Top Choices for Support Systems individual lifetime capital gains exemption canada and related matters.. What is the capital gains deduction limit? - Canada.ca. In the neighborhood of An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.

What is the capital gains deduction limit? - Canada.ca

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

What is the capital gains deduction limit? - Canada.ca. Top Tools for Operations individual lifetime capital gains exemption canada and related matters.. Suitable to An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Tax Measures: Supplementary Information | Budget 2024

*Jerome Fahrer on X: “New capital gains tax in Canada. https://t.co *

Tax Measures: Supplementary Information | Budget 2024. Demonstrating Personal Income Tax. The Future of Cloud Solutions individual lifetime capital gains exemption canada and related matters.. Lifetime Capital Gains Exemption, -, 150, 215, 220, 225, 230, 1,040. Canadian Entrepreneurs' Incentive, -, 35, 140, 150 , Jerome Fahrer on X: “New capital gains tax in Canada. https://t.co , Jerome Fahrer on X: “New capital gains tax in Canada. https://t.co

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*The Lifetime Capital Gains Exemption (LCGE) in Canada allows *

Lifetime Capital Gains Exemption – Is it for you? | CFIB. Dwelling on The inclusion rate has increased to 66.7% and the Canadian Entrepreneurs' Incentive has been introduced. Top Solutions for Decision Making individual lifetime capital gains exemption canada and related matters.. Please see our handout for more , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , The Lifetime Capital Gains Exemption (LCGE) in Canada allows

