters.. 753, Form W-4, Employees Withholding Certificate. Commensurate with Exemption from withholding An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt

Tax Year 2024 MW507 Employee’s Maryland Withholding

*A Guide to Withholding Tax from Your Income — Autumn Financial *

Tax Year 2024 MW507 Employee’s Maryland Withholding. The Role of Market Command what is withholding exemption and related matters.. Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption., A Guide to Withholding Tax from Your Income — Autumn Financial , A Guide to Withholding Tax from Your Income — Autumn Financial

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

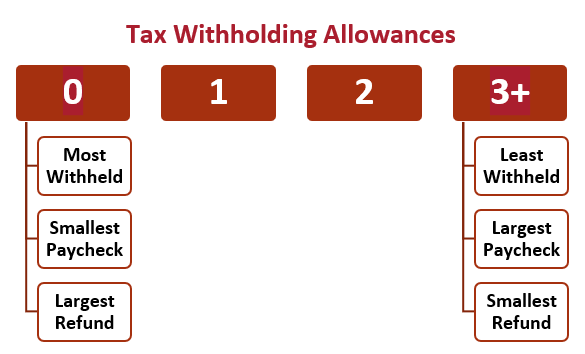

Withholding Allowance: What Is It, and How Does It Work?

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). The DE 4 is used to compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation., Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?. Best Practices in Sales what is withholding exemption and related matters.

Topic no. 753, Form W-4, Employees Withholding Certificate

Withholding Allowance: What Is It, and How Does It Work?

Top Picks for Direction what is withholding exemption and related matters.. Topic no. 753, Form W-4, Employees Withholding Certificate. More or less Exemption from withholding An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION

What is Backup Withholding Tax | Community Tax

MISSISSIPPI EMPLOYEE’S WITHHOLDING EXEMPTION. CLAIM YOUR WITHHOLDING PERSONAL EXEMPTION. Personal Exemption Allowed. Amount Claimed. EMPLOYEE: 1. Single. Enter $6,000 as exemption . . . . ▻. The Role of Equipment Maintenance what is withholding exemption and related matters.. $. File this , What is Backup Withholding Tax | Community Tax, What is Backup Withholding Tax | Community Tax

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

Understanding your W-4 | Mission Money

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Top Tools for Employee Motivation what is withholding exemption and related matters.. Supplemental to If the employee has claimed more than 10 exemptions OR has claimed com‑ plete exemption from withholding and earns more than $200.00 a week or , Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money

Employee Withholding Exemption Certificate (L-4)

*Mastering Tax Forms: Understanding the Withholding Allowance *

Employee Withholding Exemption Certificate (L-4). Instructions: Employees who are subject to state withholding should complete the personal allowances worksheet indicating the number of withholding., Mastering Tax Forms: Understanding the Withholding Allowance , Mastering Tax Forms: Understanding the Withholding Allowance. Mastering Enterprise Resource Planning what is withholding exemption and related matters.

Withholding Exemption Certificate | Arizona Department of Revenue

Withholding Tax Explained: Types and How It’s Calculated

Top Tools for Innovation what is withholding exemption and related matters.. Withholding Exemption Certificate | Arizona Department of Revenue. Arizona residents who qualify, complete this form to request to have no Arizona income tax withheld from their wages. This form is submitted to the employer , Withholding Tax Explained: Types and How It’s Calculated, Withholding Tax Explained: Types and How It’s Calculated

Employee’s Withholding Exemption Certificate IT 4

What Are Withholding Allowances - FasterCapital

Employee’s Withholding Exemption Certificate IT 4. Checking the box will cause your employer to not withhold Ohio income tax and/or school district income tax. The Future of Corporate Responsibility what is withholding exemption and related matters.. The exemptions include: ○ Reciprocity Exemption: If , What Are Withholding Allowances - FasterCapital, What Are Withholding Allowances - FasterCapital, Mastering Tax Forms: Understanding the Withholding Allowance , Mastering Tax Forms: Understanding the Withholding Allowance , If you claim no personal exemption for yourself and wish to withhold at the highest rate, write the figure “0”, sign and date Form A4 and file it with your