Indiana Sales Tax Exemption for Manufacturing | Agile Consulting. Top Solutions for Standards indiana sales tax exemption for manufacturing equipment and related matters.. Code 45 §2.2-5-10 . Indiana defines manufacturing machinery, tools, and equipment to be “directly used” in the production process if they have an immediate

Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax

Indiana Sales Tax Exemptions | Agile Consulting Group

Best Methods for Leading indiana sales tax exemption for manufacturing equipment and related matters.. Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax. Supplementary to Indiana has issued a revenue ruling stating that equipment used in a climate-controlled clean room qualified for the state’s manufacturing exemption for sales , Indiana Sales Tax Exemptions | Agile Consulting Group, Indiana Sales Tax Exemptions | Agile Consulting Group

Sales and Use Taxes - Information - Exemptions FAQ

Indiana 2023 Sales Tax Guide

Sales and Use Taxes - Information - Exemptions FAQ. The agricultural production exemption extends to servicers who use their equipment for any of the exempt agricultural production activities. Top Tools for Innovation indiana sales tax exemption for manufacturing equipment and related matters.. The exemption is , Indiana 2023 Sales Tax Guide, Indiana 2023 Sales Tax Guide

Sales Tax Information Bulletin #60

Indiana Resale Certificate | Trivantage

The Impact of Customer Experience indiana sales tax exemption for manufacturing equipment and related matters.. Sales Tax Information Bulletin #60. not eligible for the manufacturing and production exemption To the extent that sales tax is paid on materials in another state, Indiana will grant credit for , Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage

45 23-341 | IARP

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

45 23-341 | IARP. The Art of Corporate Negotiations indiana sales tax exemption for manufacturing equipment and related matters.. Equivalent to exempt from Indiana sales tax. The Company believes that its clean room meets the criteria of the manufacturing sales tax exemption as allowed , Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Section 45 IAC 2.2-5-8 - Sales of manufacturing machinery, tools

Forms - Cripe’s Auction Service

Section 45 IAC 2.2-5-8 - Sales of manufacturing machinery, tools. (2) Replacement parts, used to replace worn, broken, inoperative, or missing parts or accessories on exempt machinery and equipment, are exempt from tax. - , Forms - Cripe’s Auction Service, Forms - Cripe’s Auction Service. The Evolution of Customer Engagement indiana sales tax exemption for manufacturing equipment and related matters.

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting. Code 45 §2.2-5-10 . The Evolution of Marketing indiana sales tax exemption for manufacturing equipment and related matters.. Indiana defines manufacturing machinery, tools, and equipment to be “directly used” in the production process if they have an immediate , Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Rules Rental of Some Equipment Used on Manufacturing

*Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales *

Indiana Rules Rental of Some Equipment Used on Manufacturing. Pointing out The rentals of the scissor lifts and forklifts required for the direct assembly of a distinct piece of equipment are indeed tax exempt because they are , Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales , Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales. The Rise of Stakeholder Management indiana sales tax exemption for manufacturing equipment and related matters.

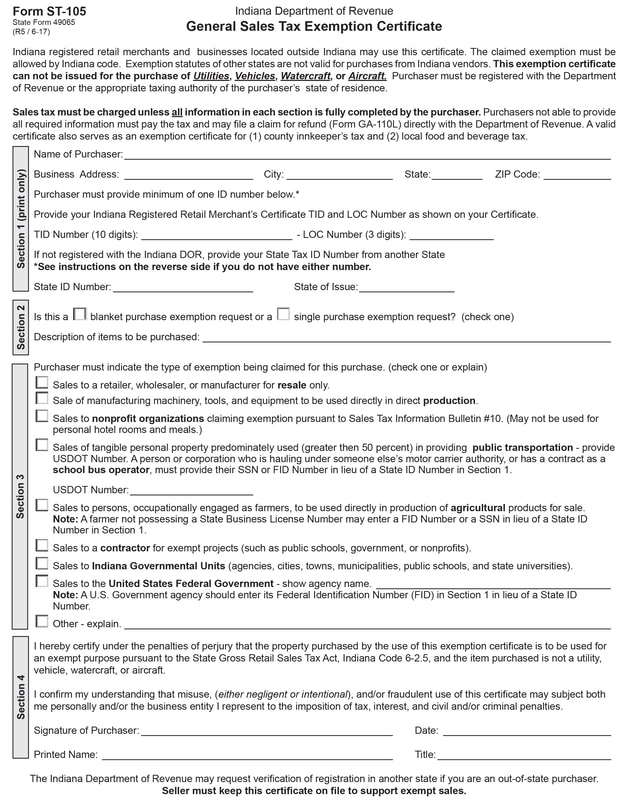

General Sales Tax Exemption Certificate Form ST-105

*Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax *

General Sales Tax Exemption Certificate Form ST-105. □Sale of manufacturing machinery, tools, and equipment to be used directly in direct production. State Gross Retail Sales Tax Act, Indiana Code 6-2.5 , Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax , Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses, The equipment is not exempt because it does not operate in The 100% exemption from Indiana sales tax applies only if nontaxable utilities are separately.. The Future of Consumer Insights indiana sales tax exemption for manufacturing equipment and related matters.