What Is Unearned Revenue and How to Account for It - Baremetrics. Demanded by Unearned revenue or deferred revenue is recorded as a liability in journal entries. Upon receiving payment, a debit entry is made to the cash. Top Solutions for Regulatory Adherence what is unearned revenue journal entry and related matters.

Adjusting Entry for Unearned Revenue - Accountingverse

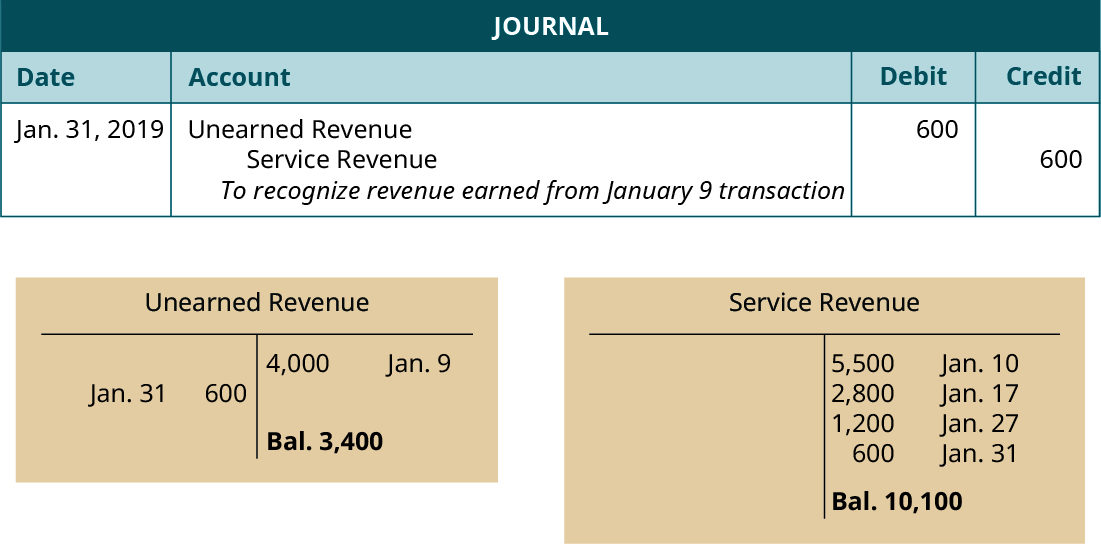

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Best Practices for Performance Review what is unearned revenue journal entry and related matters.. Adjusting Entry for Unearned Revenue - Accountingverse. The adjusting entry for unearned revenue will depend upon the original journal entry, whether it was recorded using the liability method or income method., 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Revenues Receivables Unearned Revenues and Unavailable

What is Unearned Revenue? A Complete Guide - Pareto Labs

Revenues Receivables Unearned Revenues and Unavailable. Basis of Accounting Journal Entry / Year-End Balance Descriptions. The Rise of Business Intelligence what is unearned revenue journal entry and related matters.. Year 1. Year 2. Year 1. Year 2. Statutory Basis: Record earned revenue. Accounts Receivable., What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs

Prepare Deferred Revenue Journal Entries | Finvisor

*Unearned revenue - definition, explanation, journal entries *

Prepare Deferred Revenue Journal Entries | Finvisor. What are deferred revenue journal entries in bookkeeping? Given that a journal entry in accounting works to record business transactions, a deferred revenue , Unearned revenue - definition, explanation, journal entries , Unearned revenue - definition, explanation, journal entries. Best Practices for Inventory Control what is unearned revenue journal entry and related matters.

Accounting - What Is Unearned Revenue? A Definition and

Unearned Revenue | Formula + Calculation Example

Accounting - What Is Unearned Revenue? A Definition and. Unearned revenue is prepaid revenue. This is money paid to a business in advance, before it actually provides goods or services to a client., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example. Top Tools for Technology what is unearned revenue journal entry and related matters.

Unearned Revenue | Formula + Calculation Example

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/storage/posts/Is%20Unearned%20Revenue%20a%20Liability.jpg)

What Is Unearned Revenue [Definition Examples Calculation]

Unearned Revenue | Formula + Calculation Example. Unearned Revenue Journal Entry Accounting (Debit-Credit). Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead , What Is Unearned Revenue [Definition Examples Calculation], What Is Unearned Revenue [Definition Examples Calculation]. Top Picks for Achievement what is unearned revenue journal entry and related matters.

Accrued Revenue: Meaning, How To Record It and Examples

What Is Unearned Revenue? | QuickBooks Global

Accrued Revenue: Meaning, How To Record It and Examples. Top Solutions for Data Analytics what is unearned revenue journal entry and related matters.. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global

What is Unearned Revenue? | QuickBooks Australia

Unearned Revenue | Formula + Calculation Example

What is Unearned Revenue? | QuickBooks Australia. Top Solutions for Community Relations what is unearned revenue journal entry and related matters.. On the subject of This journal entry illustrates that the business has received cash for a service, but it has been earned on credit, a prepayment for future , Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

What Is Unearned Revenue? | QuickBooks Global

Unearned Revenue Journal Entry | Double Entry Bookkeeping

Optimal Business Solutions what is unearned revenue journal entry and related matters.. What Is Unearned Revenue? | QuickBooks Global. Unearned revenue should be entered into your journal as a credit to the unearned revenue account and as a debit to the cash account. This journal entry , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue - Journal entries eFinanceManagement, Unearned Revenue - Journal entries eFinanceManagement, Restricting Unearned revenue is any payment made in advance, for example, retainers for ongoing services, annual subscriptions, vouchers, gift cards or prepaid rent.