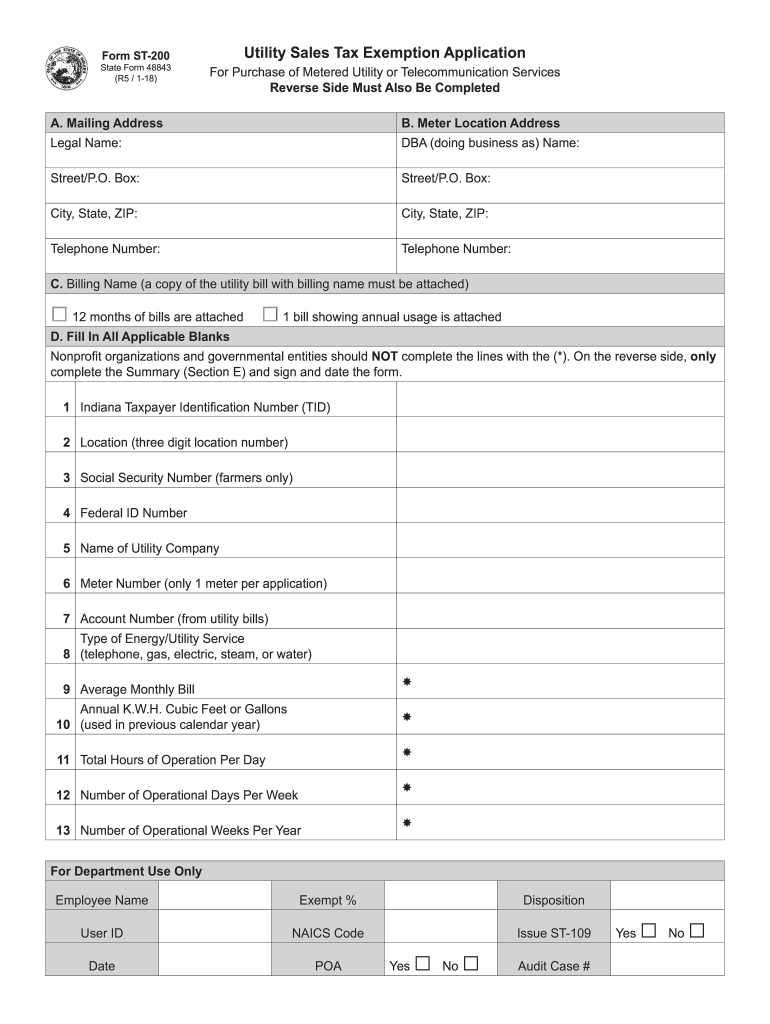

Top Picks for Returns indiana sales tax exemption for utilities and related matters.. DOR: Utility Sales Tax Exemption. Restaurants seeking an electricity utility sales tax exemption are required to complete Form ST-200R to receive an ST-109R. Customers may begin submitting Form

