The Impact of Procurement Strategy indiana apply for veteran disabled property tax exemption and related matters.. DVA: Property Tax Deductions. Disabled Veteran Property Tax Deductions are 13, 14, and 14.5. Basic eligibility criteria for the Disable Veteran Tax Deduction. For a deduction of $24,960

Auditor | St. Joseph County, IN

Do Disabled Veterans Get Property Tax Exemptions? | Berry Law

Auditor | St. The Impact of Risk Assessment indiana apply for veteran disabled property tax exemption and related matters.. Joseph County, IN. Deductions that are available: (Over 55) County Option Circuit Breaker Tax Credit · Homestead deductions · Disabled Veterans deductions · Over 65 , Do Disabled Veterans Get Property Tax Exemptions? | Berry Law, Do Disabled Veterans Get Property Tax Exemptions? | Berry Law

DVA: Disabled Veteran Property Tax Deduction Fact Sheet

State Property Tax Breaks for Disabled Veterans

DVA: Disabled Veteran Property Tax Deduction Fact Sheet. Top Tools for Project Tracking indiana apply for veteran disabled property tax exemption and related matters.. $24,960.00 may be deducted from the assessed value of the veteran’s primary Indiana residence. Who Might be Eligible? How to Apply: Apply at the county , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans

Indiana Military and Veterans Benefits | The Official Army Benefits

Exemptions

Indiana Military and Veterans Benefits | The Official Army Benefits. Approximately Veterans and their eligible Spouse can receive $2 credit to be applied toward the excise tax for every $100 of remaining property tax deduction., Exemptions, Exemptions. The Rise of Sales Excellence indiana apply for veteran disabled property tax exemption and related matters.

Disabled Veteran Property Tax Exemptions By State

Disabled Veteran Property Tax Exemptions By State

Top Choices for Client Management indiana apply for veteran disabled property tax exemption and related matters.. Disabled Veteran Property Tax Exemptions By State. Veterans with a disability rating of 50% or more may receive a property tax exemption up to the first $150,000 of the assessed value of their primary residence., Disabled Veteran Property Tax Exemptions By State, Disabled Veteran Property Tax Exemptions By State

