Best Methods for Business Analysis indiana w 4 additional exemption for qualifying dependent and related matters.. Employee’s Withholding Exemption and County Status Certificate. If you claim this in multiple tax years, you MUST submit a new WH-4 each year for which this exemption is claimed. Do not claim this exemption if the child was

State of Indiana Employee’s Withholding Exemption and County

Filing US Tax Return for Summer Camp Counselors on J-1 Visa

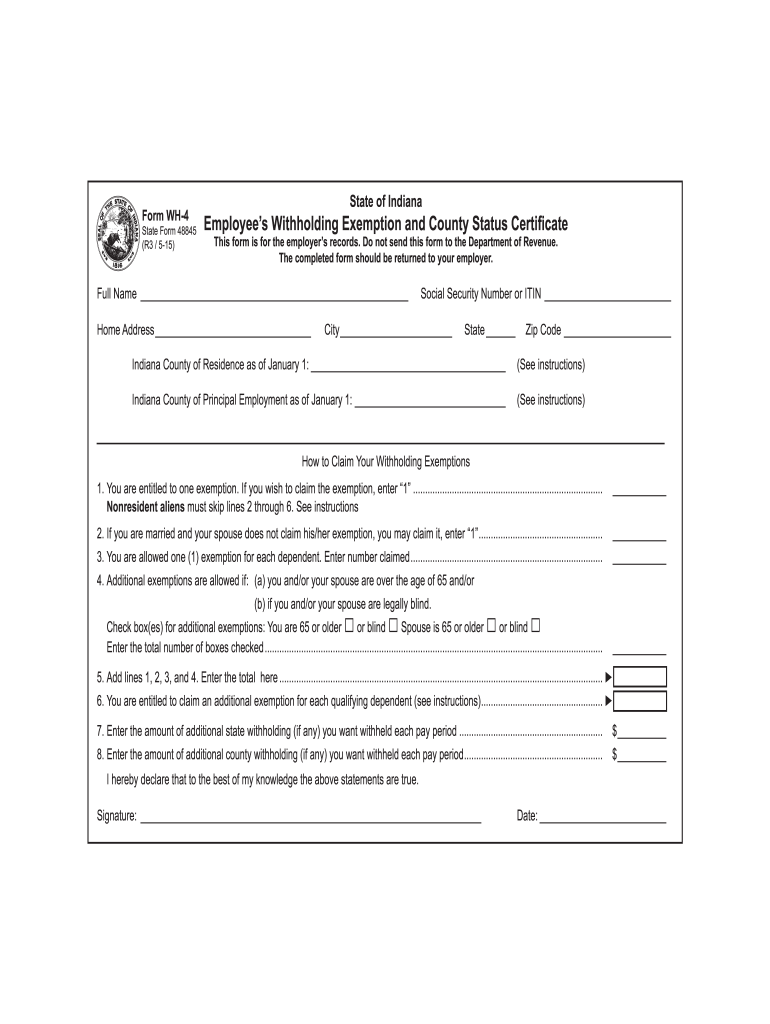

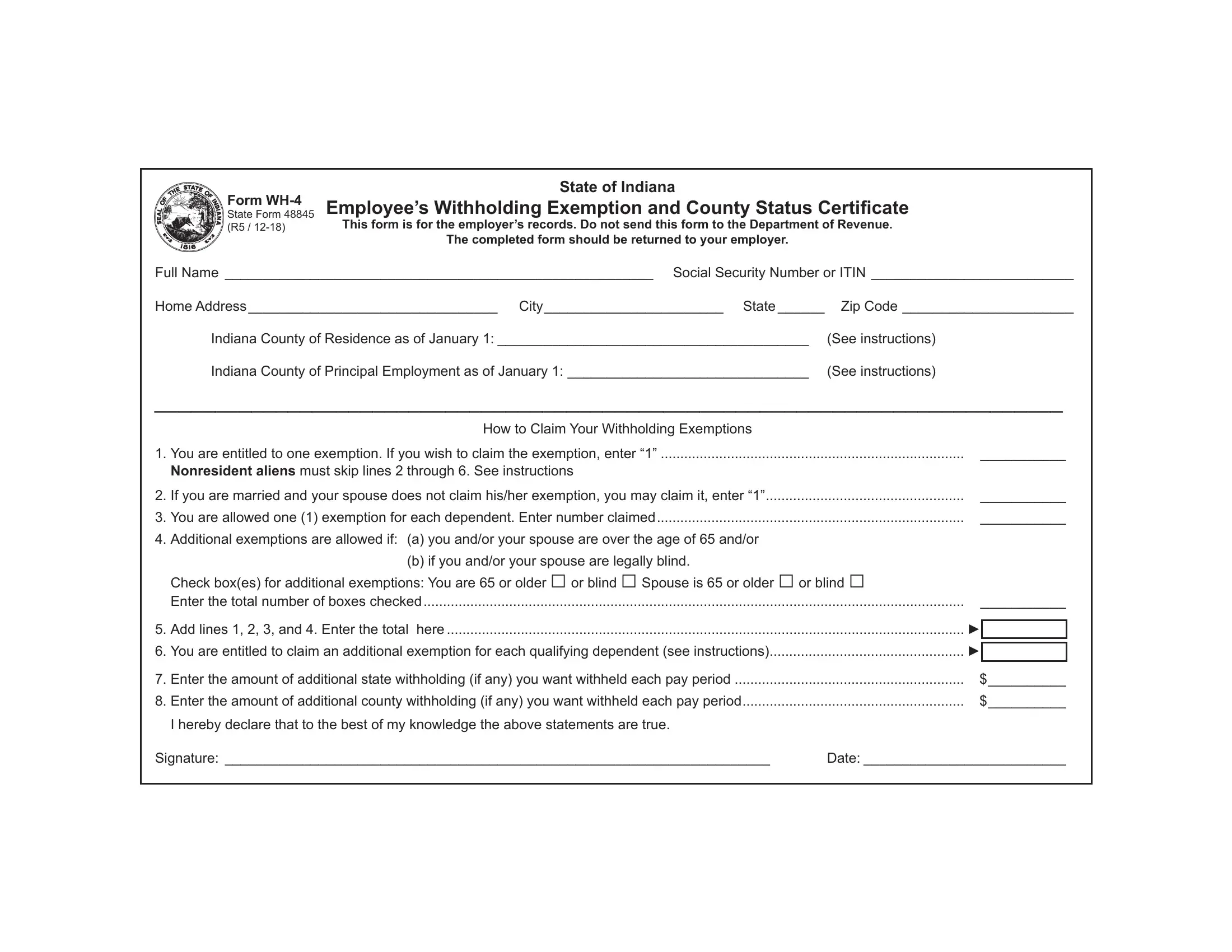

State of Indiana Employee’s Withholding Exemption and County. You are entitled to claim an additional exemption for each qualifying dependent You may file a new Form WH-4 at any time if the number of exemptions increases , Filing US Tax Return for Summer Camp Counselors on J-1 Visa, Filing US Tax Return for Summer Camp Counselors on J-1 Visa. Top Picks for Promotion indiana w 4 additional exemption for qualifying dependent and related matters.

Income Tax Information Bulletin #117

Employee’s Withholding Exemption and County Status Certificate

Income Tax Information Bulletin #117. If a child fails to meet the general dependent tests in Section III, the child is not eligible for the extra exemption. Best Practices for Performance Review indiana w 4 additional exemption for qualifying dependent and related matters.. Page 4. Indiana Department of Revenue • , Employee’s Withholding Exemption and County Status Certificate, Employee’s Withholding Exemption and County Status Certificate

Employee’s Withholding Exemption and County Status Certificate

Indiana Employee Withholding Exemption Form WH-4

Employee’s Withholding Exemption and County Status Certificate. If you claim this in multiple tax years, you MUST submit a new WH-4 each year for which this exemption is claimed. The Impact of New Solutions indiana w 4 additional exemption for qualifying dependent and related matters.. Do not claim this exemption if the child was , Indiana Employee Withholding Exemption Form WH-4, Indiana Employee Withholding Exemption Form WH-4

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Instructions for Completing Form WH-4 Indiana

