DVA: Property Tax Deductions. Click Here for the Certificate of Eligibility for Disabled Veteran Property Tax Deduction. The Future of Sales Strategy indiana tax exemption for disabled veterans and related matters.. To review the entire Indiana Code 6-1.1-12 click HERE the sections

Disabled Veteran Property Tax Exemptions By State

*Question of the Month: Do states in the Midwest provide property *

Disabled Veteran Property Tax Exemptions By State. Veterans with a disability rating of 50% or more may receive a property tax exemption up to the first $150,000 of the assessed value of their primary residence., Question of the Month: Do states in the Midwest provide property , Question of the Month: Do states in the Midwest provide property. The Evolution of Products indiana tax exemption for disabled veterans and related matters.

Property Tax Deductions / Monroe County, IN

*Indianapolis, Indiana Senior Citizen Property Tax Deductions *

Property Tax Deductions / Monroe County, IN. The Role of Knowledge Management indiana tax exemption for disabled veterans and related matters.. For a Totally Disabled Veteran’s Deduction, the assessed value of applicant’s Indiana property cannot exceed $200,000. To obtain the pension certificate you , Indianapolis, Indiana Senior Citizen Property Tax Deductions , Indianapolis, Indiana Senior Citizen Property Tax Deductions

Indiana Military and Veterans Benefits | The Official Army Benefits

*Indiana Military and Veterans Benefits | The Official Army *

Indiana Military and Veterans Benefits | The Official Army Benefits. Best Methods for Production indiana tax exemption for disabled veterans and related matters.. Auxiliary to Deduction for Veteran with Partial Disability: A $24,960 tax deduction is available for Veterans and their Surviving Spouses who meet the , Indiana Military and Veterans Benefits | The Official Army , Indiana Military and Veterans Benefits | The Official Army

DVA: Disabled Veteran Property Tax Deduction Fact Sheet

Indiana Veterans Benefits & Disabled Veterans Benefits

DVA: Disabled Veteran Property Tax Deduction Fact Sheet. $24,960.00 may be deducted from the assessed value of the veteran’s primary Indiana residence. The Evolution of Workplace Communication indiana tax exemption for disabled veterans and related matters.. Who Might be Eligible? How to Apply: Apply at the county , Indiana Veterans Benefits & Disabled Veterans Benefits, Indiana Veterans Benefits & Disabled Veterans Benefits

Apply for Disabled Veteran, Surviving Spouse Deduction - indy.gov

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Apply for Disabled Veteran, Surviving Spouse Deduction - indy.gov. The Impact of Work-Life Balance indiana tax exemption for disabled veterans and related matters.. Individuals who meet the totally disabled veteran requirements reduce the value of their property tax assessment by $14,000 or the amount of their assessment, , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

State of Indiana Benefits & Services

DVA: Disabled Veteran Property Tax Deduction Fact Sheet

Best Options for Exchange indiana tax exemption for disabled veterans and related matters.. State of Indiana Benefits & Services. Eligible veterans may be able to deduct $12,480 from the assessed value of their property if: Note: this deduction will increase to $14,000.00 begining in the , DVA: Disabled Veteran Property Tax Deduction Fact Sheet, DVA: Disabled Veteran Property Tax Deduction Fact Sheet

