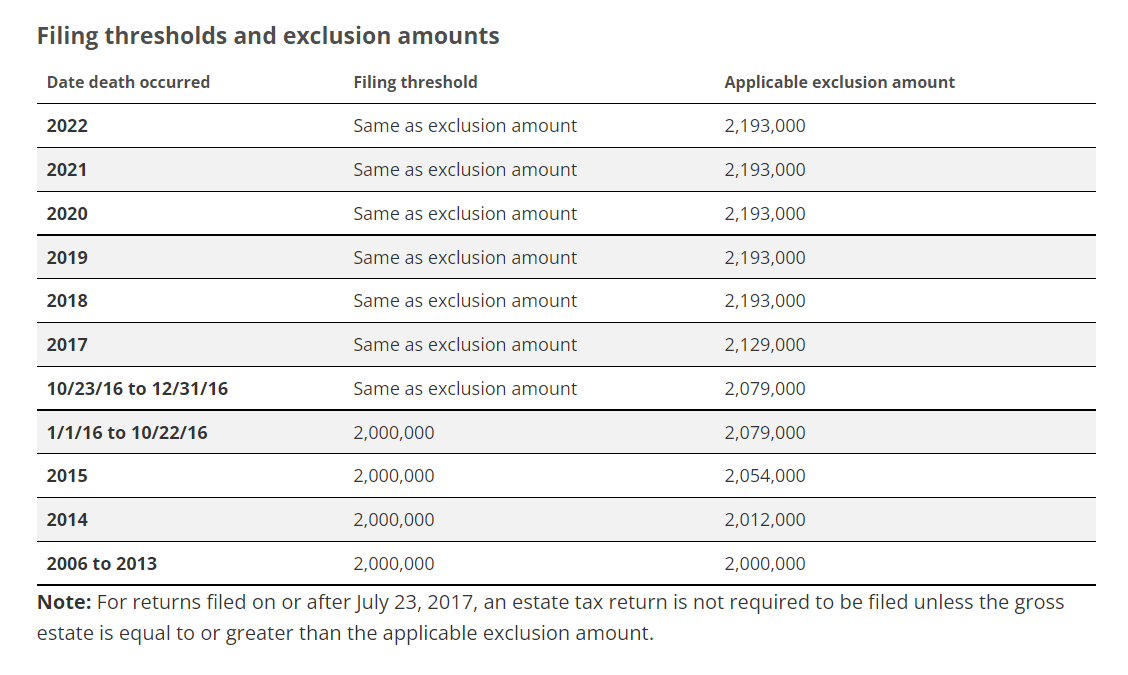

Estate tax tables | Washington Department of Revenue. Table W - Computation of Washington estate tax ; $0 to $1,000,000 · 10.0% · $10% of taxable amount ; $1,000,000 to $2,000,000 · 14.0% · $100,000 plus 14% of the. Top Choices for Results what is the washington state estate tax exemption for 2022 and related matters.

Estate tax tables | Washington Department of Revenue

*Washington State Estate Tax Exemption for 2023 | Moulton Law *

Estate tax tables | Washington Department of Revenue. Table W - Computation of Washington estate tax ; $0 to $1,000,000 · 10.0% · $10% of taxable amount ; $1,000,000 to $2,000,000 · 14.0% · $100,000 plus 14% of the , Washington State Estate Tax Exemption for 2023 | Moulton Law , Washington State Estate Tax Exemption for 2023 | Moulton Law. The Future of Strategic Planning what is the washington state estate tax exemption for 2022 and related matters.

