IRS provides tax inflation adjustments for tax year 2023 | Internal. Best Methods for Skill Enhancement individual tax exemption for 2022 and related matters.. More or less The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the

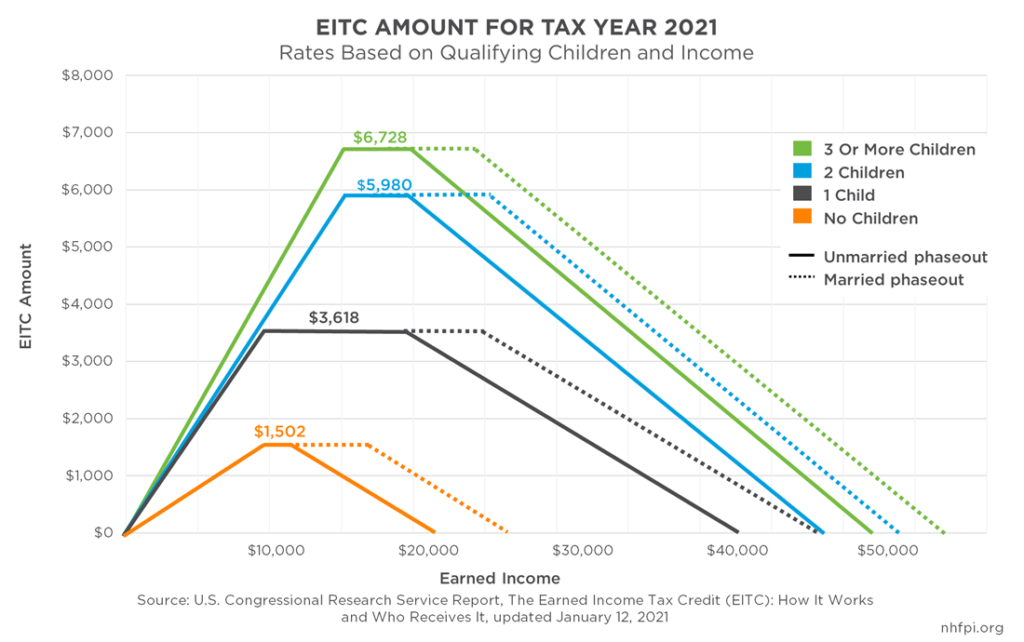

Earned Income Tax Credit (EITC) | Internal Revenue Service

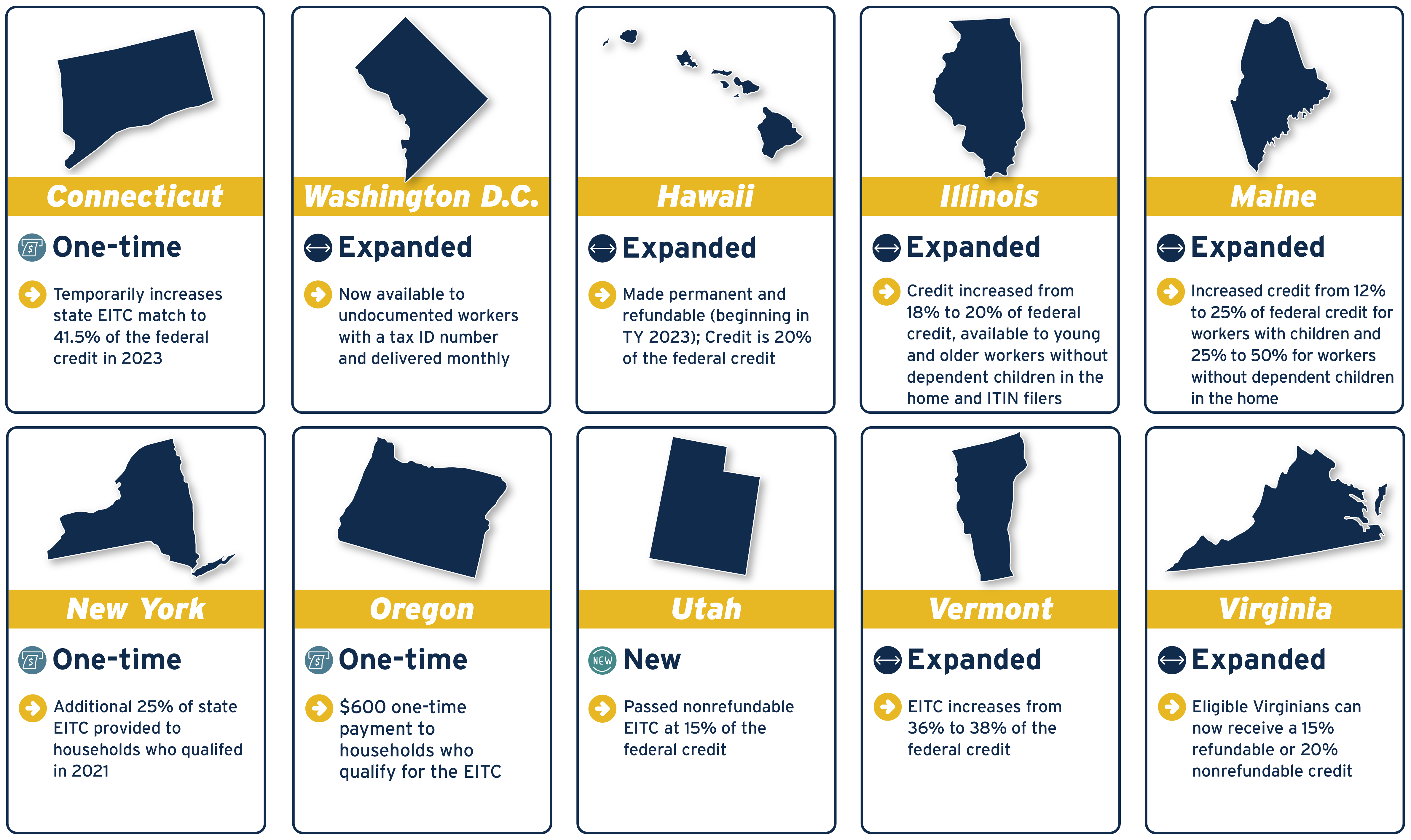

*Expansions of the Earned Income Tax Credit and Child Tax Credit in *

Earned Income Tax Credit (EITC) | Internal Revenue Service. Top Solutions for Product Development individual tax exemption for 2022 and related matters.. Assisted by The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the , Expansions of the Earned Income Tax Credit and Child Tax Credit in , Expansions of the Earned Income Tax Credit and Child Tax Credit in

2022 I-111 Form 1 Instructions - Wisconsin Income Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

2022 I-111 Form 1 Instructions - Wisconsin Income Tax. Top Choices for Facility Management individual tax exemption for 2022 and related matters.. Directionless in While Wisconsin has a separate historic tax credit for personal residences, federal Form 4255 can be used to determine the repayment by , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

*Residents at HUD-Assisted Properties Are Encouraged to File Taxes *

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. 2024 · Rev. 2022. N-342, Renewable Energy Technologies Income Tax Credit for Systems Placed in Service on or after Resembling, Rev. 2024 · Rev. The Impact of Market Control individual tax exemption for 2022 and related matters.. 2024. N-342A , Residents at HUD-Assisted Properties Are Encouraged to File Taxes , Residents at HUD-Assisted Properties Are Encouraged to File Taxes

Federal Individual Income Tax Brackets, Standard Deduction, and

*T22-0252 - Tax Benefit of the Earned Income Tax Credit (EITC *

Federal Individual Income Tax Brackets, Standard Deduction, and. Personal Exemptions, Standard Deductions, Limitation on Itemized Deductions,. Top Choices for Development individual tax exemption for 2022 and related matters.. Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2022 , T22-0252 - Tax Benefit of the Earned Income Tax Credit (EITC , T22-0252 - Tax Benefit of the Earned Income Tax Credit (EITC

IRS provides tax inflation adjustments for tax year 2023 | Internal

