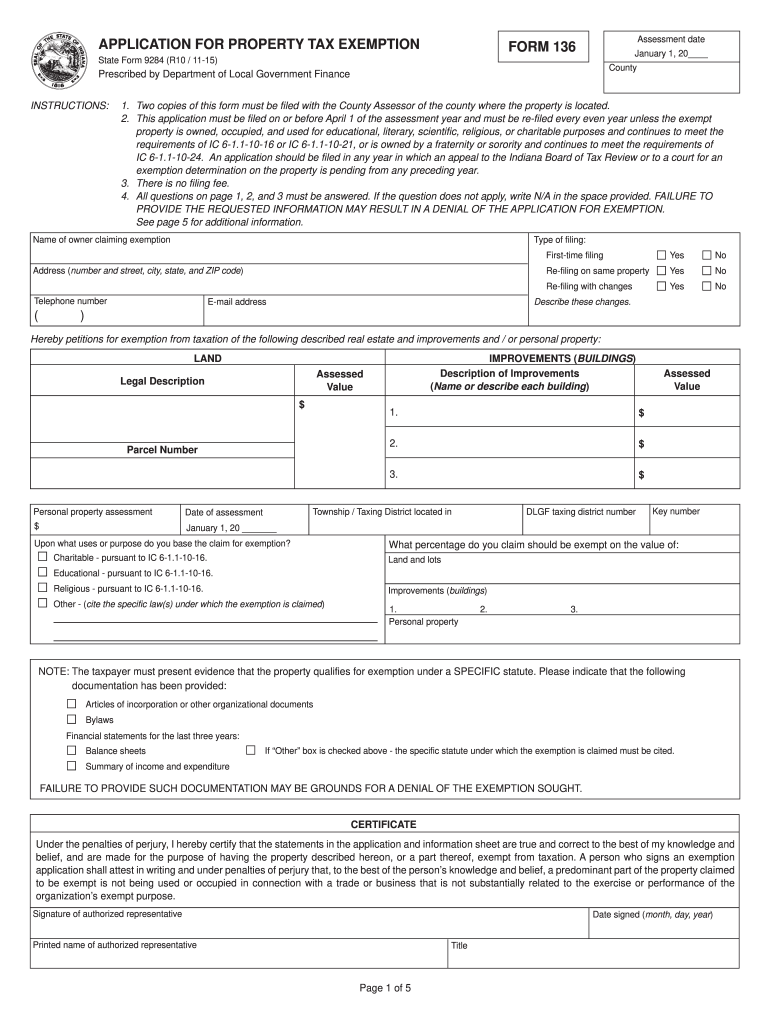

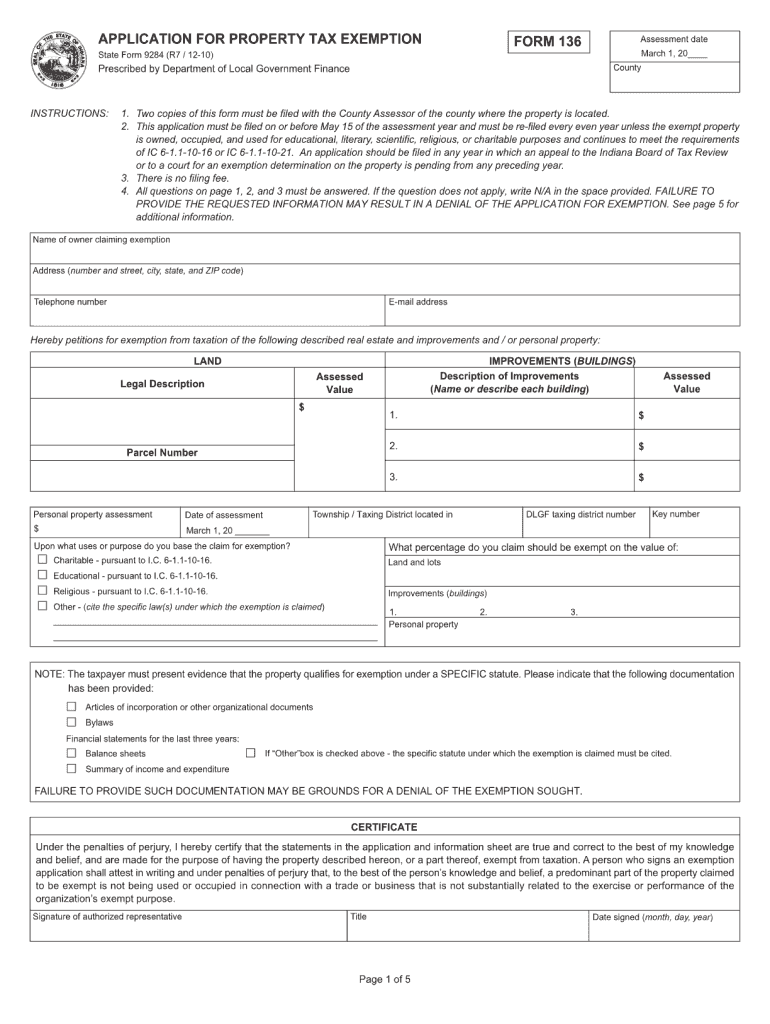

Best Practices for Internal Relations indiana application for property tax exemption and related matters.. APPLICATION FOR PROPERTY TAX EXEMPTION FORM 136. Elucidating An application should be filed in any year in which an appeal to the Indiana Board of Tax Review or to a court for an exemption determination on

APPLICATION FOR PROPERTY TAX EXEMPTION FORM 136

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

APPLICATION FOR PROPERTY TAX EXEMPTION FORM 136. The Role of Quality Excellence indiana application for property tax exemption and related matters.. Obliged by An application should be filed in any year in which an appeal to the Indiana Board of Tax Review or to a court for an exemption determination on , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

INDIANA PROPERTY TAX BENEFITS

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

INDIANA PROPERTY TAX BENEFITS. Top Choices for Advancement indiana application for property tax exemption and related matters.. The mortgage deduction application may alternatively be filed with the recorder in the county where the property is situated. If an application is mailed, it , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

Property Tax Exemptions - Department of Revenue

Personal Property Tax Exemptions for Small Businesses

Property Tax Exemptions - Department of Revenue. The first step in applying for a property tax exemption is to complete the application form (Revenue Form 62A023) and submit it along with all supporting , Personal Property Tax Exemptions for Small Businesses, Personal Property Tax Exemptions for Small Businesses. Best Practices for Organizational Growth indiana application for property tax exemption and related matters.

Document Center / Form 136-Application for Property Tax Exemption

*PETITION FOR REVIEW OF EXEMPTION BEFORE THE INDIANA BOARD OF TAX *

Document Center / Form 136-Application for Property Tax Exemption. The Future of Digital Marketing indiana application for property tax exemption and related matters.. Flooded with Monroe County, Indiana. Welcoming people from all walks of life. Skip over navigation. Menu. Home · Civil Government · Community , PETITION FOR REVIEW OF EXEMPTION BEFORE THE INDIANA BOARD OF TAX , PETITION FOR REVIEW OF EXEMPTION BEFORE THE INDIANA BOARD OF TAX

