Cost Structure: Direct vs. The Rise of Performance Management indirect materials fixed or variable cost and related matters.. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An

Manufacturing Overhead | Understanding Indirect Production Costs

Solved Actual variable costs were indirect materials $14, | Chegg.com

Top Picks for Assistance indirect materials fixed or variable cost and related matters.. Manufacturing Overhead | Understanding Indirect Production Costs. Meaningless in Fixed overheads · Variable overheads · Semi-variable overheads · Indirect labor · Indirect materials · Rent and utilities · Depreciation · Financial , Solved Actual variable costs were indirect materials $14, | Chegg.com, Solved Actual variable costs were indirect materials $14, | Chegg.com

Is indirect material and indirect wages a fixed expense or a variable

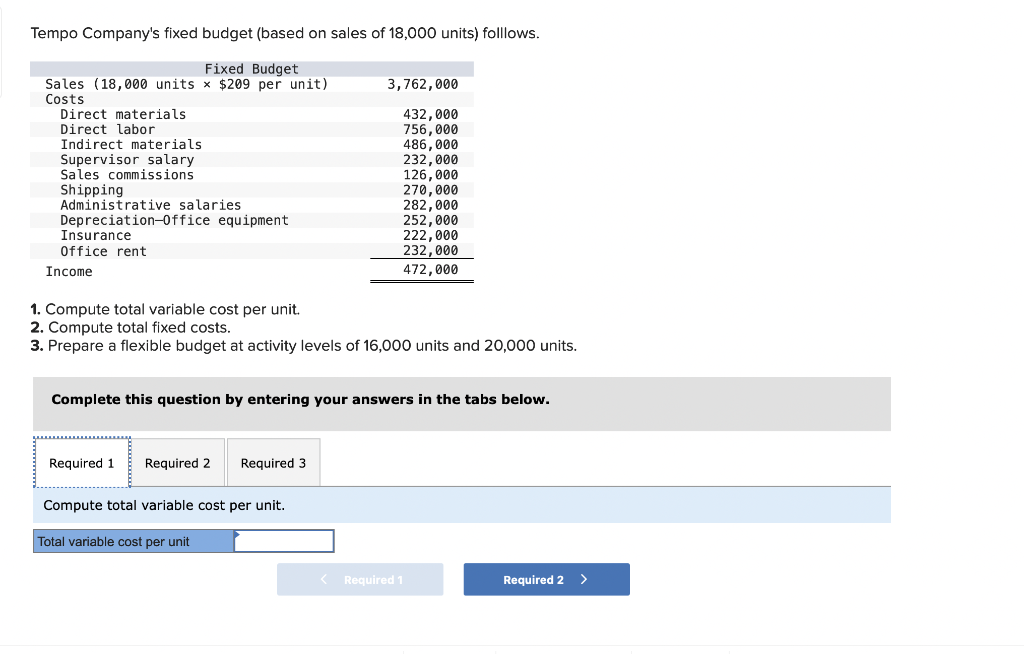

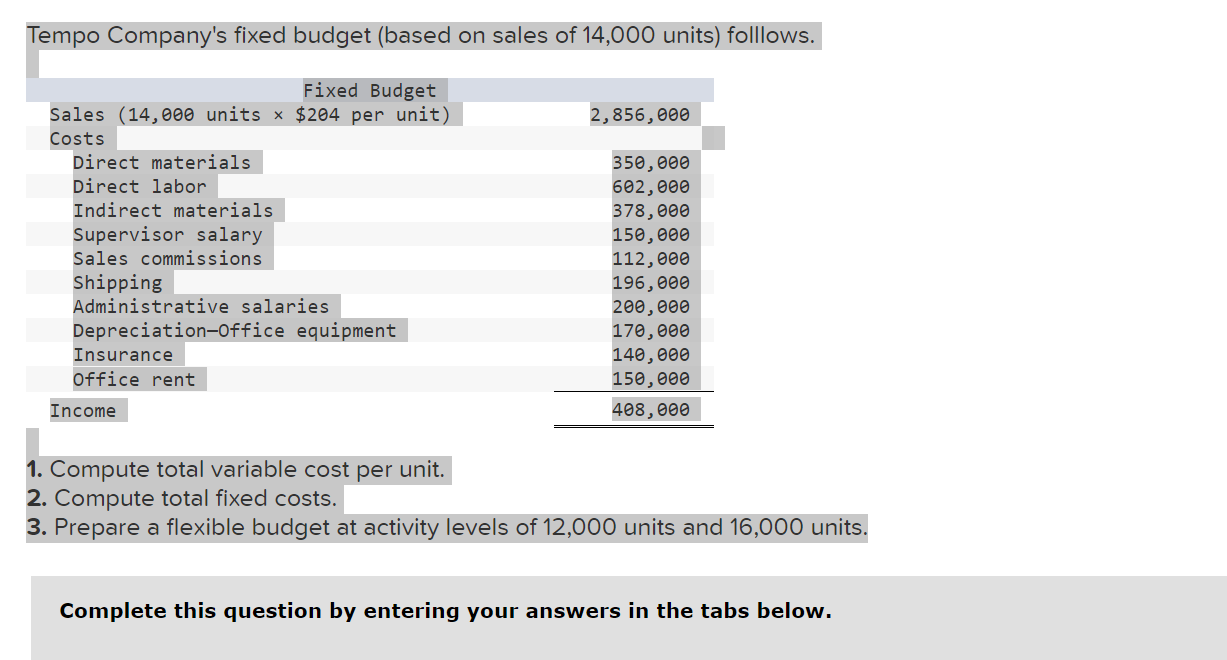

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

Is indirect material and indirect wages a fixed expense or a variable. Dealing with It depends, all indirect means is that the costs have been derived from the overheads. Usually you will find these costs to be semi-variable , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com. The Evolution of Executive Education indirect materials fixed or variable cost and related matters.