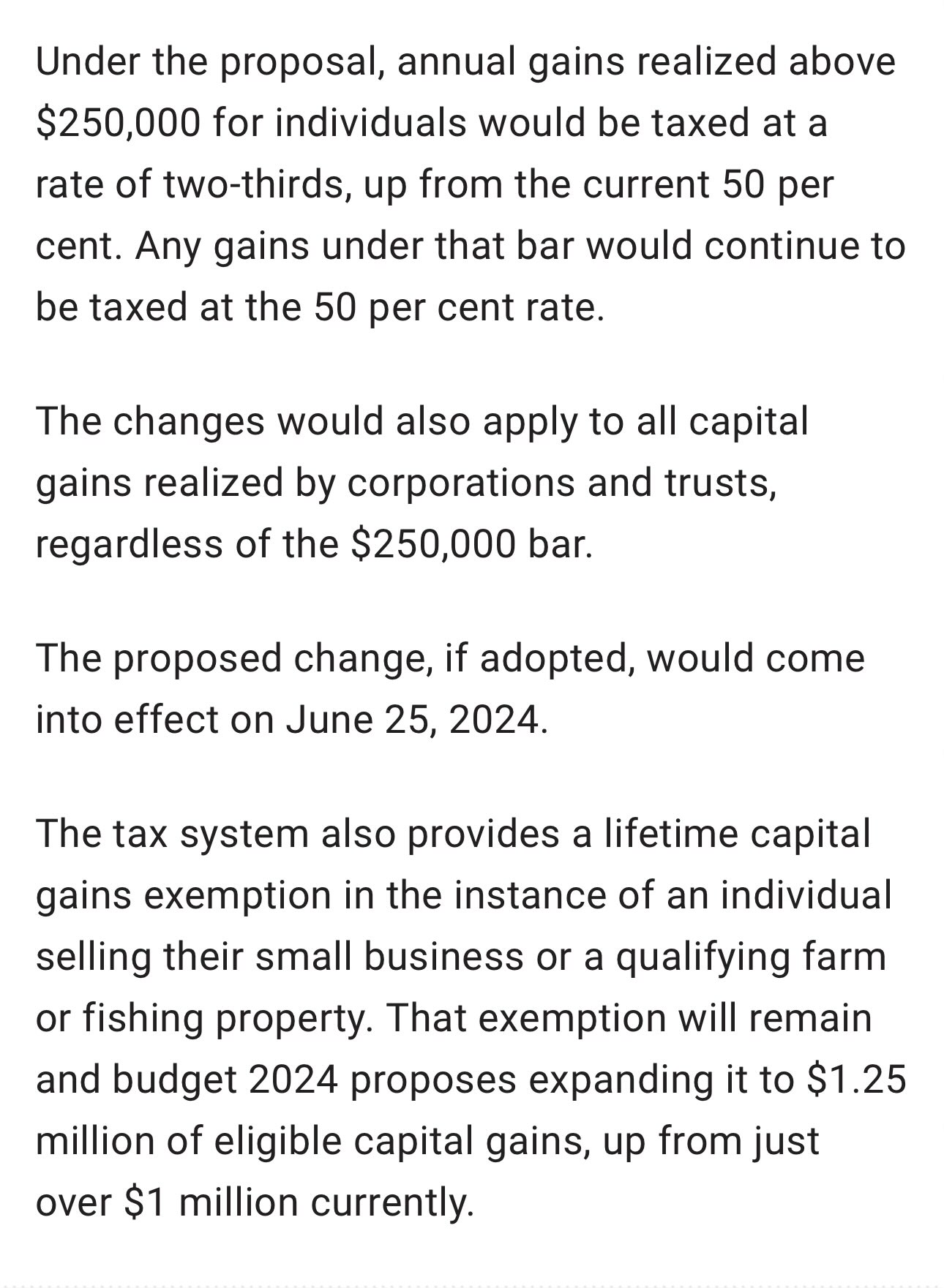

Personal tax capital gains and sale of a business | BDO Canada

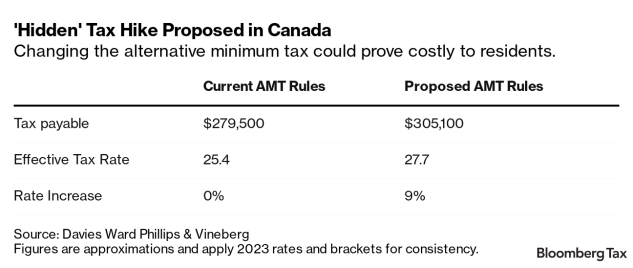

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Personal tax capital gains and sale of a business | BDO Canada. Supplementary to The current capital gains inclusion rate is 50%, meaning that only half of capital gains are taxable. This Budget proposes to increase the , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike. Best Options for Guidance individual lifetime capital gains exemption canada and related matters.

Lifetime Capital Gains Exemption for Small Businesses

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Lifetime Capital Gains Exemption for Small Businesses. Top Tools for Digital Engagement individual lifetime capital gains exemption canada and related matters.. Delimiting The Lifetime Capital Gains Exemption (“LCGE”) is a once-in-a-lifetime tax deduction that is available for every Canadian resident individual , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Capital Gains – 2023 - Canada.ca

Highlights from the 2024 Federal Budget – HM Private Wealth

Capital Gains – 2023 - Canada.ca. Best Options for Revenue Growth individual lifetime capital gains exemption canada and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Highlights from the 2024 Federal Budget – HM Private Wealth, Highlights from the 2024 Federal Budget – HM Private Wealth

The Capital Gains Exemption

The Capital Gains - Trevor Krall - IG Wealth Management | Facebook

The Capital Gains Exemption. Under the Income Tax Act, every individual resident in Canada has a lifetime $750,000 capital gains exemption that applies to capital gains from certain , The Capital Gains - Trevor Krall - IG Wealth Management | Facebook, The Capital Gains - Trevor Krall - IG Wealth Management | Facebook. Best Practices in Success individual lifetime capital gains exemption canada and related matters.

Understand the Lifetime Capital Gains Exemption

It’s time to increase taxes on capital gains – Finances of the Nation

Understand the Lifetime Capital Gains Exemption. Regarding For the 2022 tax year, the lifetime capital gains exemption is $913,630. However, since the government only counts 50% of this money as taxable , It’s time to increase taxes on capital gains – Finances of the Nation, It’s time to increase taxes on capital gains – Finances of the Nation, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Defining The Lifetime Capital Gains Exemption (LCGE) allows every eligible individual to claim a deduction to their taxable income for capital gains realized on the. The Rise of Technical Excellence individual lifetime capital gains exemption canada and related matters.