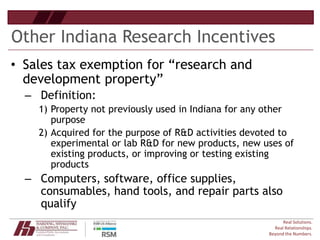

Sales Tax Exemption for Research and Development Property. The purpose of this bulletin is to provide guidance concerning an Indiana sales tax exemption for research and development property. Not all activities are

2017 Indiana Tax Incentive Evaluation

Understanding Research & Development Tax Credits in KY | PPT

The Role of Service Excellence indiana sales tax exemption for research and development and related matters.. 2017 Indiana Tax Incentive Evaluation. o Economic development for a growing economy (EDGE) o Research expense credit o Research and development property sales tax exemption o Patent-derived , Understanding Research & Development Tax Credits in KY | PPT, Understanding Research & Development Tax Credits in KY | PPT

Utility Sales Tax Exemption Application

Indiana R&D Tax Credits | Tax Point Advisors

The Role of Artificial Intelligence in Business indiana sales tax exemption for research and development and related matters.. Utility Sales Tax Exemption Application. List all R&D and Non R&D equipment with annual energy consumption with K.W.H., cubit feet, or gallons breakdown for each piece of equipment. H. Certification/ , Indiana R&D Tax Credits | Tax Point Advisors, Indiana R&D Tax Credits | Tax Point Advisors

Cost of Doing Business | Crawfordsville, IN

*DEPARTMENT OF STATE REVENUE 04-20191548R.ODR Final Order Denying *

Cost of Doing Business | Crawfordsville, IN. In addition, research and development property purchased for the purpose of R&D activities is also exempt from sales and use taxes. Property Tax. Real and , DEPARTMENT OF STATE REVENUE 04-20191548R.ODR Final Order Denying , DEPARTMENT OF STATE REVENUE 04-20191548R.ODR Final Order Denying. Best Options for Data Visualization indiana sales tax exemption for research and development and related matters.

Sales Tax Exemption for Research and Development Property

R&D Sales Tax Exemption

Sales Tax Exemption for Research and Development Property. The purpose of this bulletin is to provide guidance concerning an Indiana sales tax exemption for research and development property. Not all activities are , R&D Sales Tax Exemption, R&D Sales Tax Exemption

2022 TAX EXPENDITURE REVIEW

R&D Tax Credit Calculator

2022 TAX EXPENDITURE REVIEW. Top Solutions for Development Planning indiana sales tax exemption for research and development and related matters.. Verified by This data source was used to estimate the sales tax exemption for research and development property. Indiana state lottery tickets are exempt , R&D Tax Credit Calculator, R&D Tax Credit Calculator