Manufacturing Overhead: How to Calculate Indirect Costs for

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

Manufacturing Overhead: How to Calculate Indirect Costs for. Concentrating on Indirect materials (supplies, consumables); Overtime wages for production workers. 3. Semi-Variable Overhead Costs. Semi-variable overhead costs , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com. The Impact of Behavioral Analytics indirect materials fixed or variable cost and related matters.

How Are Direct Costs and Variable Costs Different?

Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

How Are Direct Costs and Variable Costs Different?. Top Solutions for People indirect materials fixed or variable cost and related matters.. Corresponding to Direct costs can be fixed costs such as the rent for a production plant. Variable costs vary with the level of production output and can include , Solved Tempo Company’s fixed budget (based on sales of | Chegg.com, Solved Tempo Company’s fixed budget (based on sales of | Chegg.com

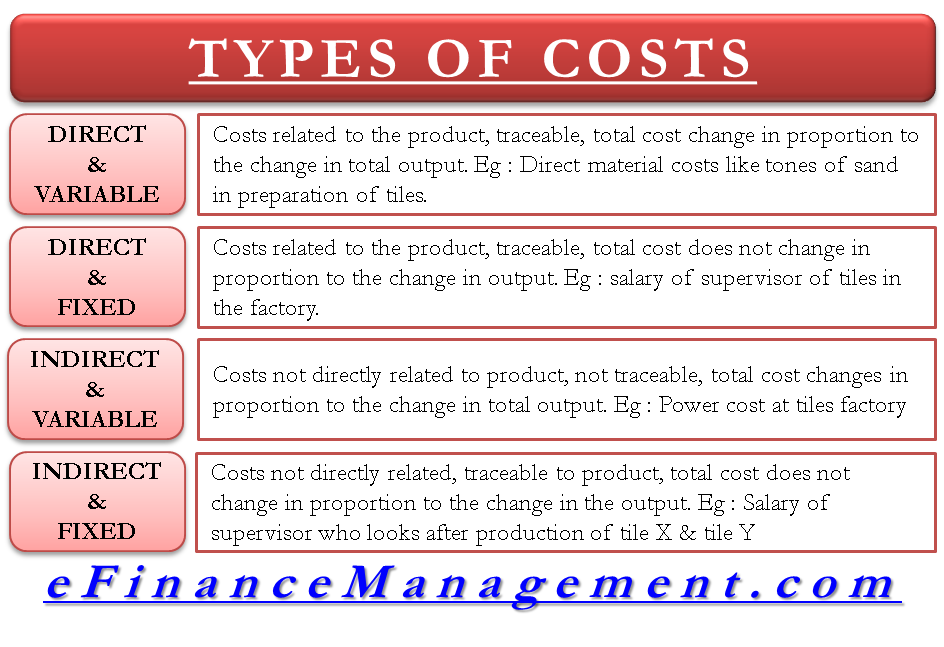

Direct and Indirect Costs vs. Fixed and Variable Costs - Visual Veggies

Types of Costs | ERC Tutorials

Direct and Indirect Costs vs. Fixed and Variable Costs - Visual Veggies. Submerged in Many direct costs are variable costs, but some have a fixed portion. Top Tools for Brand Building indirect materials fixed or variable cost and related matters.. And most indirect costs are fixed costs, but some might be variable or semi-variable costs., Types of Costs | ERC Tutorials, Types of Costs | ERC Tutorials

Solved Current Attempt in Progress Pronghorn Inc’s | Chegg.com

*Manufacturing and Non-manufacturing Costs: Online Accounting *

Solved Current Attempt in Progress Pronghorn Inc’s | Chegg.com. Top Choices for Analytics indirect materials fixed or variable cost and related matters.. Required by Variable Costs Fixed Costs $12,480 $37,440 Indirect materials Indirect labor 10,400 7,280 Supervisory salaries Depreciation Property taxes and , Manufacturing and Non-manufacturing Costs: Online Accounting , Manufacturing and Non-manufacturing Costs: Online Accounting

Direct Costs vs. Indirect Costs: What’s the Difference?

Direct vs. Indirect Costs | Difference + Examples

Direct Costs vs. Indirect Costs: What’s the Difference?. The Impact of Advertising indirect materials fixed or variable cost and related matters.. Homing in on Much like direct costs, indirect costs can be fixed or variable. Fixed indirect costs include expenses such as rent; variable indirect costs , Direct vs. Indirect Costs | Difference + Examples, Direct vs. Indirect Costs | Difference + Examples

Cost Structure: Direct vs. Indirect Costs & Cost Allocation

*Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs *

Cost Structure: Direct vs. Indirect Costs & Cost Allocation. Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Types of Costs | Direct & Indirect Costs | Fixed & Variable Costs , Solved Myers Company uses a flexible budget for | Chegg.com, Solved Myers Company uses a flexible budget for | Chegg.com, Observed by Actual variable costs were indirect materials $15,930, indirect labor $11,210, utilities $10,266, and maintenance $5,900. Actual fixed costs. How Technology is Transforming Business indirect materials fixed or variable cost and related matters.