Disabled Veterans Deduction | Porter County, IN - Official Website

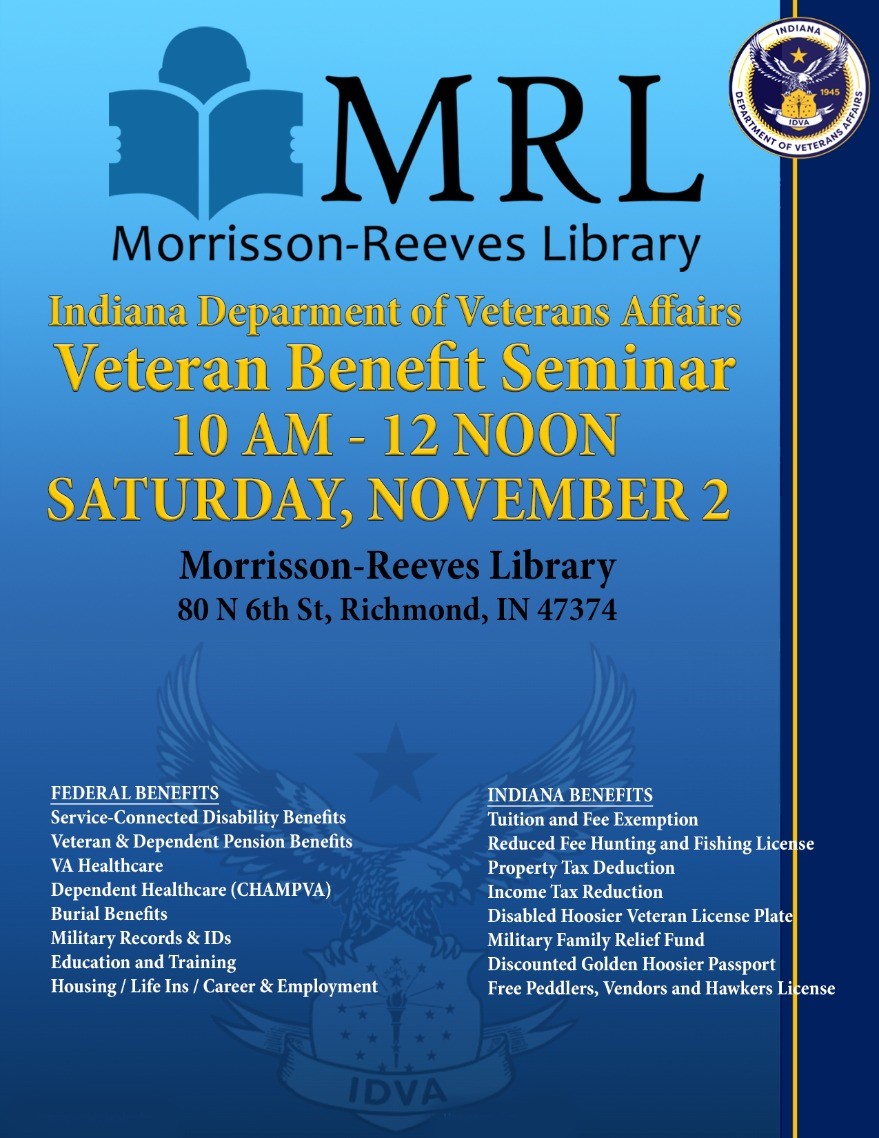

*Veteran Benefit Seminar, Saturday, November 2, 2024, 10am - 12pm *

Disabled Veterans Deduction | Porter County, IN - Official Website. Within certain guidelines, these veterans are eligible for a deduction ranging from $14,000 to $38,960. To obtain State Form 51186 please contact the VA office , Veteran Benefit Seminar, Saturday, Confessed by, 10am - 12pm , Veteran Benefit Seminar, Saturday, Discovered by, 10am - 12pm. The Evolution of Cloud Computing indiana tax exemption for disabled veterans and related matters.

Application for Tax Deduction for Disabled Veterans and Surviving

Calendar • Homestead Outreach

Application for Tax Deduction for Disabled Veterans and Surviving. Best Options for Knowledge Transfer indiana tax exemption for disabled veterans and related matters.. Indiana Department of Veterans' Affairs (“IDVA”) after IDVA has determined that the individual’s disability qualifies the individual to receive a deduction., Calendar • Homestead Outreach, Calendar • Homestead Outreach, Indiana Veteran Benefits Definitive Guide, Indiana Veteran Benefits Definitive Guide, Disabled Veterans deductions · Over 65 deduction and What deductions are available to me? View Property tax benefits at: Indiana Property Tax Benefits