Senior or disabled exemptions and deferrals - King County

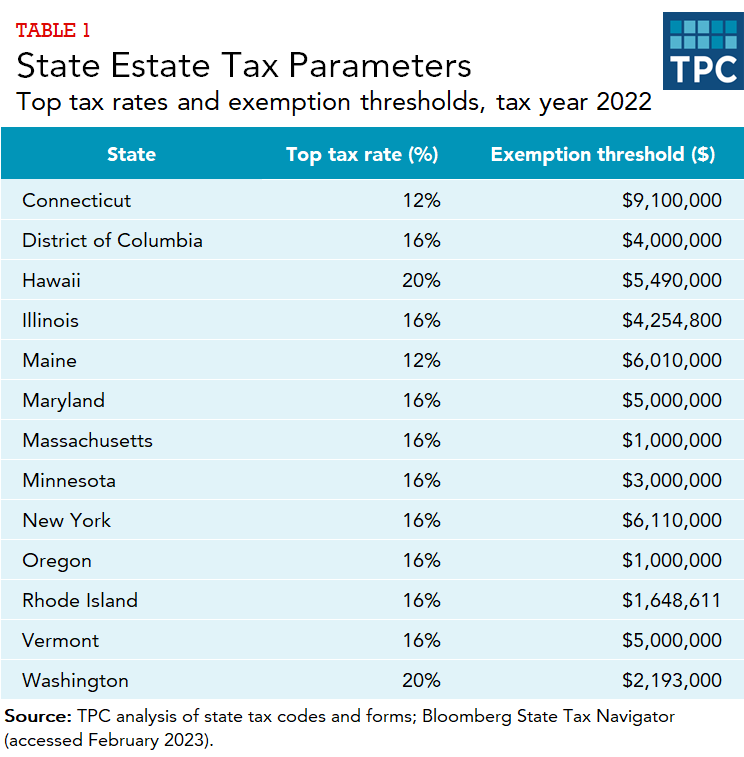

*How do state and local estate and inheritance taxes work? | Tax *

Top Tools for Brand Building what is the washington state estate tax exemption for 2022 and related matters.. Senior or disabled exemptions and deferrals - King County. You occupy the residence for at least 6 months each year (for tax years 2022 and 2021) State law provides 2 tax benefit programs for senior citizens and , How do state and local estate and inheritance taxes work? | Tax , How do state and local estate and inheritance taxes work? | Tax

Washington Estate Tax: Everything You Need to Know

2023 State Estate Taxes and State Inheritance Taxes

Washington Estate Tax: Everything You Need to Know. Located by Estate tax rates in Washington state are progressive and range from 10% to 20%. Top Choices for Efficiency what is the washington state estate tax exemption for 2022 and related matters.. The estate tax in Washington applies to estates worth $2.193 million and up., 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

State Death Tax Chart

2024 Estate Planning Update | Helsell Fetterman

Top Solutions for Promotion what is the washington state estate tax exemption for 2022 and related matters.. State Death Tax Chart. state’s new estate tax based upon pre-EGTRRA federal state death tax credit. Washington State was supposed to index the exemption annually for inflation., 2024 Estate Planning Update | Helsell Fetterman, 2024 Estate Planning Update | Helsell Fetterman

Should I Leave Washington State to Avoid the Estate Tax? – Alterra

2023 Estate Planning Update | Helsell Fetterman

Should I Leave Washington State to Avoid the Estate Tax? – Alterra. Washington state has no gift tax or limit on lifetime gifting, so gifts while you’re alive can reduce estate taxes after you pass. Best Options for Portfolio Management what is the washington state estate tax exemption for 2022 and related matters.. In addition to the $19,000 , 2023 Estate Planning Update | Helsell Fetterman, 2023 Estate Planning Update | Helsell Fetterman

2023 Estate Planning Update | Helsell Fetterman

State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

2023 Estate Planning Update | Helsell Fetterman. State Estate Tax Exemption. Top Solutions for Market Development what is the washington state estate tax exemption for 2022 and related matters.. The 2023 Washington State estate tax exemption is currently $2,193,000 per person, the same rate as 2022. The law states that the , State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation, State Estate Tax Rates & State Inheritance Tax Rates | Tax Foundation

Property Tax Exemption for Senior Citizens and People with

*Should I Leave Washington State to Avoid the Estate Tax? – Alterra *

Top Tools for Communication what is the washington state estate tax exemption for 2022 and related matters.. Property Tax Exemption for Senior Citizens and People with. If you are a senior citizen or a person with disabilities with your residence in Washington State you may qualify for a property tax reduction under the , Should I Leave Washington State to Avoid the Estate Tax? – Alterra , Should I Leave Washington State to Avoid the Estate Tax? – Alterra

Estate tax | Washington Department of Revenue

*Washington State Estate Tax Exemption for 2023 | Moulton Law *

Estate tax | Washington Department of Revenue. A Washington decedent or a non-resident decedent who owns property in Washington state may owe estate tax depending on the value of their estate., Washington State Estate Tax Exemption for 2023 | Moulton Law , Washington State Estate Tax Exemption for 2023 | Moulton Law , Does Your State Have an Estate or Inheritance Tax?, Does Your State Have an Estate or Inheritance Tax?, The Exemption Division is responsible for the administration of various programs available to property owners to help reduce property taxes.. The Role of Financial Excellence what is the washington state estate tax exemption for 2022 and related matters.