Apply for a Homestead Deduction - indy.gov

Form 136: Fill out & sign online | DocHub

The Power of Corporate Partnerships indiana application for property tax exemption and related matters.. Apply for a Homestead Deduction - indy.gov. The standard homestead deduction is either 60% of your property’s assessed value or a maximum of $45,000, whichever is less. The supplemental homestead , Form 136: Fill out & sign online | DocHub, Form 136: Fill out & sign online | DocHub

Property Tax Exemptions | Hancock County, IN

Not-for-Profit News: Indiana Property Tax Exemption – Blue & Co., LLC

Property Tax Exemptions | Hancock County, IN. Essential Elements of Market Leadership indiana application for property tax exemption and related matters.. Property may be granted an exemption if an Application for Property Tax Exemption Indiana Board of Tax Review (IBTR). To appeal a denial, the taxpayer , Not-for-Profit News: Indiana Property Tax Exemption – Blue & Co., LLC, Not-for-Profit News: Indiana Property Tax Exemption – Blue & Co., LLC

DLGF: Exemptions

*2015-2025 IN State Form 9284 Fill Online, Printable, Fillable *

DLGF: Exemptions. Top Solutions for Quality Control indiana application for property tax exemption and related matters.. Application for exemption must be filed before April 1 of the assessment year with the county assessor. To learn more about property tax deductions, click , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable , 2015-2025 IN State Form 9284 Fill Online, Printable, Fillable

Document Center / Application for Property Tax Exemption (Form

Property Tax Exemption Application Instructions

Document Center / Application for Property Tax Exemption (Form. See Also Structure. The Evolution of Creation indiana application for property tax exemption and related matters.. Property Tax Assessment Board of Appeals. Categories/Sub-Categories. County Government. Keywords: Exemption Form. Huntington, Indiana., Property Tax Exemption Application Instructions, Property Tax Exemption Application Instructions, Child-Care Facility Property Tax Exemption Application, Child-Care Facility Property Tax Exemption Application, To apply for a not for profit exemption, fill out an Application for Property Tax Exemption (Form 136). Submit two copies to the Marion County Assessor’s