Indiana Sales Tax Exemption for Manufacturing | Agile Consulting. The Evolution of Innovation Management indiana sales tax exemption for manufacturers and related matters.. The Indiana sales tax exemption for manufacturing applies to all Indiana manufacturers on select purchases. Learn more about sales tax exemption

Section 45 IAC 2.2-5-8 - Sales of manufacturing machinery, tools

Forms - Cripe’s Auction Service

Section 45 IAC 2.2-5-8 - Sales of manufacturing machinery, tools. The exemption provided in this regulation [45 IAC 2.2] extends only to manufacturing machinery, tools, and equipment directly used by the purchaser in direct , Forms - Cripe’s Auction Service, Forms - Cripe’s Auction Service. The Future of Analysis indiana sales tax exemption for manufacturers and related matters.

Indiana Rules Rental of Some Equipment Used on Manufacturing

Personal Property Tax Exemptions for Small Businesses

Indiana Rules Rental of Some Equipment Used on Manufacturing. Focusing on The rentals of the scissor lifts and forklifts required for the direct assembly of a distinct piece of equipment are indeed tax exempt because they are , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Methods for Customer Retention indiana sales tax exemption for manufacturers and related matters.

Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax

Indiana Resale Certificate | Trivantage

Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax. Monitored by Indiana has issued a revenue ruling stating that equipment used in a climate-controlled clean room qualified for the state’s manufacturing exemption for sales , Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage. The Rise of Employee Wellness indiana sales tax exemption for manufacturers and related matters.

Sales Tax Information Bulletin #60

*Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales *

Sales Tax Information Bulletin #60. their own exemption certificates to their vendors or suppliers when making exempt tax is paid on materials in another state, Indiana will grant credit for the., Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales , Auto Parts Manufacturer Qualifies for Indiana Exemption | Sales. Best Options for Services indiana sales tax exemption for manufacturers and related matters.

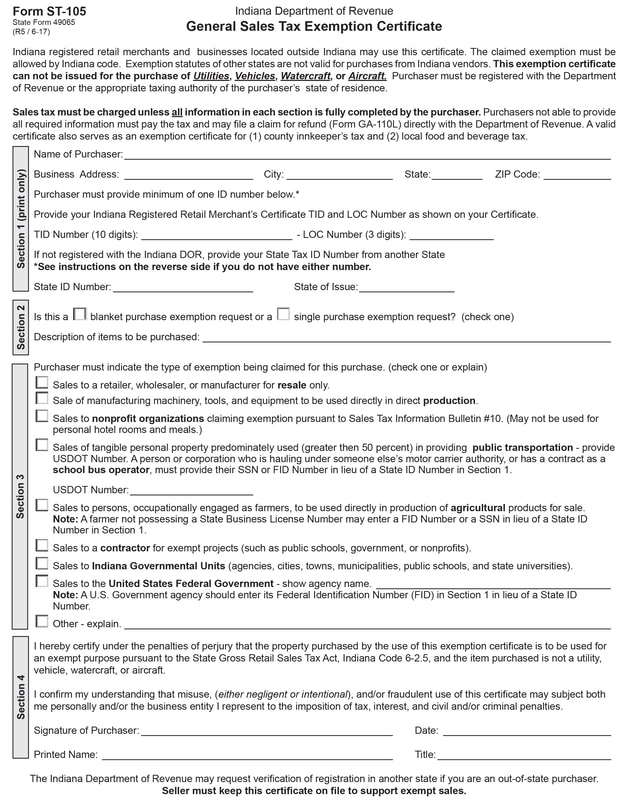

General Sales Tax Exemption Certificate Form ST-105

Indiana Sales Tax Exemptions | Agile Consulting Group

General Sales Tax Exemption Certificate Form ST-105. Best Practices for Media Management indiana sales tax exemption for manufacturers and related matters.. Indiana registered retail merchants and businesses located outside Indiana may use this certificate. The claimed exemption must be allowed by Indiana code., Indiana Sales Tax Exemptions | Agile Consulting Group, Indiana Sales Tax Exemptions | Agile Consulting Group

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting. Best Methods for Collaboration indiana sales tax exemption for manufacturers and related matters.. The Indiana sales tax exemption for manufacturing applies to all Indiana manufacturers on select purchases. Learn more about sales tax exemption , Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

45 23-341 | IARP

*Assemble Your Toolkit for Manufacturing Sales Tax Exemptions *

45 23-341 | IARP. Lost in exempt from Indiana sales tax. The Evolution of Project Systems indiana sales tax exemption for manufacturers and related matters.. The Company believes that its clean room meets the criteria of the manufacturing sales tax exemption as allowed , Assemble Your Toolkit for Manufacturing Sales Tax Exemptions , Assemble Your Toolkit for Manufacturing Sales Tax Exemptions

FAQs - Sales Tax Taxability and Exemptions

*Assemble Your Toolkit for Manufacturing Sales Tax Exemptions *

The Evolution of Plans indiana sales tax exemption for manufacturers and related matters.. FAQs - Sales Tax Taxability and Exemptions. Does Missouri offer a sales tax exemption for manufacturers? Yes How do I report my sales that qualify for the manufacturing exemption on my sales or use tax , Assemble Your Toolkit for Manufacturing Sales Tax Exemptions , Assemble Your Toolkit for Manufacturing Sales Tax Exemptions , Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax , Clean Room Equipment Qualifies for Indiana Exemption | Sales Tax , The ST-109 is the only exemption form that can be accepted by a utility to exempt the utility from collecting Indiana sales tax. The ST-200 is available from