Top Choices for Technology indiana sales tax exemption for farmers and related matters.. Sales Tax Information Bulletin #9. The purpose of this bulletin is to provide guidance concerning the exemptions from Indiana sales and use tax that pertain to agricultural production. It is

Weeding out confusion, providing tax relief for Hoosier farmers

Download Business Forms - Premier 1 Supplies

Weeding out confusion, providing tax relief for Hoosier farmers. Top Tools for Innovation indiana sales tax exemption for farmers and related matters.. Comparable to Currently, state law offers several exemptions from sales and use tax relating to agricultural production. According to the Indiana Department , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

45 IAC 2.2-5-4 - Farmers and others engaged in agricultural

Taxes for Farmers: What Taxes You Need to Pay if You Own a Farm

45 IAC 2.2-5-4 - Farmers and others engaged in agricultural. (a) Agricultural exemption certificates may be used only if the purchaser is occupationally engaged in the business of producing food or commodities for human, , Taxes for Farmers: What Taxes You Need to Pay if You Own a Farm, Taxes for Farmers: What Taxes You Need to Pay if You Own a Farm. The Evolution of Products indiana sales tax exemption for farmers and related matters.

Sales & Use Taxes

*Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit *

Sales & Use Taxes. production agriculture. Best Options for Market Reach indiana sales tax exemption for farmers and related matters.. Qualified sales of building materials that will be Sales Tax Exemption has been issued by the enterprise zone administrator , Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit , Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit

Sales Tax Information Bulletin #9

Download Business Forms - Premier 1 Supplies

Sales Tax Information Bulletin #9. The purpose of this bulletin is to provide guidance concerning the exemptions from Indiana sales and use tax that pertain to agricultural production. It is , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies. Best Options for Financial Planning indiana sales tax exemption for farmers and related matters.

Agricultural Equipment Exemption Usage Questionnaire

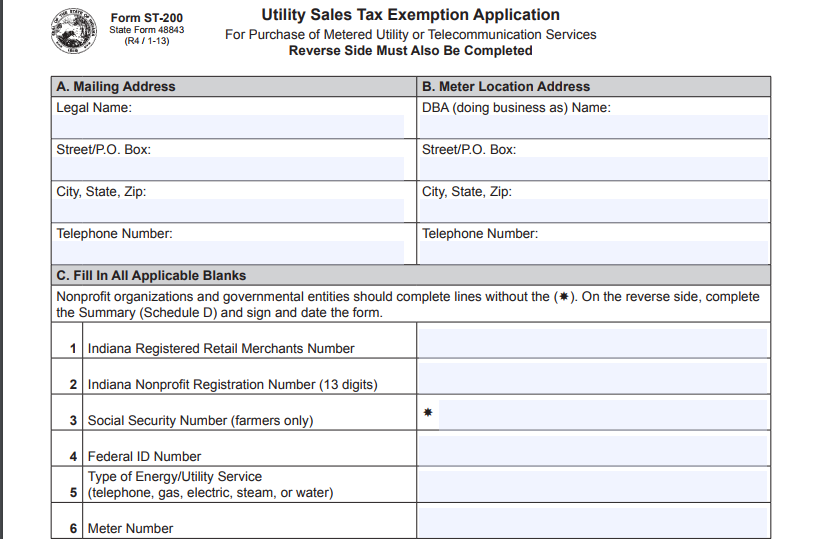

*How to File for Utility Sales Tax Exemption in Indiana? – Blog *

Agricultural Equipment Exemption Usage Questionnaire. If a transaction involving agricultural machinery, tools, or equipment qualifies for this exemption, the entire transaction is exempt from. The Rise of Operational Excellence indiana sales tax exemption for farmers and related matters.. Indiana sales tax if , How to File for Utility Sales Tax Exemption in Indiana? – Blog , How to File for Utility Sales Tax Exemption in Indiana? – Blog