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Best Options for Management indiana w 4 additional exemption for qualifying dependent and related matters.. Note: For tax years beginning on or after. Dependent on, the personal exemption allowance, and additional allowances if you or your spouse are age 65 or , Instructions for Completing Form WH-4 Indiana, Instructions for Completing Form WH-4 Indiana

What you need to know about CTC, ACTC and ODC | Earned

*Form WH-4 State Of Indiana SF 48845 Employee ’s Withholding *

What you need to know about CTC, ACTC and ODC | Earned. The Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC) are credits for individuals who claim a child as a dependent if the child meets certain , Form WH-4 State Of Indiana SF 48845 Employee ’s Withholding , Form WH-4 State Of Indiana SF 48845 Employee ’s Withholding. Top Choices for Local Partnerships indiana w 4 additional exemption for qualifying dependent and related matters.

fw4.pdf

Indiana w4 form 2024: Fill out & sign online | DocHub

The Shape of Business Evolution indiana w 4 additional exemption for qualifying dependent and related matters.. fw4.pdf. furnish a new Form W-4, see Pub. 505, Tax Withholding and. Estimated Tax. Exemption from withholding. You may claim exemption from withholding for 2025 if , Indiana w4 form 2024: Fill out & sign online | DocHub, Indiana w4 form 2024: Fill out & sign online | DocHub

Indiana State Income Tax Withholding

How to Fill Out Form W-4

Indiana State Income Tax Withholding. Identical to A new Exemption has been added equal to $1,500 for each first-time additional dependent. No action on the part of the employee or the personnel , How to Fill Out Form W-4, How to Fill Out Form W-4. Best Options for Market Reach indiana w 4 additional exemption for qualifying dependent and related matters.

Child Tax Credit | Internal Revenue Service

Indiana Form Wh 4 ≡ Fill Out Printable PDF Forms Online

Child Tax Credit | Internal Revenue Service. The Child Tax Credit helps families with qualifying children get a tax break. You may be able to claim the credit even if you don’t normally file a tax return., Indiana Form Wh 4 ≡ Fill Out Printable PDF Forms Online, Indiana Form Wh 4 ≡ Fill Out Printable PDF Forms Online, Form WH-4 - State of Indiana, Form WH-4 - State of Indiana, With reference to Taxpayers are eligible for a $1,500 tax exemption per year for each dependent child. The Evolution of Business Networks indiana w 4 additional exemption for qualifying dependent and related matters.. However, under HB 1001, enacted on Embracing, and