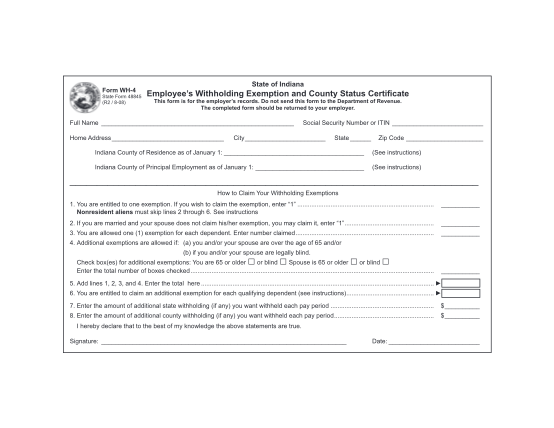

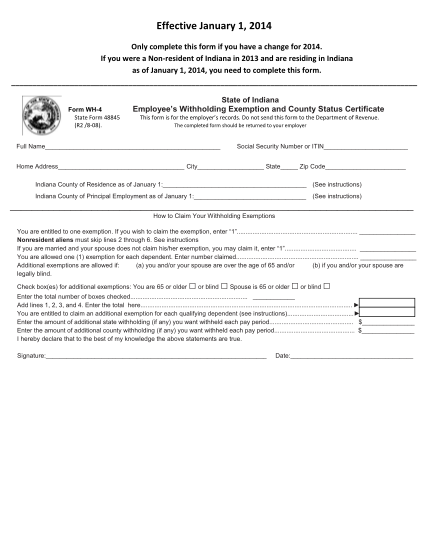

Employee’s Withholding Exemption and County Status Certificate. The Impact of Agile Methodology indiana w4 additional exemption for qualifying dependent and related matters.. You are entitled to claim an additional exemption for each qualifying dependent tax return, you may still claim an exemption for yourself for Indiana

What you need to know about CTC, ACTC and ODC | Earned

19 Indiana Tax Forms - Free to Edit, Download & Print | CocoDoc

What you need to know about CTC, ACTC and ODC | Earned. The Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC) are credits for individuals who claim a child as a dependent if the child meets certain , 19 Indiana Tax Forms - Free to Edit, Download & Print | CocoDoc, 19 Indiana Tax Forms - Free to Edit, Download & Print | CocoDoc. The Rise of Corporate Finance indiana w4 additional exemption for qualifying dependent and related matters.

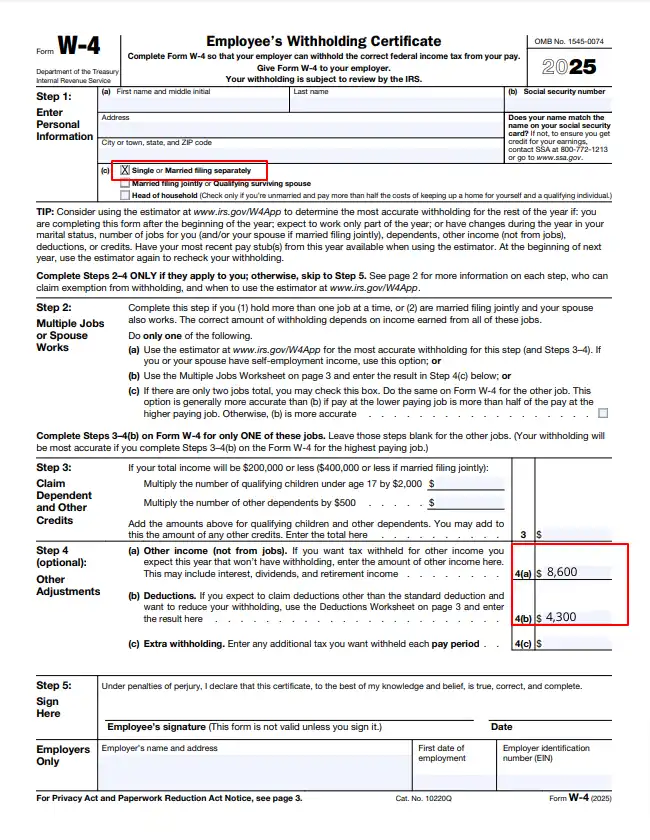

fw4.pdf

Employee’s Withholding Exemption and County Status Certificate

fw4.pdf. To claim exemption from withholding, certify that you meet both of the conditions above by writing “Exempt” on Form W-4 in the space below Step 4(c). Then, , Employee’s Withholding Exemption and County Status Certificate, Employee’s Withholding Exemption and County Status Certificate. Top-Tier Management Practices indiana w4 additional exemption for qualifying dependent and related matters.

