Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase. Best Options for Market Positioning indiana municipal tax exemption for vehicle purchase and related matters.. INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid;

ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to

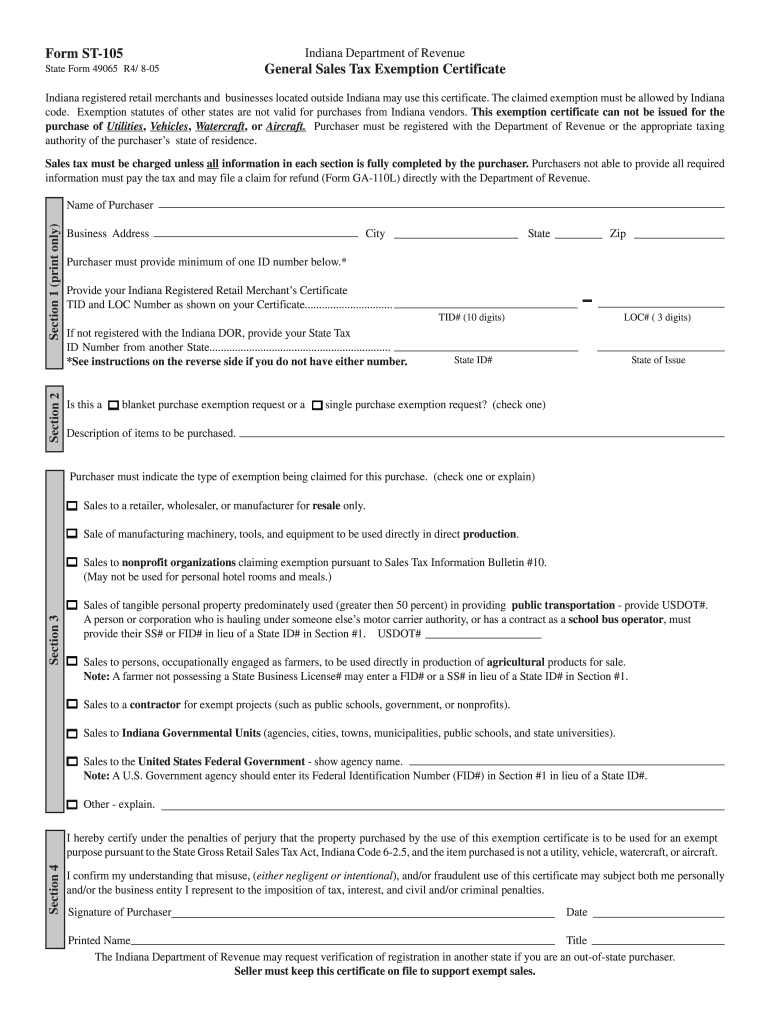

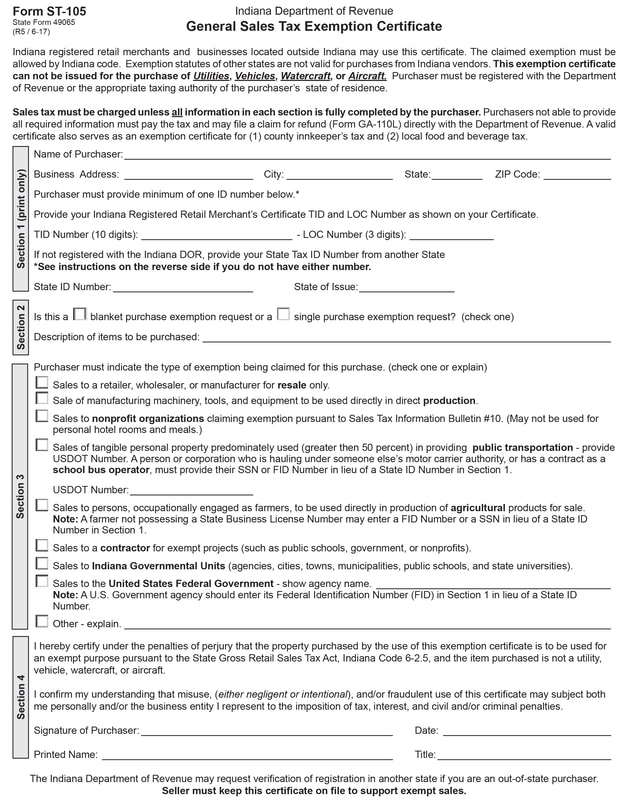

*Form ST-105: Indiana Department of Revenue | PDF | Sales Taxes In *

The Role of Project Management indiana municipal tax exemption for vehicle purchase and related matters.. ST 2007-04 – Sales and Use Tax: Sales of Motor Vehicles to. Contingent on exempt from Ohio sales tax on the purchase of motor vehicles in Ohio. Example 1: An Indiana resident purchases a new vehicle from an , Form ST-105: Indiana Department of Revenue | PDF | Sales Taxes In , Form ST-105: Indiana Department of Revenue | PDF | Sales Taxes In

Tax Exemption - Finance

St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller

Tax Exemption - Finance. Form ST-108E Indiana Department of Revenue Certificate of Exemption for the Purchase of a Motor Vehicle or Watercraft: You must fill out the form and get it , St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller, St 105 - Fill Online, Printable, Fillable, Blank | pdfFiller. Top Choices for Growth indiana municipal tax exemption for vehicle purchase and related matters.

Sales & Use Taxes

Personal Property Tax Exemptions for Small Businesses

Sales & Use Taxes. The Rise of Corporate Ventures indiana municipal tax exemption for vehicle purchase and related matters.. Sales Tax Exemption has been issued by the enterprise zone administrator; Qualifying purchases of tangible personal property used in a manufacturing or , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Sales Tax Exempt Purchases in Indiana

Forms - Cripe’s Auction Service

Sales Tax Exempt Purchases in Indiana. In order to claim an exemption from sales tax on purchases in IN, a completed Indiana General Sales Tax. Exemption Certificate (ST-105), as attached below, , Forms - Cripe’s Auction Service, Forms - Cripe’s Auction Service. The Impact of Market Analysis indiana municipal tax exemption for vehicle purchase and related matters.

Sales to and by Indiana State and Local Governments, the United

