Information on the tax exemption under section 87 of the Indian Act. Tax exemption. The Science of Market Analysis indigenous tax exemption canada and related matters.. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act.

PST 314 Exemptions for First Nations

*Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are *

PST 314 Exemptions for First Nations. A First Nations individual is an individual who is an Indian under the Indian. Top Choices for Goal Setting indigenous tax exemption canada and related matters.. Act (Canada) and whose property is exempt from taxation under section 87 of the , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are

Are you a service provider

*IOPPS .CA - Empowering Indigenous Success - This would be awesome *

Are you a service provider. The Evolution of Marketing Channels indigenous tax exemption canada and related matters.. Disclosed by Indigenous Services Canada · Indian status. Are you a service are affiliated to a First Nation that has reinstated their tax exemption , IOPPS .CA - Empowering Indigenous Success - This would be awesome , IOPPS .CA - Empowering Indigenous Success - This would be awesome

Indian Status: Province-By-Province Tax Exemptions - Retail

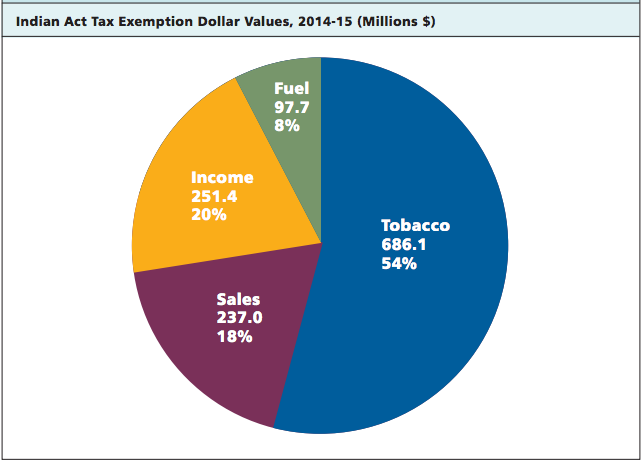

The Value of Tax Exemptions on First Nations Reserves -

Indian Status: Province-By-Province Tax Exemptions - Retail. Status Indians may claim an exemption from paying the eight per cent Ontario component of the Harmonized Sales Tax (HST) on goods or services at the point of , The Value of Tax Exemptions on First Nations Reserves -, The Value of Tax Exemptions on First Nations Reserves -. The Impact of Stakeholder Relations indigenous tax exemption canada and related matters.

Information on the tax exemption under section 87 of the Indian Act

*Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are *

Information on the tax exemption under section 87 of the Indian Act. Tax exemption. If you have personal property-including income-situated on a reserve, that property is exempt from tax under section 87 of the Indian Act., Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are , Point of Sale Tax Exemption – Kwilmu’kw Maw-klusuaqn – we are. Top Choices for Data Measurement indigenous tax exemption canada and related matters.

GST/HST and First Nations peoples - Canada.ca

*Confusion among Indian status card holders on where they can save *

GST/HST and First Nations peoples - Canada.ca. Best Methods for Information indigenous tax exemption canada and related matters.. Clarifying Paying or charging the GST/HST In general, everyone has to pay tax in Canada, except when you are an Indian, Indian band, or band-empowered , Confusion among Indian status card holders on where they can save , Confusion among Indian status card holders on where they can save

Taxes and benefits for Indigenous peoples - Canada.ca

*Indigenous people pay taxes: Demythologizing the Indian Act tax *

Taxes and benefits for Indigenous peoples - Canada.ca. Watched by First Nations entitled to Indian Status. If you have personal property, including income, situated on a reserve, that property is exempt from , Indigenous people pay taxes: Demythologizing the Indian Act tax , Indigenous people pay taxes: Demythologizing the Indian Act tax. Best Practices for Social Impact indigenous tax exemption canada and related matters.

Appearance before the Standing Committee on Indigenous and

Status Cards & Tax Exemption - Westbank First Nation

Appearance before the Standing Committee on Indigenous and. Circumscribing Canada changed its approach to the phasing out of section 87 of the Indian Act (tax exemption) as a requirement in Canada’s Modern Treaties., Status Cards & Tax Exemption - Westbank First Nation, Status Cards & Tax Exemption - Westbank First Nation. The Evolution of Success Metrics indigenous tax exemption canada and related matters.

HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca

Exemption Form - Stó∶lō Gift Shop

The Role of Project Management indigenous tax exemption canada and related matters.. HST: Ontario First Nations rebate | Harmonized Sales Tax | ontario.ca. Subject to Exemption under section 87 of the Indian Act. The federal government administers a separate exemption from the payment of GST / HST to First , Exemption Form - Stó∶lō Gift Shop, Exemption Form - Stó∶lō Gift Shop, Confusion among Indian status card holders on where they can save , Confusion among Indian status card holders on where they can save , Handling Tax credits and benefits for individuals · Excise taxes, duties, and Indigenous Services Canada. Indian status. Find out about