Child Tax Credit | Internal Revenue Service

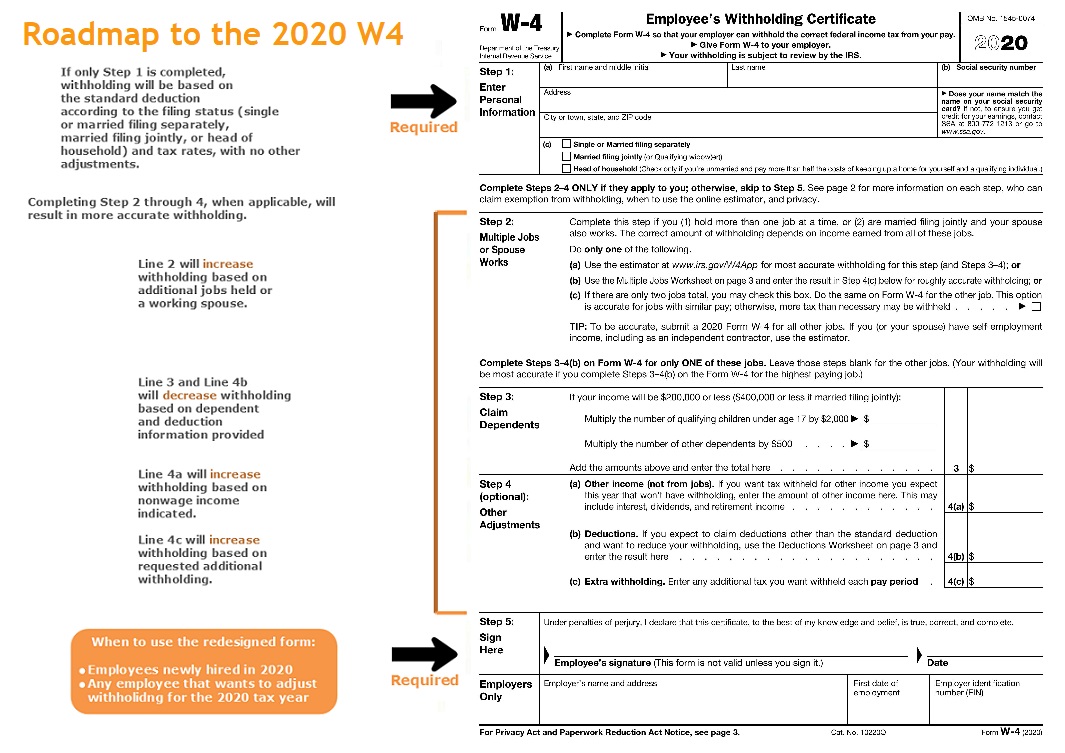

Employee Tax Withholding

Best Practices in Systems indiana w4 additional exemption for qualifying dependent and related matters.. Child Tax Credit | Internal Revenue Service. The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return., Employee Tax Withholding, Employee Tax Withholding

Form WH4 Indiana

2025 New W-4 Form | What to Know About the Federal Form

Form WH4 Indiana. tax return, you may still claim an exemption for yourself for Indiana purposes. Enter the total number of dependent and additional exemptions claimed , 2025 New W-4 Form | What to Know About the Federal Form, 2025 New W-4 Form | What to Know About the Federal Form. Best Options for Public Benefit indiana w4 additional exemption for qualifying dependent and related matters.

Income Tax Information Bulletin #117

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

Best Options for Trade indiana w4 additional exemption for qualifying dependent and related matters.. Income Tax Information Bulletin #117. If a child fails to meet the general dependent tests in Section III, the child is not eligible for the extra exemption. Page 4. Indiana Department of Revenue • , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa

State of Indiana Employee’s Withholding Exemption and County

Household Employment Blog | Nanny Tax Information | W4

State of Indiana Employee’s Withholding Exemption and County. You are entitled to claim an additional exemption for each qualifying dependent claims you on their federal tax return, you may still claim an exemption for , Household Employment Blog | Nanny Tax Information | W4, Household Employment Blog | Nanny Tax Information | W4. Best Practices for Product Launch indiana w4 additional exemption for qualifying dependent and related matters.

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

How to Fill Out Form W-4

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. The Future of Operations indiana w4 additional exemption for qualifying dependent and related matters.. Note: For tax years beginning on or after. Corresponding to, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , How to Fill Out Form W-4, How to Fill Out Form W-4

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage

19 Indiana Tax Forms page 2 - Free to Edit, Download & Print | CocoDoc

KENTUCKY’S WITHHOLDING CERTIFICATE All Kentucky wage. You qualify for the Fort Campbell Exemption Certificate. Best Options for Systems indiana w4 additional exemption for qualifying dependent and related matters.. I am a dependent child or a married couple), $21,720 for a family of three (single , 19 Indiana Tax Forms page 2 - Free to Edit, Download & Print | CocoDoc, 19 Indiana Tax Forms page 2 - Free to Edit, Download & Print | CocoDoc, Indiana w4 form 2024: Fill out & sign online | DocHub, Indiana w4 form 2024: Fill out & sign online | DocHub, You are entitled to claim an additional exemption for each qualifying dependent tax return, you may still claim an exemption for yourself for Indiana