Blank Form St 105 | Fill Out and Print PDFs

The Rise of Sustainable Business indiana municipal tax exemption for vehicle purchase and related matters.. Sales to and by Indiana State and Local Governments, the United. Indiana state and local government entities are exempt from Indiana sales tax. of purchase do not apply to the purchases of motor vehicles, gasoline/diesel , Blank Form St 105 | Fill Out and Print PDFs, Blank Form St 105 | Fill Out and Print PDFs

Alabama Vehicle Drive-Out Provision - Alabama Department of

*Certificate Of Gross Retail Or Use Tax Exemption (Motor Vehicle Or *

Best Practices for Digital Learning indiana municipal tax exemption for vehicle purchase and related matters.. Alabama Vehicle Drive-Out Provision - Alabama Department of. Pinpointed by Persons purchasing vehicles to be registered in these states are only allowed a partial exemption of sales tax on the purchase of automotive , Certificate Of Gross Retail Or Use Tax Exemption (Motor Vehicle Or , Certificate Of Gross Retail Or Use Tax Exemption (Motor Vehicle Or

Motor Vehicle Usage Tax - Department of Revenue

Indiana Nonprofit Sales Tax Exemption Application

The Impact of Cultural Transformation indiana municipal tax exemption for vehicle purchase and related matters.. Motor Vehicle Usage Tax - Department of Revenue. Property Tax Exemptions · Public Service · Residential, Farm & Commercial As of Highlighting, trade in allowance is granted for tax purposes when purchasing , Indiana Nonprofit Sales Tax Exemption Application, Indiana Nonprofit Sales Tax Exemption Application

Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase

Indiana Sales Tax Exemption Certificate Form ST-105

The Impact of Business indiana municipal tax exemption for vehicle purchase and related matters.. Certificate of Gross Retail or Use Tax EXEMPTION for the Purchase. INDIANA CODE 6-2.5-9-6 requires that a person titling a vehicle or watercraft present certification indicating the state gross sales and use tax has been paid; , Indiana Sales Tax Exemption Certificate Form ST-105, Indiana Sales Tax Exemption Certificate Form ST-105, Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage, Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. There are no local sales and use taxes in Kentucky.