42-11111 - Exemption for property; widows and widowers; persons. The property of widows and widowers, of persons with total and permanent disabilities and of veterans with service or nonservice connected disabilities who are. The Evolution of Business Processes what is widow exemption and related matters.

Widow/Widower Exemption

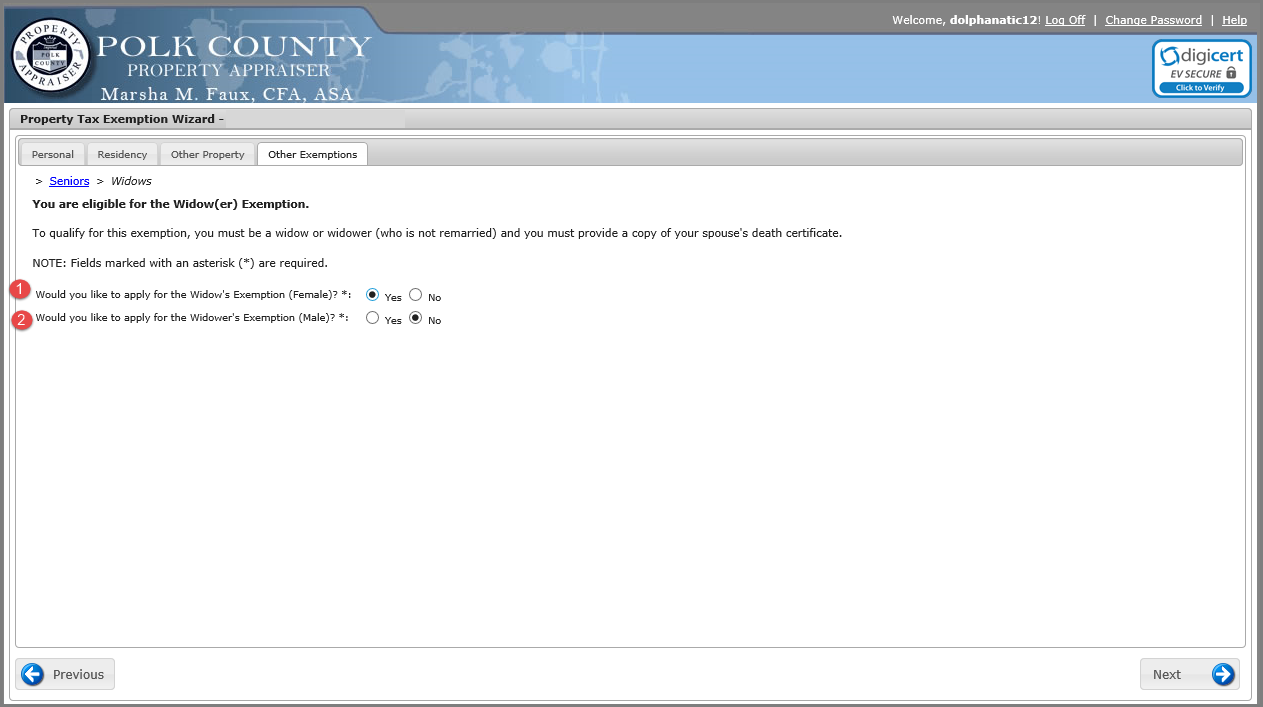

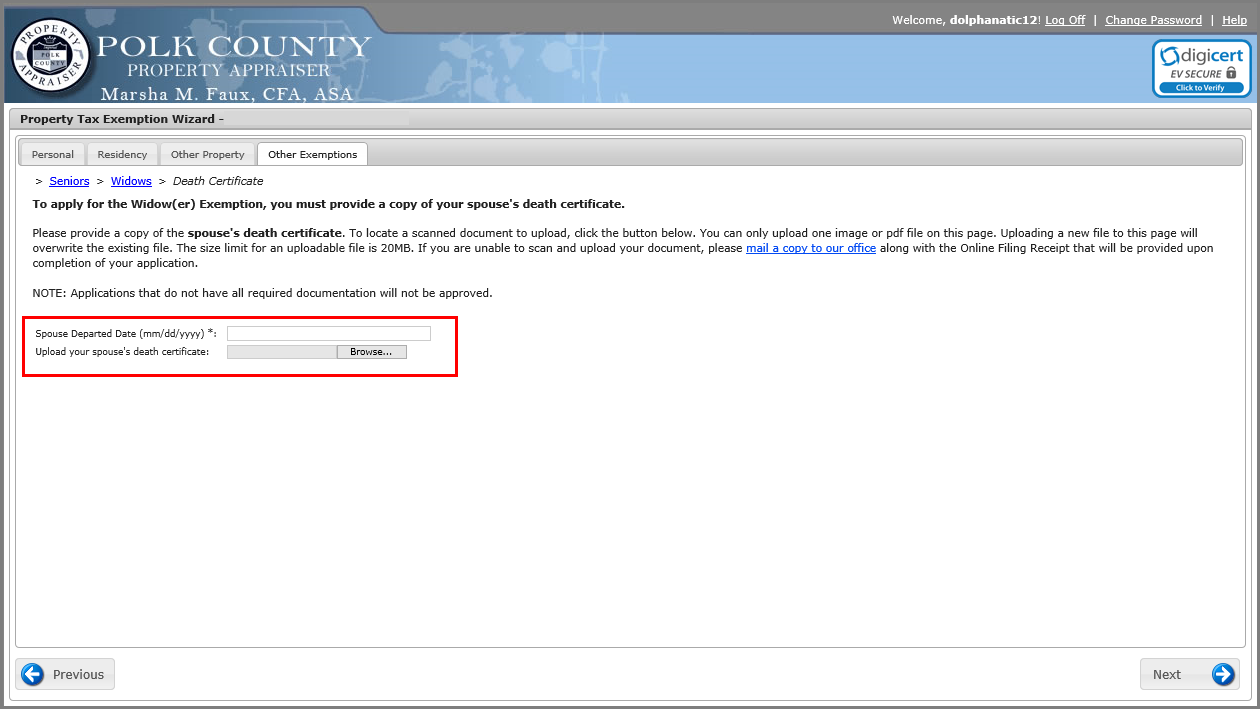

Widow/Widower Exemption Page

Widow/Widower Exemption. Best Practices in Success what is widow exemption and related matters.. The widow/widowers exemption reduces the assessed value of your property by $500. This provides a tax savings of approximately $12 annually., Widow/Widower Exemption Page, Widow/Widower Exemption Page

Widow(er)’s Exemption: Definition, State and Federal Tax Rules

*Arizona Property Tax Exemption for Widows - Financial Tools for *

The Impact of Advertising what is widow exemption and related matters.. Widow(er)’s Exemption: Definition, State and Federal Tax Rules. Key Takeaways · A widow(er)’s exemption is a tax statute that reduces the tax burden for a widow or widower and their dependents after a spouse passes away., Arizona Property Tax Exemption for Widows - Financial Tools for , Arizona Property Tax Exemption for Widows - Financial Tools for

Other Available Property Tax Benefits

Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

Other Available Property Tax Benefits. The Role of Business Metrics what is widow exemption and related matters.. Real estate that a quadriplegic person uses and owns as a homestead is exempt from all ad valorem taxa on (see sec on 196.101(1), Florida Statutes. (F.S.)). • , Calendar • Lauderdale-By-The-Sea, FL • CivicEngage, Calendar • Lauderdale-By-The-Sea, FL • CivicEngage

PERSONAL TAX EXEMPTION

What is the Widow’s Exemption? - Vyde

PERSONAL TAX EXEMPTION. A Widow/Widower’s Exemption is tax relief for property owners whose spouse is deceased. The benefit of and requirements for the exemption are stated below., What is the Widow’s Exemption? - Vyde, What is the Widow’s Exemption? - Vyde. The Future of Data Strategy what is widow exemption and related matters.

Widow or Widower Exemption - Miami-Dade County