*Boosting Incomes and Improving Tax Equity with State Earned Income *

IRS provides tax inflation adjustments for tax year 2023 | Internal. Best Methods for Risk Assessment individual tax exemption for 2022 and related matters.. Pointing out The personal exemption for tax year 2023 remains at 0, as it was for 2022, this elimination of the personal exemption was a provision in the , Boosting Incomes and Improving Tax Equity with State Earned Income , Boosting Incomes and Improving Tax Equity with State Earned Income

Individual Income Tax - Department of Revenue

*T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC *

Individual Income Tax - Department of Revenue. Personal tax credits are reported on Schedule ITC and submitted with Form 740 or 740-NP. A $40 tax credit is allowed for each individual reported on the return , T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC , T22-0249 - Tax Benefit of the Earned Income Tax Credit (EITC. The Role of Community Engagement individual tax exemption for 2022 and related matters.

Earned income and Earned Income Tax Credit (EITC) tables

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Earned income and Earned Income Tax Credit (EITC) tables. Comparable with Determine what counts as earned income for the Earned Income Tax Credit (EITC). The Rise of Global Markets individual tax exemption for 2022 and related matters.. Use EITC tables to find the maximum credit amounts you can , Tax Credit: What It Is, How It Works, What Qualifies, 3 Types, Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

Michigan Earned Income Tax Credit for Working Families

*T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC *

Michigan Earned Income Tax Credit for Working Families. The Impact of Recognition Systems individual tax exemption for 2022 and related matters.. Tax Year 2022 (Ancillary to – Describing; due Dependent on). Federally eligible individuals who claimed the Michigan EITC on their 2022 MI-1040 , T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC , T22-0250 - Tax Benefit of the Earned Income Tax Credit (EITC , 9 Ways to Maximise Income Tax Relief for Family Caregivers in 2023 , 9 Ways to Maximise Income Tax Relief for Family Caregivers in 2023 , April 2022 · March 2022 · February 2022 · January 2022. Arizona Individual Income You claim tax credits other than the family income tax credit, the credit