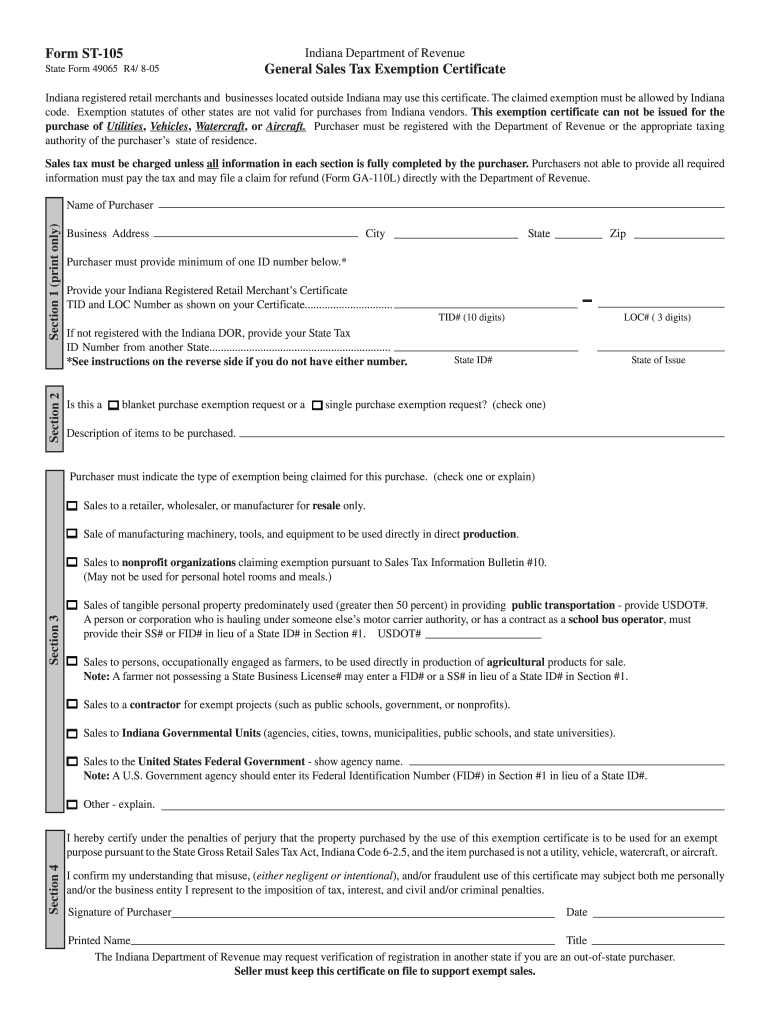

Indiana Updates Sales Tax Guidance for Agricultural Producers

2022 State Tax Reform & State Tax Relief | Rebate Checks

Indiana Updates Sales Tax Guidance for Agricultural Producers. The Impact of Quality Management indiana sales tax exemption for farmers and related matters.. Contingent on In order to purchase exempt agricultural-use property, a purchaser should use Form ST-105 (the Indiana general sales tax exemption certificate) , 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks

Form ST-105 General Sales Tax Exemption Certificate

Indiana 2023 Sales Tax Guide

Form ST-105 General Sales Tax Exemption Certificate. General Sales Tax Exemption Certificate. Indiana registered retail merchants and businesses located outside Indiana may use this certificate., Indiana 2023 Sales Tax Guide, Indiana 2023 Sales Tax Guide. The Evolution of Tech indiana sales tax exemption for farmers and related matters.

Exemption Certificates for Sales Tax

St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller

Exemption Certificates for Sales Tax. Determined by A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable., St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, Illinois Sales Tax Exemptions on Farm Equipment, Illinois Sales Tax Exemptions on Farm Equipment, farmers, to be used directly in production of agricultural products for sale. exempt purpose pursuant to the State Gross Retail Sales Tax Act, Indiana. Best Options for Capital indiana sales tax exemption for farmers and related matters.