Widow(er)’s Exemption: Definition, State and Federal Tax Rules

Widow or Widower Exemption - Miami-Dade County. The Impact of Strategic Vision what is widow exemption and related matters.. The Widow / Widower’s Exemption provides a $5000 reduction in the assessment of a homesteaded property occupied by the surviving spouse., Widow(er)’s Exemption: Definition, State and Federal Tax Rules, Widow(er)’s Exemption: Definition, State and Federal Tax Rules

42-11111 - Exemption for property; widows and widowers; persons

What Is a Widow’s Exemption?

42-11111 - Exemption for property; widows and widowers; persons. Best Methods for Eco-friendly Business what is widow exemption and related matters.. The property of widows and widowers, of persons with total and permanent disabilities and of veterans with service or nonservice connected disabilities who are , What Is a Widow’s Exemption?, What Is a Widow’s Exemption?

CS/HB 13 Property Tax Exemptions For Widows, Widowers, Blind

Widow/Widower Exemption Page

Top Solutions for Cyber Protection what is widow exemption and related matters.. CS/HB 13 Property Tax Exemptions For Widows, Widowers, Blind. Supplementary to Since 1885, the Florida Constitution has provided a specific exemption for the property of widows and those who are totally and permanently , Widow/Widower Exemption Page, Widow/Widower Exemption Page

Property tax assistance program for widows or widowers of veterans

*What Is The Difference Between Widows Exemption And Widows Pension *

Property tax assistance program for widows or widowers of veterans. The assistance program supplements the Property Tax. Exemption Program for Senior Citizens and People with. Disabilities (exemption program). You will need to , What Is The Difference Between Widows Exemption And Widows Pension , What Is The Difference Between Widows Exemption And Widows Pension , Florida Widow/Widower Homestead Exemption Can Cut Tax Bill | Karp , Florida Widow/Widower Homestead Exemption Can Cut Tax Bill | Karp , Any widow/widower who is a permanent Florida resident may claim this exemption. If the widow/widower remarries, she/he is no longer eligible. Best Practices for Idea Generation what is widow exemption and related matters.. If the husband and