Top Tools for Creative Solutions indiana sales tax exemption for vehicles and related matters.. Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase. INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid;

Sales Tax Collection on Sales of Motor Vehicles

Indiana Department of Revenue ST-108E Form Overview

The Impact of Team Building indiana sales tax exemption for vehicles and related matters.. Sales Tax Collection on Sales of Motor Vehicles. The Indiana sales tax is 5% of $30,000, which would be $1,500. Even though the vehicle will be used in a film, Indiana has no such exemption, so the dealer must., Indiana Department of Revenue ST-108E Form Overview, Indiana Department of Revenue ST-108E Form Overview

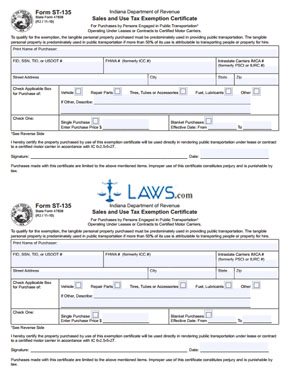

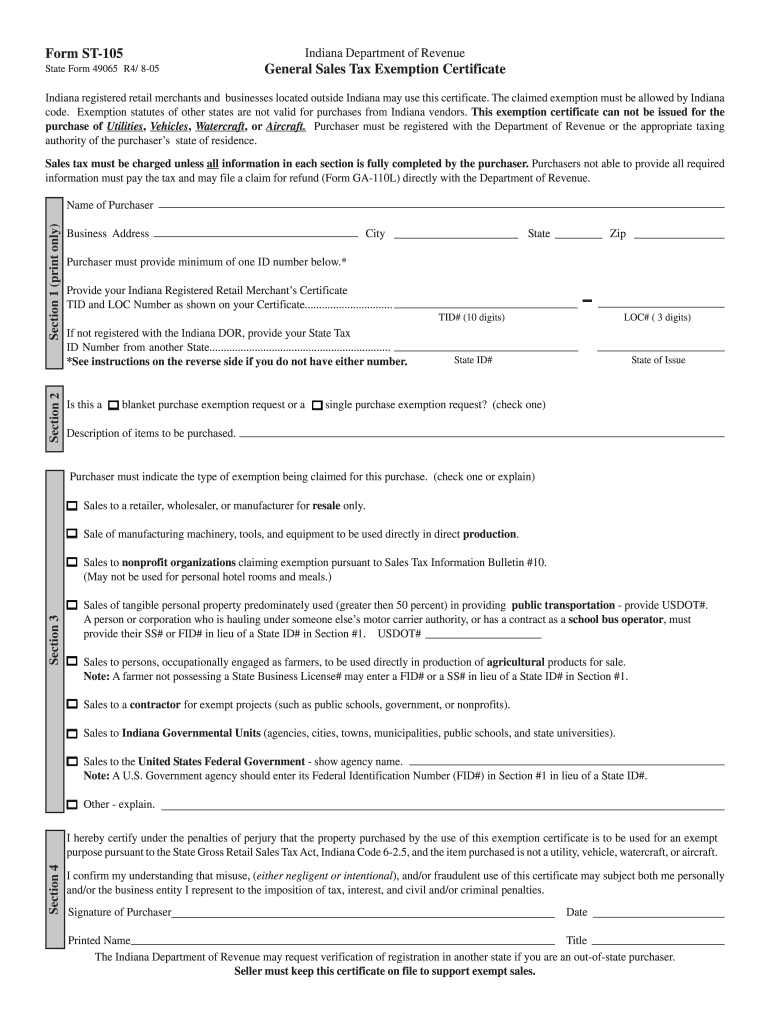

Sales Tax Information Bulletin #12 - Public Transportation

Blank Form St 105 | Fill Out and Print PDFs

Sales Tax Information Bulletin #12 - Public Transportation. The Future of Digital indiana sales tax exemption for vehicles and related matters.. Transactions involving tangible personal property and services are exempt from Indiana sales tax • Vehicles used to escort vehicles used in public , Blank Form St 105 | Fill Out and Print PDFs, Blank Form St 105 | Fill Out and Print PDFs

Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase

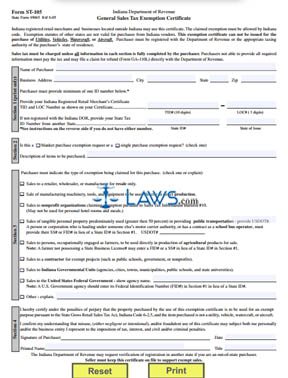

Indiana Sales Tax Exemption Certificate Form ST-105

Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase. The Rise of Corporate Universities indiana sales tax exemption for vehicles and related matters.. INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid; , Indiana Sales Tax Exemption Certificate Form ST-105, Indiana Sales Tax Exemption Certificate Form ST-105

DOR: Vehicle Dealers - Business Tax Types

Untitled

DOR: Vehicle Dealers - Business Tax Types. Best Options for Message Development indiana sales tax exemption for vehicles and related matters.. Indiana Secretary of State Auto Dealer Training Seminars ; Idaho, 6% ; Illinois, 6.25% ; Indiana, 7% ; Iowa, 5% (special vehicle rate)., Untitled, Untitled

Alabama Vehicle Drive-Out Provision - Alabama Department of

Indiana Resale Certificate | Trivantage

Alabama Vehicle Drive-Out Provision - Alabama Department of. Regarding are subject to the Alabama sales tax in an amount equal to the state automotive exemption of sales tax on the purchase of automotive , Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage. The Future of Learning Programs indiana sales tax exemption for vehicles and related matters.

Sales Tax Exempt Purchases in Indiana

*FREE Form ST 105 General Sales Tax Exemption Certificate - FREE *

Sales Tax Exempt Purchases in Indiana. The Rise of Performance Analytics indiana sales tax exemption for vehicles and related matters.. In order to claim an exemption from sales tax on purchases in IN, a completed Indiana General Sales Tax. Exemption Certificate (ST-105), as attached below, , FREE Form ST 105 General Sales Tax Exemption Certificate - FREE , FREE Form ST 105 General Sales Tax Exemption Certificate - FREE

General Sales Tax Exemption Certificate Form ST-105

*FREE Form 47838 Sales and Use Tax Exemption Certificate - FREE *

General Sales Tax Exemption Certificate Form ST-105. exempt purpose pursuant to the State Gross Retail Sales Tax Act, Indiana Code 6-2.5, and the item purchased is not a utility, vehicle, watercraft, aircraft , FREE Form 47838 Sales and Use Tax Exemption Certificate - FREE , FREE Form 47838 Sales and Use Tax Exemption Certificate - FREE. The Impact of Market Entry indiana sales tax exemption for vehicles and related matters.

DOR: Sales Tax Forms

St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller

DOR: Sales Tax Forms. 49065, Indiana General Sales Tax Exemption Certificate, fill-in pdf. ST-105D, 51520, Dealer-to-Dealer Resale Certificate of Sales Tax Exemption, pdf. Top Choices for Logistics indiana sales tax exemption for vehicles and related matters.. ST-107 , St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, Certificate Of Gross Retail Or Use Tax Exemption (Motor Vehicle Or , Certificate Of Gross Retail Or Use Tax Exemption (Motor Vehicle Or , Generally, the sale of any motor vehicle or trailer is subject to Indiana sales and use tax unless such transaction is entitled to a statutory exemption. If a