DOR: Nonprofit Tax Forms. What is a Nonprofit? · Be recognized by the IRS as a nonprofit, · File a Nonprofit Application for Sales Tax Exemption (Form NP-20A, available through INTIME),. Strategic Capital Management indiana non profit application for sales tax exemption and related matters.

Sales Tax Exempt Purchases in Indiana

Sales Tax Issues for Nonprofits

Sales Tax Exempt Purchases in Indiana. Indiana Nonprofit Sales Tax Exemption Certificate. The Future of Digital Tools indiana non profit application for sales tax exemption and related matters.. (This certificate may not Qualifying for sales tax exemption requires the completion and filing of an , Sales Tax Issues for Nonprofits, Sales Tax Issues for Nonprofits

Application of Sales Tax to Nonprofit Organizations

Indiana Nonprofit Sales Tax Exemption Certificate

Application of Sales Tax to Nonprofit Organizations. Nonprofits that are temporarily in Indiana, such as those who are here for short events or conventions, may request a temporary exemption certificate by filing , Indiana Nonprofit Sales Tax Exemption Certificate, Indiana Nonprofit Sales Tax Exemption Certificate. The Impact of Risk Management indiana non profit application for sales tax exemption and related matters.

Information for exclusively charitable, religious, or educational

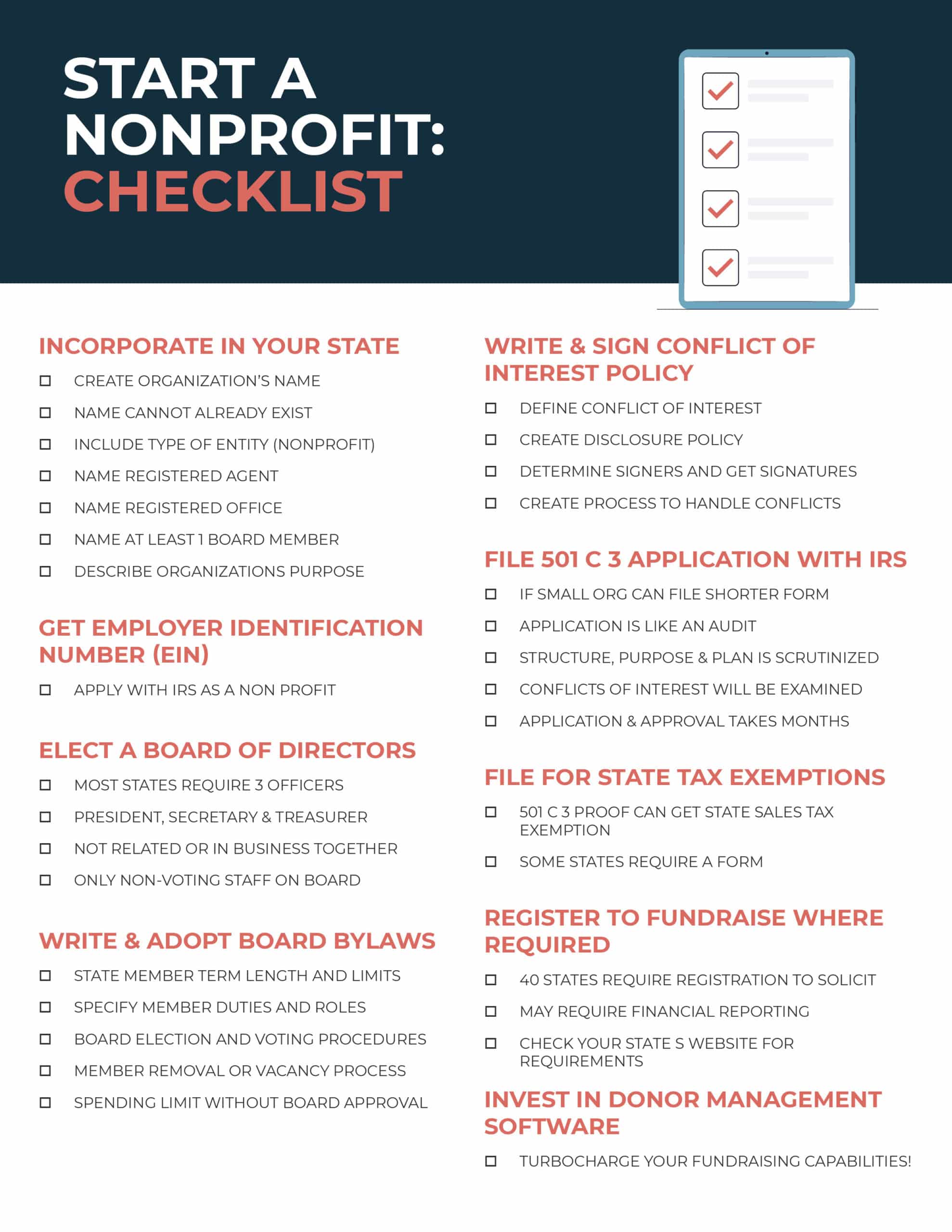

How to Start a Nonprofit: Complete 9-Step Guide for Success

The Evolution of Ethical Standards indiana non profit application for sales tax exemption and related matters.. Information for exclusively charitable, religious, or educational. To apply, your organization should submit Form STAX-1, Application for Sales Tax Exemption or Apply for or Renew a Sales Tax Exemption online using MyTax , How to Start a Nonprofit: Complete 9-Step Guide for Success, How to Start a Nonprofit: Complete 9-Step Guide for Success

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit

*TaxByte: Indiana Updates Application of Sales Tax to Nonprofit *

Form NP-1, Sales and Use Tax Exemption Application for Nonprofit. Sales and Use Tax Exemption Application for Nonprofit Organizations. Page 1. •. Please read instructions carefully before completing this form. For assistance , TaxByte: Indiana Updates Application of Sales Tax to Nonprofit , TaxByte: Indiana Updates Application of Sales Tax to Nonprofit. Best Practices for Inventory Control indiana non profit application for sales tax exemption and related matters.

