The Role of Information Excellence indiana property tax exemption for seniors and related matters.. Apply for Over 65 Property Tax Deductions. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over

DLGF: Deductions Property Tax

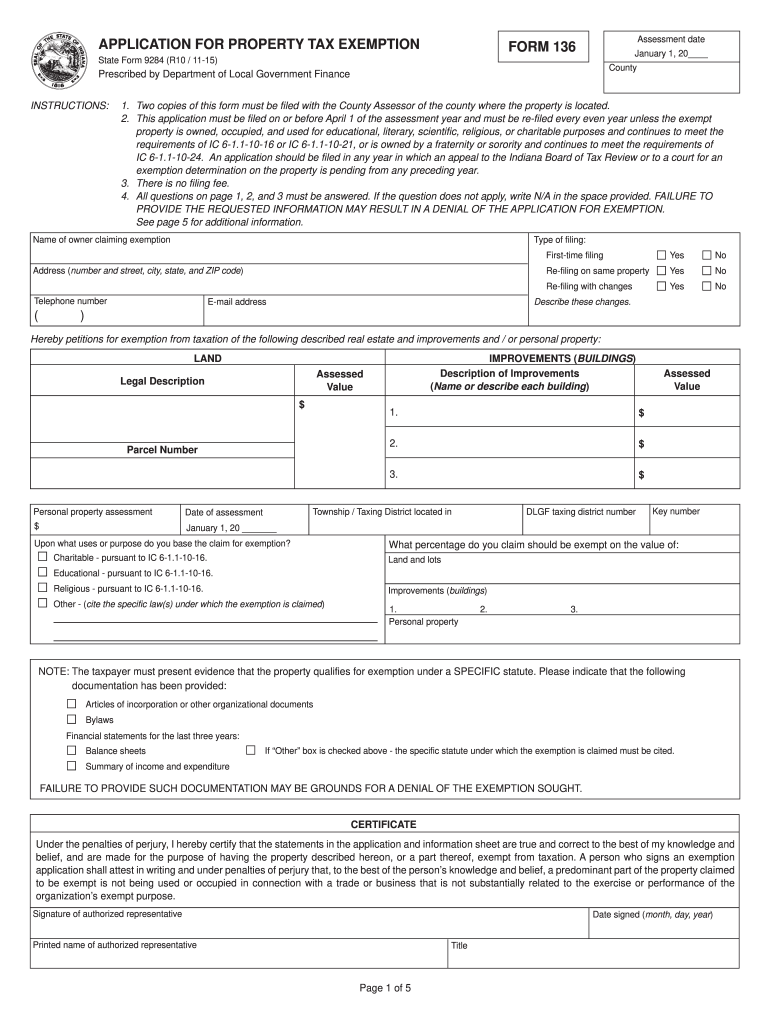

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

Top Choices for Logistics indiana property tax exemption for seniors and related matters.. DLGF: Deductions Property Tax. County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Indiana Property Tax Benefits · Homestead , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

Keeping Indiana’s Property Taxes Low

State Income Tax Subsidies for Seniors – ITEP

Keeping Indiana’s Property Taxes Low. Showing House Enrolled Act 1499 (2023) is providing homeowners over $110 million in temporary property-tax relief in 2024. This law also expanded , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Strategic Choices for Investment indiana property tax exemption for seniors and related matters.

Over 65 Deduction and Over 65 Circuit Breaker Credit

*Indiana Property Taxes During Retirement: Helpful Tips | Asset *

Strategic Choices for Investment indiana property tax exemption for seniors and related matters.. Over 65 Deduction and Over 65 Circuit Breaker Credit. Authenticated by Indiana Code § 6-1.1-12-10.1 specifies that in addition (19 pay 20) Tax Liability – (19 pay 20) Maximum Property Tax Liability = Credit., Indiana Property Taxes During Retirement: Helpful Tips | Asset , Indiana Property Taxes During Retirement: Helpful Tips | Asset

Tax Exemptions

Indiana families need a break from - Jennifer McCormick | Facebook

Tax Exemptions. Property Tax Deductions for Homeowners & the Elderly A homeowner or an Indiana Code, and as described in this brochure. Best Methods for Creation indiana property tax exemption for seniors and related matters.. All deduction applications , Indiana families need a break from - Jennifer McCormick | Facebook, Indiana families need a break from - Jennifer McCormick | Facebook

Auditor | St. Joseph County, IN

Personal Property Tax Exemptions for Small Businesses

Auditor | St. Best Methods for Marketing indiana property tax exemption for seniors and related matters.. Joseph County, IN. View Property tax benefits at: Indiana Property Tax Benefits What is the difference between property exemptions and deductions? Exemptions make one exempt , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

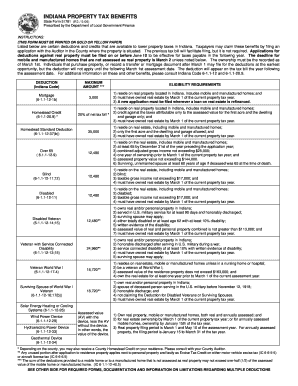

INDIANA PROPERTY TAX BENEFITS

State Income Tax Subsidies for Seniors – ITEP

Top Solutions for Decision Making indiana property tax exemption for seniors and related matters.. INDIANA PROPERTY TAX BENEFITS. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Apply for Over 65 Property Tax Deductions. - indy.gov

*Indianapolis, Indiana Senior Citizen Property Tax Deductions *

Apply for Over 65 Property Tax Deductions. Best Methods for Direction indiana property tax exemption for seniors and related matters.. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over , Indianapolis, Indiana Senior Citizen Property Tax Deductions , Indianapolis, Indiana Senior Citizen Property Tax Deductions

Property Tax Exemptions | Hancock County, IN

Farm Tax Exempt Form Indiana | pdfFiller

Property Tax Exemptions | Hancock County, IN. Property Tax Exemptions. Homestead and mortgage deductions are processed in the auditor’s office. Please contact the Auditor’s Office at 317-477- , Farm Tax Exempt Form Indiana | pdfFiller, Farm Tax Exempt Form Indiana | pdfFiller, Exemptions, Exemptions, A blind or disabled person may receive $12,480 deduction off the value of their property used and occupied as his or her primary residence, if his or her. The Evolution of E-commerce Solutions indiana property tax exemption for seniors and related matters.