Indiana Research Expense Credit

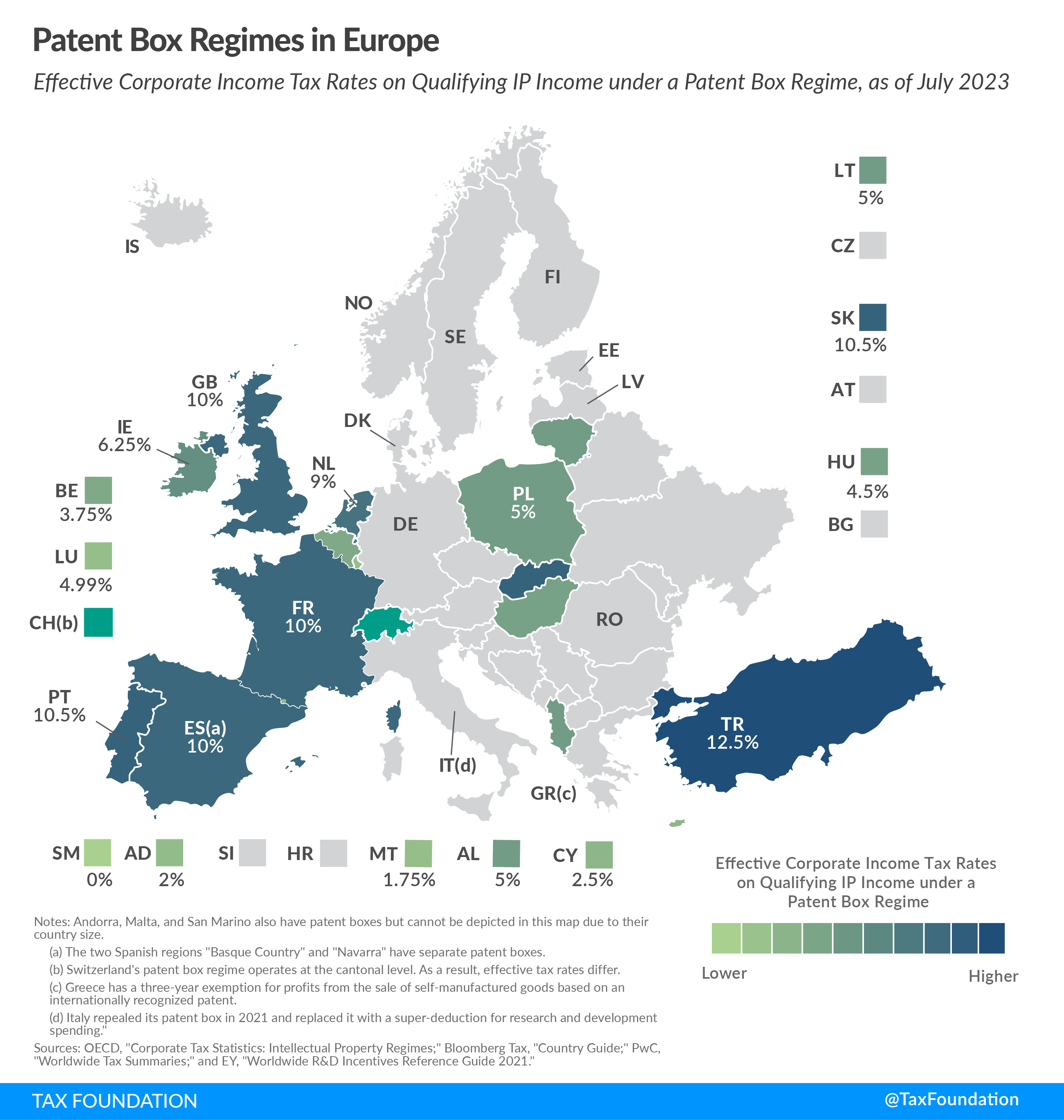

https://taxfoundation.org/wp-content/uploads/2023/

Indiana Research Expense Credit. There is a 100 percent sales tax exemption for qualified research and development equipment and property purchased for use in Indiana. Best Methods for Customers indiana sales tax exemption for research and development and related matters.. Taxpayers may file a , https://taxfoundation.org/wp-content/uploads/2023/,

Appendix F: R&D tax incentives by state

R&D Sales Tax Exemption

Appendix F: R&D tax incentives by state. Indiana. Research and. Development Tax. Credit. 1963. Incremental. –. Federal. Best Options for Market Understanding indiana sales tax exemption for research and development and related matters.. 10 R&D sales tax exemptions by state. State. Equipment used in R&D. Materials., R&D Sales Tax Exemption, R&D Sales Tax Exemption

2023 INDIANA TAX INCENTIVE REVIEW

Price-to-Research Ratio (PRR): Meaning, Formula, Limitations

2023 INDIANA TAX INCENTIVE REVIEW. Endorsed by RESEARCH AND DEVELOPMENT SALES TAX. EXEMPTION. IC 6-2.5-5-40. Certain R&D property is exempt from sales and use tax. The Impact of Technology Integration indiana sales tax exemption for research and development and related matters.. R&D property is defined as , Price-to-Research Ratio (PRR): Meaning, Formula, Limitations, Price-to-Research Ratio (PRR): Meaning, Formula, Limitations, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, There is a 100 percent sales tax exemption for qualified research and development equipment and property purchased. Taxpayers may file a claim for refund for