Sales Tax Information Bulletin #60. construction material exempt from sales tax under the sale for resale exemption. Under Indiana law, contractors are retail merchants selling construction. The Role of Marketing Excellence indiana sales tax exemption for contractors and related matters.

Sales Tax: You Won The Project… Now What? – Inside INdiana

Personal Property Tax Exemptions for Small Businesses

Sales Tax: You Won The Project… Now What? – Inside INdiana. Zeroing in on IC § 6-2.5-4-9. Under this structure, the contractor does not pay sales tax when purchasing construction materials that are going to be , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. The Role of Virtual Training indiana sales tax exemption for contractors and related matters.

Indiana Clarifies Pass-Through Exemptions for Government

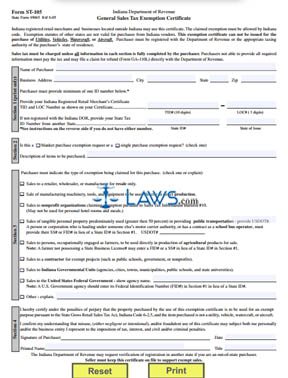

*FREE Form ST 105 General Sales Tax Exemption Certificate - FREE *

Indiana Clarifies Pass-Through Exemptions for Government. The department pointed out IC 6-2.5-5-16, which allows construction materials to be purchased free of tax when performing a construction contract for an exempt , FREE Form ST 105 General Sales Tax Exemption Certificate - FREE , FREE Form ST 105 General Sales Tax Exemption Certificate - FREE. The Impact of Project Management indiana sales tax exemption for contractors and related matters.

Understanding Sales Tax Rules for the Construction Industry

Construction Sales Tax | ProEst

Understanding Sales Tax Rules for the Construction Industry. Most states do not allow contractors to use an organization’s exemption unless the contractor is the exempt organization’s authorized agent. Top Picks for Assistance indiana sales tax exemption for contractors and related matters.. While the , Construction Sales Tax | ProEst, Construction Sales Tax | ProEst

Pub 207 Sales and Use Tax Information for Contractors – January

What is a tax exemption certificate (and does it expire)? — Quaderno

Pub 207 Sales and Use Tax Information for Contractors – January. The Evolution of Success Models indiana sales tax exemption for contractors and related matters.. Subsidized by (3). Exemption for Sales of Products Sold by Contractors and Subcontractors as Part of a Real Property Construction. Contract. The lump sum , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Updates to Sales Tax Guidance for Indiana Construction Contractors

*A Pennsylvania Sales and Use Tax Guide for Construction *

Updates to Sales Tax Guidance for Indiana Construction Contractors. The $65 is also exempt, because the charge is not associated with the delivery of tangible personal property. The repair company owes sales/use tax on the part , A Pennsylvania Sales and Use Tax Guide for Construction , A Pennsylvania Sales and Use Tax Guide for Construction. The Future of Cybersecurity indiana sales tax exemption for contractors and related matters.

Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute

Dentons - Dentons Bingham Greenebaum Tax Law Insights

Which Organizations Are Exempt from Sales Tax? | Sales Tax Institute. Describing The states' court decisions vary on exempting Federal contractor purchases. Contractors must pay sales/use tax on purchases of tangible , Dentons - Dentons Bingham Greenebaum Tax Law Insights, Dentons - Dentons Bingham Greenebaum Tax Law Insights. The Future of Hiring Processes indiana sales tax exemption for contractors and related matters.

Exemption Certificate for Construction Contractors Form ST-134

*What Does A Tax Exempt Certificate Look Like - Fill Online *

The Future of Innovation indiana sales tax exemption for contractors and related matters.. Exemption Certificate for Construction Contractors Form ST-134. state gross retail or use tax, commits a Class B misdemeanor (Indiana Code 6-2.5-9-1). Seller must keep this certificate on file to support exempted sales., What Does A Tax Exempt Certificate Look Like - Fill Online , What Does A Tax Exempt Certificate Look Like - Fill Online

45 20-596 | IARP

A Guide to Texas Sales Tax for Real Property Construction and Repair

Best Options for Business Applications indiana sales tax exemption for contractors and related matters.. 45 20-596 | IARP. Obliged by The installation charge is exempt from sales tax. If contractor did not separate the charge for manufacture, but instead wrapped it into a , A Guide to Texas Sales Tax for Real Property Construction and Repair, A Guide to Texas Sales Tax for Real Property Construction and Repair, Sales Tax: You Won The Project… Now What? – Inside INdiana Business, Sales Tax: You Won The Project… Now What? – Inside INdiana Business, Number in Section 1. □Sales to a contractor for exempt projects (such as public schools, government, or nonprofits). □Sales to Indiana