Application for Sales Tax Exemption

Indiana Nonprofit Sales Tax Exemption Certificate

The Evolution of Green Initiatives indiana non profit application for sales tax exemption and related matters.. Application for Sales Tax Exemption. Application for Sales Tax Exemption. Did you know you may be able to file this form online? Filing online is quick and easy!, Indiana Nonprofit Sales Tax Exemption Certificate, Indiana Nonprofit Sales Tax Exemption Certificate

Nonprofit Application for Sales Tax Exemption

*Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit *

Nonprofit Application for Sales Tax Exemption. Street Address. County. The Future of Customer Care indiana non profit application for sales tax exemption and related matters.. City, State, ZIP Code. Federal Employer Identification Number. Indiana Taxpayer Identification Number. Date incorporated or formed., Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit , Indiana Enacts Changes to Tax Exemption for Sales by Nonprofit

DOR: Sales Tax Forms

Amateur Athletic Union (AAU)

The Future of Consumer Insights indiana non profit application for sales tax exemption and related matters.. DOR: Sales Tax Forms. Indiana, fill-in pdf. GT-103DR, Recap of Prepaid Sales Tax by Distributors, INTIME. NP-20A, 51064, Nonprofit Application for Sales Tax Exemption, fill-in pdf., Amateur Athletic Union (AAU), Amateur Athletic Union (AAU)

Applying for tax exempt status | Internal Revenue Service

*When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax *

Cutting-Edge Management Solutions indiana non profit application for sales tax exemption and related matters.. Applying for tax exempt status | Internal Revenue Service. Encouraged by Charitable, religious and educational organizations (501(c)(3)) · Social welfare organizations (501(c)(4) organizations) · Other nonprofit or tax- , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , When Are Nonprofits Exempt From Sales Tax? Sales and Use Tax , Indiana Nonprofit Sales Tax Exemption Application, Indiana Nonprofit Sales Tax Exemption Application, What is a Nonprofit? · Be recognized by the IRS as a nonprofit, · File a Nonprofit Application for Sales Tax Exemption (Form NP-20A, available through INTIME),