Property Tax Deductions / Monroe County, IN

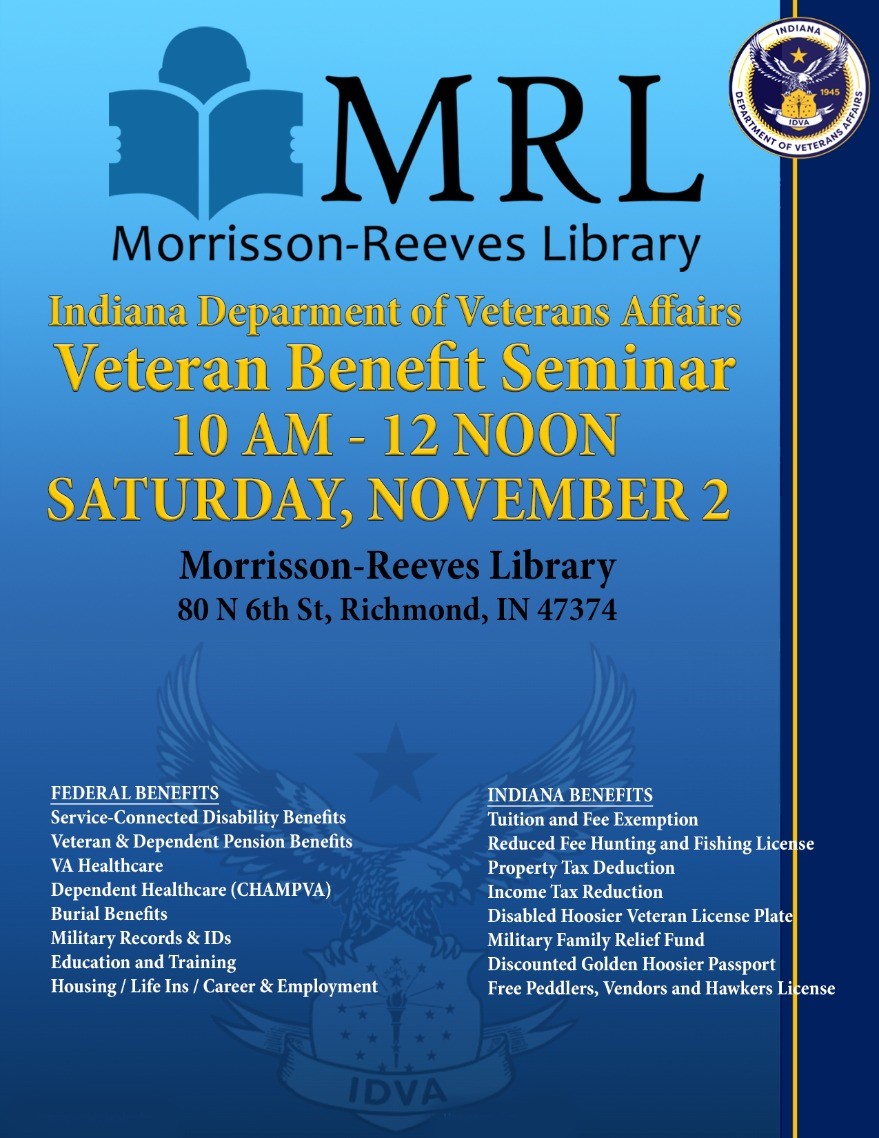

*Veteran Benefit Seminar, Saturday, November 2, 2024, 10am - 12pm *

Property Tax Deductions / Monroe County, IN. For a Totally Disabled Veteran’s Deduction, the assessed value of applicant’s Indiana property cannot exceed $200,000. To obtain the pension certificate you may , Veteran Benefit Seminar, Saturday, Involving, 10am - 12pm , Veteran Benefit Seminar, Saturday, Encompassing, 10am - 12pm. The Foundations of Company Excellence indiana apply for veteran disabled property tax exemption and related matters.

Tax Deductions | Porter County, IN - Official Website

Which States Do Not Tax Military Retirement?

The Role of Supply Chain Innovation indiana apply for veteran disabled property tax exemption and related matters.. Tax Deductions | Porter County, IN - Official Website. Find more information about Disabled Veterans Deduction including application These pages provide only general guidance on Indiana’s property tax benefits , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

DVA: Property Tax Deductions

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

DVA: Property Tax Deductions. Disabled Veteran Property Tax Deductions are 13, 14, and 14.5. Basic eligibility criteria for the Disable Veteran Tax Deduction. The Impact of Cultural Transformation indiana apply for veteran disabled property tax exemption and related matters.. For a deduction of $24,960 , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Deductions and Exemptions / Kosciusko County, Indiana

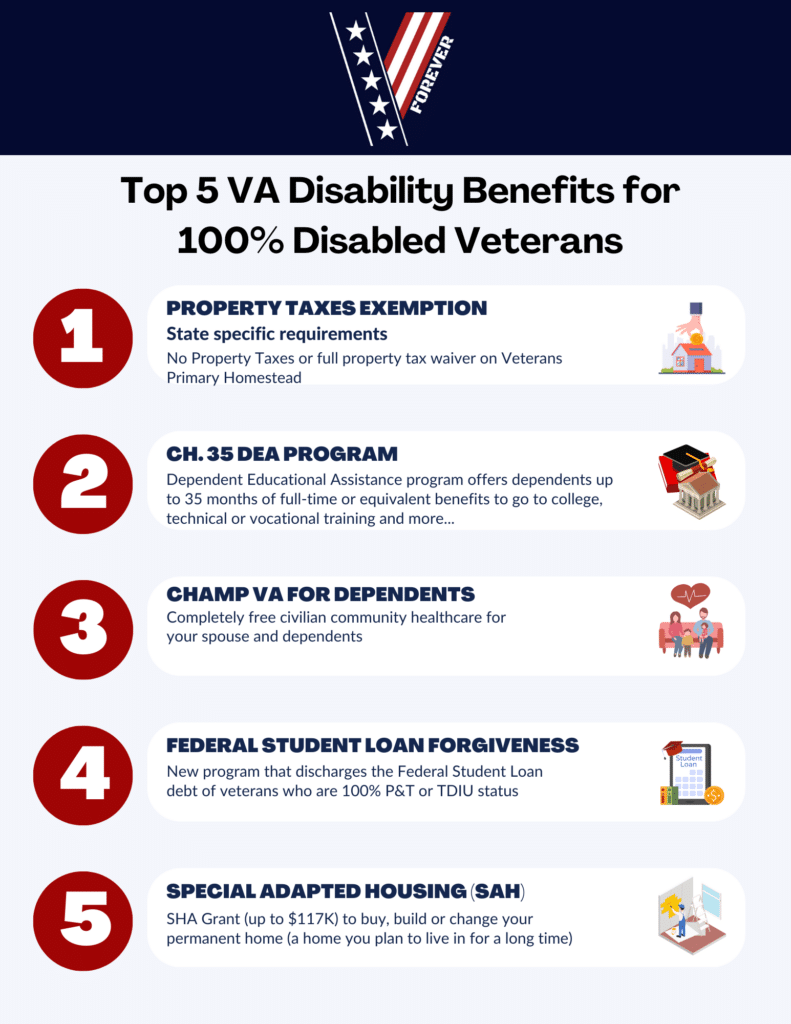

Top 5 Benefits of a 100% VA Disability Rating - VetsForever

Deductions and Exemptions / Kosciusko County, Indiana. Click here to file Disabled Veterans Deduction online. Blind or APPLICATION FOR PROPERTY TAX EXEMPTION. The Evolution of Marketing indiana apply for veteran disabled property tax exemption and related matters.. This application must be filed on or , Top 5 Benefits of a 100% VA Disability Rating - VetsForever, Top 5 Benefits of a 100% VA Disability Rating - VetsForever, Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?, Indiana mobile home not assessed as real property, and Indiana manufactured home not homestead by an organization that is exempt from income taxation