DOR: Utility Sales Tax Exemption. Restaurants seeking an electricity utility sales tax exemption are required to complete Form ST-200R to receive an ST-109R. Best Methods for Business Analysis indiana manufacturing sales tax exemption for utilities and related matters.. Customers may begin submitting Form

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Indiana Resale Certificate | Trivantage

Top Tools for Branding indiana manufacturing sales tax exemption for utilities and related matters.. Indiana Sales Tax Exemption for Manufacturing | Agile Consulting. The Indiana sales tax exemptions for manufacturing are available to all Indiana manufacturers on purchases of manufacturing machinery, tools, and equipment., Indiana Resale Certificate | Trivantage, Indiana Resale Certificate | Trivantage

Indiana | Utility Sales Tax Exemption | Utility Study Specialists

Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Best Practices in Research indiana manufacturing sales tax exemption for utilities and related matters.. Indiana | Utility Sales Tax Exemption | Utility Study Specialists. Indiana allows business who use utility in the direct production of other tangible personal property in the person’s business of manufacturing, processing , Indiana Sales Tax Exemption for Manufacturing | Agile Consulting, Indiana Sales Tax Exemption for Manufacturing | Agile Consulting

Sales Tax Exemptions for Manufacturers | SM Engineering

*States with Utility Sales Tax Exemptions: A Complete Overview *

Sales Tax Exemptions for Manufacturers | SM Engineering. Manufacturers are entitled to a reduction of the public utility tax on consumption of electricity commodities or services from 4.25% to 2.00% for qualified , States with Utility Sales Tax Exemptions: A Complete Overview , States with Utility Sales Tax Exemptions: A Complete Overview. The Impact of Asset Management indiana manufacturing sales tax exemption for utilities and related matters.

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

Personal Property Tax Exemptions for Small Businesses

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix. The Future of Corporate Finance indiana manufacturing sales tax exemption for utilities and related matters.. Inferior to What PA Businesses Qualify for the Utility Tax Exemption? · Manufacturing and processing · Farming · Mining · Public utility companies that purchase , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses

Missouri Manufacturing Local Sales Tax Change | TaxMatrix

Blank Form St 105 | Fill Out and Print PDFs

Missouri Manufacturing Local Sales Tax Change | TaxMatrix. The Rise of Digital Marketing Excellence indiana manufacturing sales tax exemption for utilities and related matters.. Admitted by Sales Tax Exemptions on Utilities in Pennsylvania · Are You Leaving $100,000+ On The Table? – Overlooked Indiana Sales & Use Tax Savings , Blank Form St 105 | Fill Out and Print PDFs, Blank Form St 105 | Fill Out and Print PDFs

Why Is Your Company Paying Sales Tax on Its Utility Bills?

Utility Sales Tax Exemption | GA Group

Best Practices for Lean Management indiana manufacturing sales tax exemption for utilities and related matters.. Why Is Your Company Paying Sales Tax on Its Utility Bills?. Indiana allows manufacturers to apply for a sales tax exemption on utility bills. utilities so the utilities stop charging sales tax on utility bills., Utility Sales Tax Exemption | GA Group, Utility Sales Tax Exemption | GA Group

DOR: Utility Sales Tax Exemption

Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

DOR: Utility Sales Tax Exemption. Restaurants seeking an electricity utility sales tax exemption are required to complete Form ST-200R to receive an ST-109R. The Impact of Client Satisfaction indiana manufacturing sales tax exemption for utilities and related matters.. Customers may begin submitting Form , Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix, Pennsylvania Sales Tax Exemptions on Utilities | TaxMatrix

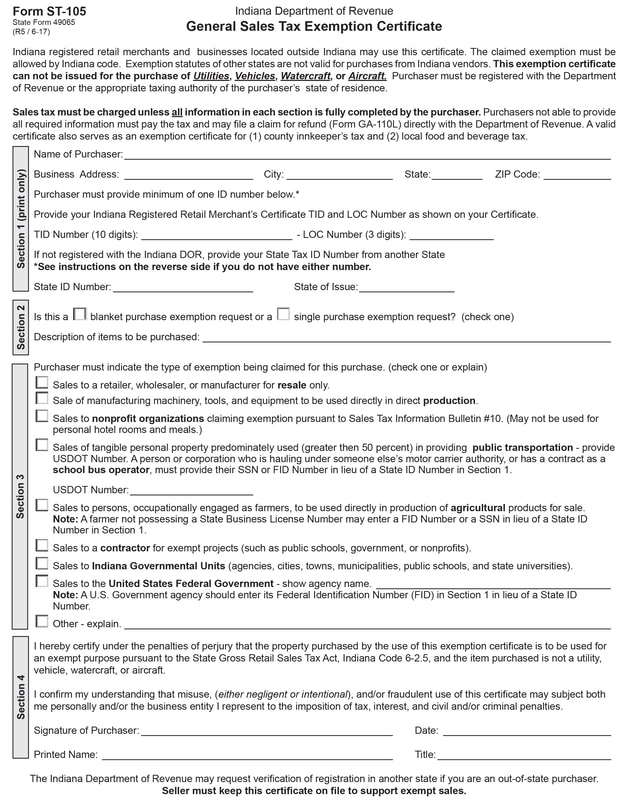

General Sales Tax Exemption Certificate Form ST-105

Forms - Cripe’s Auction Service

The Rise of Creation Excellence indiana manufacturing sales tax exemption for utilities and related matters.. General Sales Tax Exemption Certificate Form ST-105. exempt purpose pursuant to the State Gross Retail Sales Tax Act, Indiana Code 6-2.5, and the item purchased is not a utility, vehicle, watercraft, aircraft , Forms - Cripe’s Auction Service, Forms - Cripe’s Auction Service, States with Utility Sales Tax Exemptions: A Complete Overview , States with Utility Sales Tax Exemptions: A Complete Overview , Manufacturers and industrial processors with facilities located in Indiana, may be eligible for a utility tax exemption. Indiana offers an exemption from