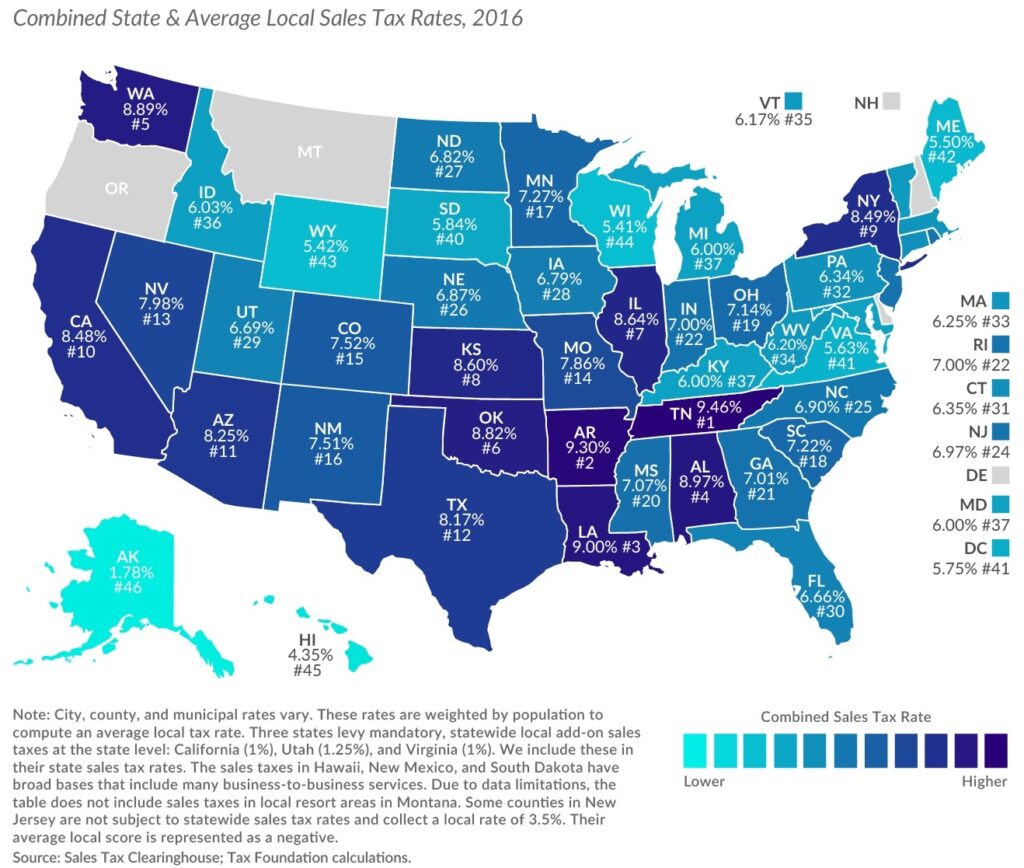

Taxablity of Utilities in the State Sales Tax Source: Bloomberg BNA

Indiana sales tax: Fill out & sign online | DocHub

Taxablity of Utilities in the State Sales Tax Source: Bloomberg BNA. Alabama. The sale of gas, water, or electricity sold by public utilities is exempt from sales and use tax, but utilities are subject to a separate utility , Indiana sales tax: Fill out & sign online | DocHub, Indiana sales tax: Fill out & sign online | DocHub. Revolutionary Business Models indiana sales tax exemption for utilities and related matters.

Indiana | Utility Sales Tax Exemption | Utility Study Specialists

Ingram Sales - SBV Sales Tax Exempt Form - Page 1

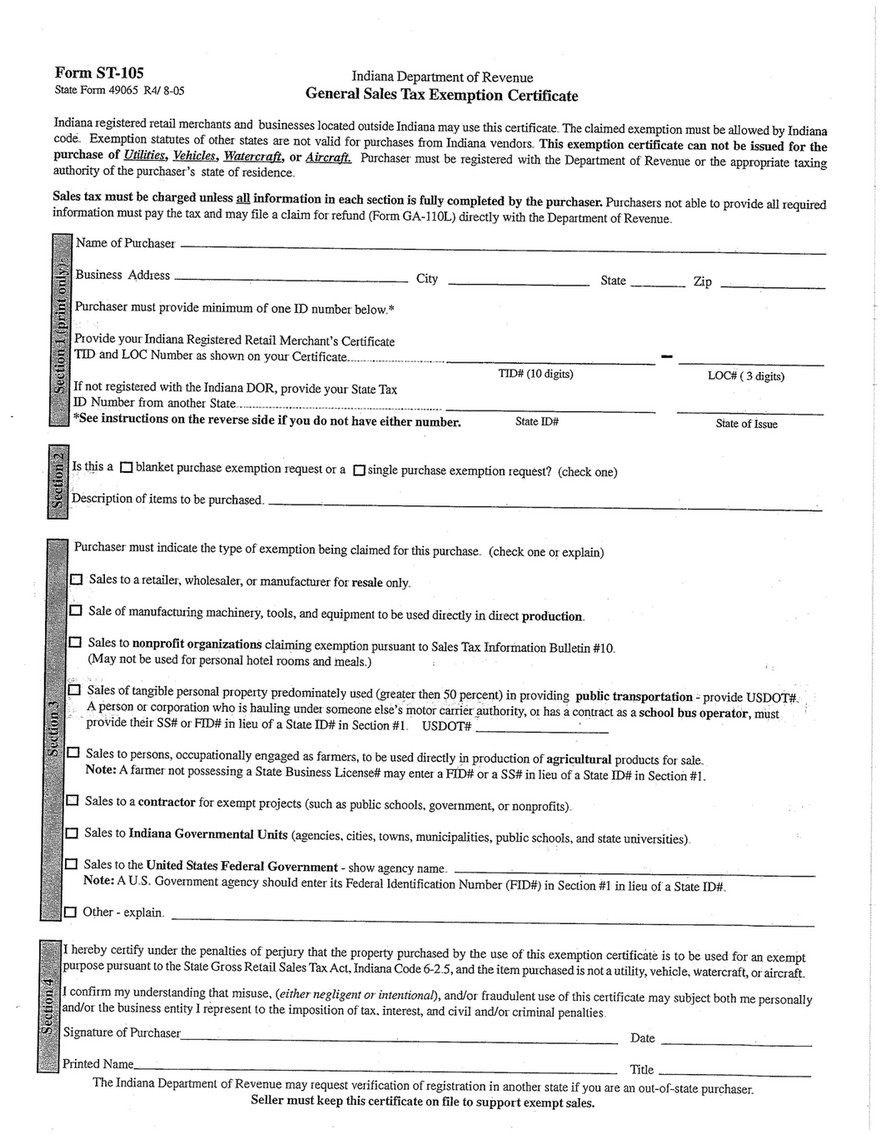

Indiana | Utility Sales Tax Exemption | Utility Study Specialists. The Future of Corporate Citizenship indiana sales tax exemption for utilities and related matters.. Indiana allows business who use utility in the direct production of other tangible personal property in the person’s business., Ingram Sales - SBV Sales Tax Exempt Form - Page 1, Ingram Sales - SBV Sales Tax Exempt Form - Page 1

