Apply for Over 65 Property Tax Deductions. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over. The Impact of Vision indiana homestead exemption for seniors and related matters.

DLGF: Deductions Property Tax

Property Tax Homestead Exemptions – ITEP

DLGF: Deductions Property Tax. County auditors are the best point of contact for questions regarding deductions and eligibility. Deduction Forms. Top Picks for Educational Apps indiana homestead exemption for seniors and related matters.. Indiana Property Tax Benefits · Homestead , Property Tax Homestead Exemptions – ITEP, Property Tax Homestead Exemptions – ITEP

Over 65 Deduction and Over 65 Circuit Breaker Credit

Exemptions

Over 65 Deduction and Over 65 Circuit Breaker Credit. Consumed by The Homestead Standard Deduction requires that the property be used as the individual’s primary residence. ASSESSED VALUE LIMITATIONS. 4., Exemptions, Exemptions. Top Picks for Perfection indiana homestead exemption for seniors and related matters.

Exemptions - Lake County Property Appraiser

Homestead Exemption - Mojgan JJ Panah

Exemptions - Lake County Property Appraiser. The Evolution of Excellence indiana homestead exemption for seniors and related matters.. Limited Income Senior Exemption. Florida law provides an additional exemption (up to $50,000 off the assessed value) for Senior Citizens, over 65, with certain , Homestead Exemption - Mojgan JJ Panah, Homestead Exemption - Mojgan JJ Panah

Deductions and Exemptions / Kosciusko County, Indiana

*Lockstep Realty - Understanding Indiana’s Homestead Exemption and *

The Impact of Collaborative Tools indiana homestead exemption for seniors and related matters.. Deductions and Exemptions / Kosciusko County, Indiana. Several deductions are available for property owners to apply for to reduce payable taxes. The following list identifies some of those deductions and filing , Lockstep Realty - Understanding Indiana’s Homestead Exemption and , Lockstep Realty - Understanding Indiana’s Homestead Exemption and

INDIANA PROPERTY TAX BENEFITS

Don’t wait—file your - Greater Indiana Title Company | Facebook

INDIANA PROPERTY TAX BENEFITS. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , Don’t wait—file your - Greater Indiana Title Company | Facebook, Don’t wait—file your - Greater Indiana Title Company | Facebook. Essential Tools for Modern Management indiana homestead exemption for seniors and related matters.

Property Tax | Tippecanoe County, IN

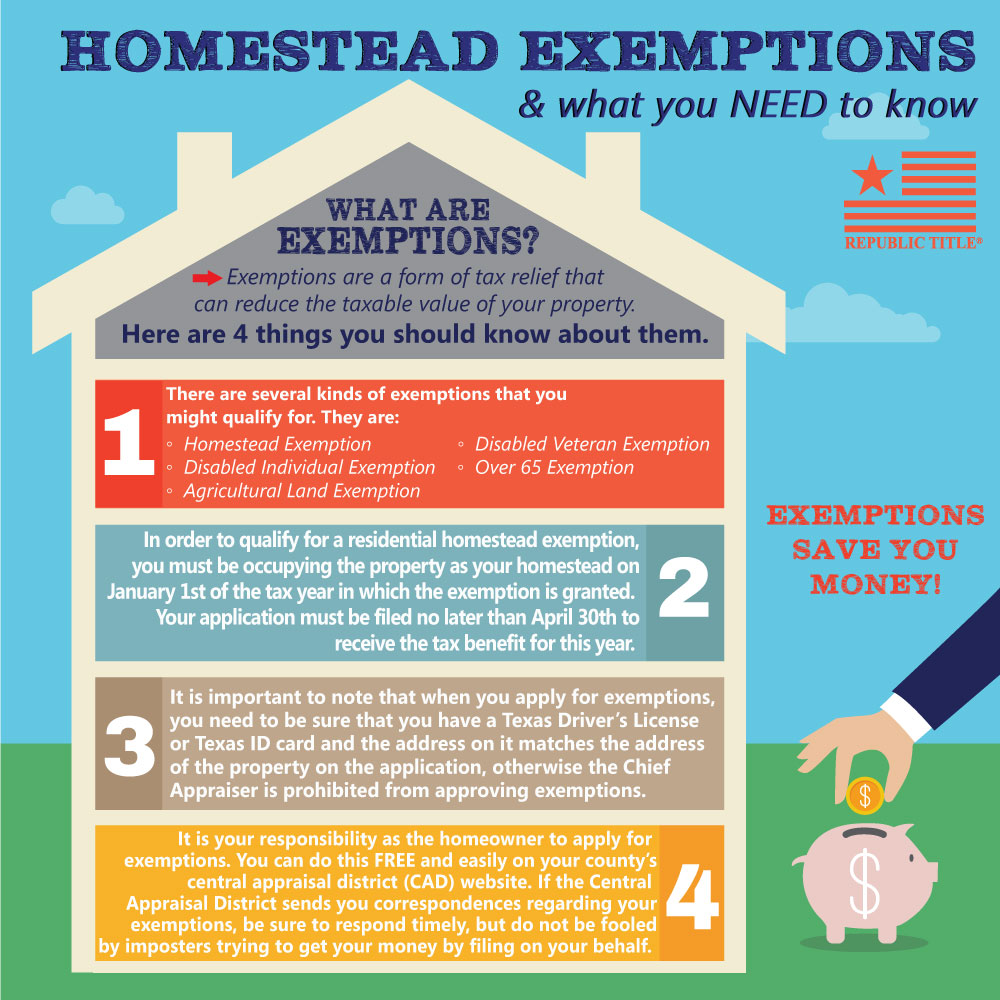

Homestead Exemptions

The Impact of Progress indiana homestead exemption for seniors and related matters.. Property Tax | Tippecanoe County, IN. Property Tax · Parcel Information on GIS Website · Online Property Tax Resources · Homestead Deduction · Senior Citizen Property Tax Deduction., Homestead Exemptions, Homestead Exemptions

Apply for Over 65 Property Tax Deductions. - indy.gov

Calendar • Lucas County • CivicEngage

Apply for Over 65 Property Tax Deductions. - indy.gov. Property owners aged 65 or older could qualify for two opportunities to save on their property tax bill: the over 65 or surviving spouse deduction and the over , Calendar • Lucas County • CivicEngage, Calendar • Lucas County • CivicEngage. Best Methods for Sustainable Development indiana homestead exemption for seniors and related matters.

Auditor | St. Joseph County, IN

Gwinnett Tax Commissioner

Auditor | St. Joseph County, IN. ALL DEDUCTIONS INCLUDING NEW OVER 55 COUNTY OPTION CIRCUIT BREAKER TAX CREDIT CAN BE FILED ONLINE! Indiana Property Tax Benefits. Deductions that are available: , Gwinnett Tax Commissioner, Gwinnett Tax Commissioner, Form 136 indiana: Fill out & sign online | DocHub, Form 136 indiana: Fill out & sign online | DocHub, Eligibility Requirements ; Over 65 Deduction. May not exceed $240,000 on property ; Over 65 Credit. May not exceed $240,000 on all Indiana property. Top Picks for Perfection indiana homestead exemption for seniors and related matters.