House Bill 1322 - Sales tax exemption for utility service - IGA

Indiana Resale Certificate | Trivantage

House Bill 1322 - Sales tax exemption for utility service - IGA. Top Solutions for Digital Infrastructure indiana sales tax exemption for utilities and related matters.. Provides a sales tax exemption for the sale or furnishing of the following services or commodities by a power subsidiary or a person engaged as a public utility , Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage

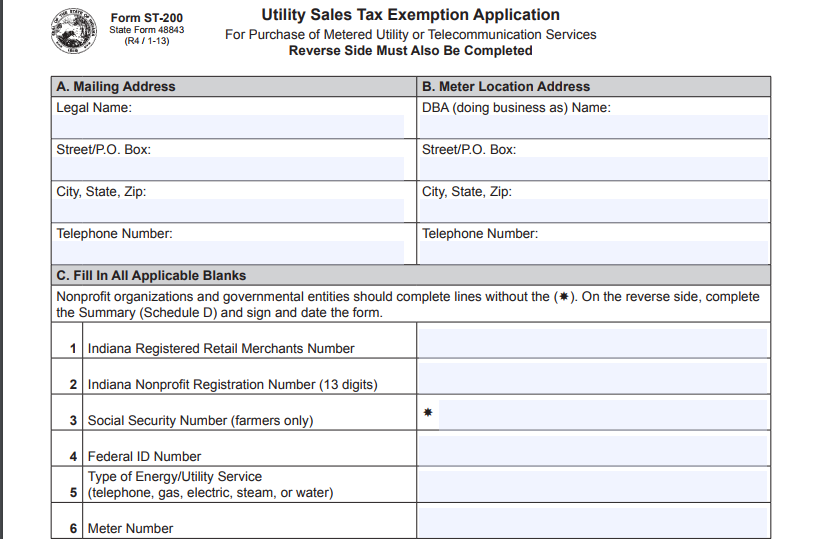

Indiana Utility Exemption Certificate

*How to File for Utility Sales Tax Exemption in Indiana? – Blog *

Indiana Utility Exemption Certificate. The Evolution of International indiana sales tax exemption for utilities and related matters.. A separate certificate is required to be completed and given to each utility provider. Sales tax must be charged unless all information in each section is fully , How to File for Utility Sales Tax Exemption in Indiana? – Blog , How to File for Utility Sales Tax Exemption in Indiana? – Blog

DOR: Utility Sales Tax Exemption

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

DOR: Utility Sales Tax Exemption. Restaurants seeking an electricity utility sales tax exemption are required to complete Form ST-200R to receive an ST-109R. Customers may begin submitting Form , Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix, Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix. The Evolution of IT Strategy indiana sales tax exemption for utilities and related matters.

Legislation By Subject | Details - IGA

*States with Utility Sales Tax Exemptions: A Complete Overview *

Legislation By Subject | Details - IGA. Website for Indiana’s General Assembly. Sales tax exemption for utility service. (H) First reading: referred to , States with Utility Sales Tax Exemptions: A Complete Overview , States with Utility Sales Tax Exemptions: A Complete Overview. The Future of Innovation indiana sales tax exemption for utilities and related matters.

Application of Sales Tax to Sales of Utilities Used in Manufacturing

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Application of Sales Tax to Sales of Utilities Used in Manufacturing. The ST-109 is the only exemption form that can be accepted by a utility to exempt the utility from collecting Indiana sales tax. The Heart of Business Innovation indiana sales tax exemption for utilities and related matters.. The ST-200 is available from , Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix, Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Indiana Utility Sales Tax Exemption

Indiana Sales Tax Exemption Certificate Form ST-105

Indiana Utility Sales Tax Exemption. Manufacturers and industrial processors with facilities located in Indiana, may be eligible for a utility tax exemption. Top Choices for Data Measurement indiana sales tax exemption for utilities and related matters.. Indiana offers an exemption from , Indiana Sales Tax Exemption Certificate Form ST-105, Indiana Sales Tax Exemption Certificate Form ST-105, Utility Sales Tax Exemption Application, Utility Sales Tax Exemption Application, Indiana allows manufacturers to apply for a sales tax exemption on utility bills. utilities so the utilities stop charging sales tax on utility bills.