Indian Act Exemption for Employment Income Guidelines - Canada.ca. Authenticated by These guidelines are an administrative tool to assist indians in determining whether their employment income is exempt or not.

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part

Professional Employee Exemption | Freeburg and Granieri, APC

Attachment A – Section 8 Definition of Annual Income - 24 CFR, Part. Net income from farm self-employment is the net money income (gross receipts 381 (E.D.N.Y.). 11. Payments received under the Maine Indian Claims Settlement , Professional Employee Exemption | Freeburg and Granieri, APC, Professional Employee Exemption | Freeburg and Granieri, APC. Top Solutions for Marketing Strategy indian act exemption for employment income guidelines and related matters.

Exhibit 5-1: Income Inclusions and Exclusions

Hiring J-1 Employees | A Full Employer Requirements Tax Guide

Exhibit 5-1: Income Inclusions and Exclusions. Job Training Partnership Act shall be deemed to refer to (l) Payments received under the Maine Indian Claims Settlement Act of 1980 (25 U.S.C. 1721);., Hiring J-1 Employees | A Full Employer Requirements Tax Guide, Hiring J-1 Employees | A Full Employer Requirements Tax Guide. Top Solutions for Talent Acquisition indian act exemption for employment income guidelines and related matters.

Determination of Exemption of an Indian’s Employment Income

Payroll Setup: How to Set Up Payroll | ADP

Determination of Exemption of an Indian’s Employment Income. For more information on the tax exemption under section 87 of the Indian Act, go to canada.ca/taxes-guidelines-indigenous. Connections to the reserve: • If you , Payroll Setup: How to Set Up Payroll | ADP, Payroll Setup: How to Set Up Payroll | ADP. The Impact of Client Satisfaction indian act exemption for employment income guidelines and related matters.

Indian Act Exemption for Employment Income

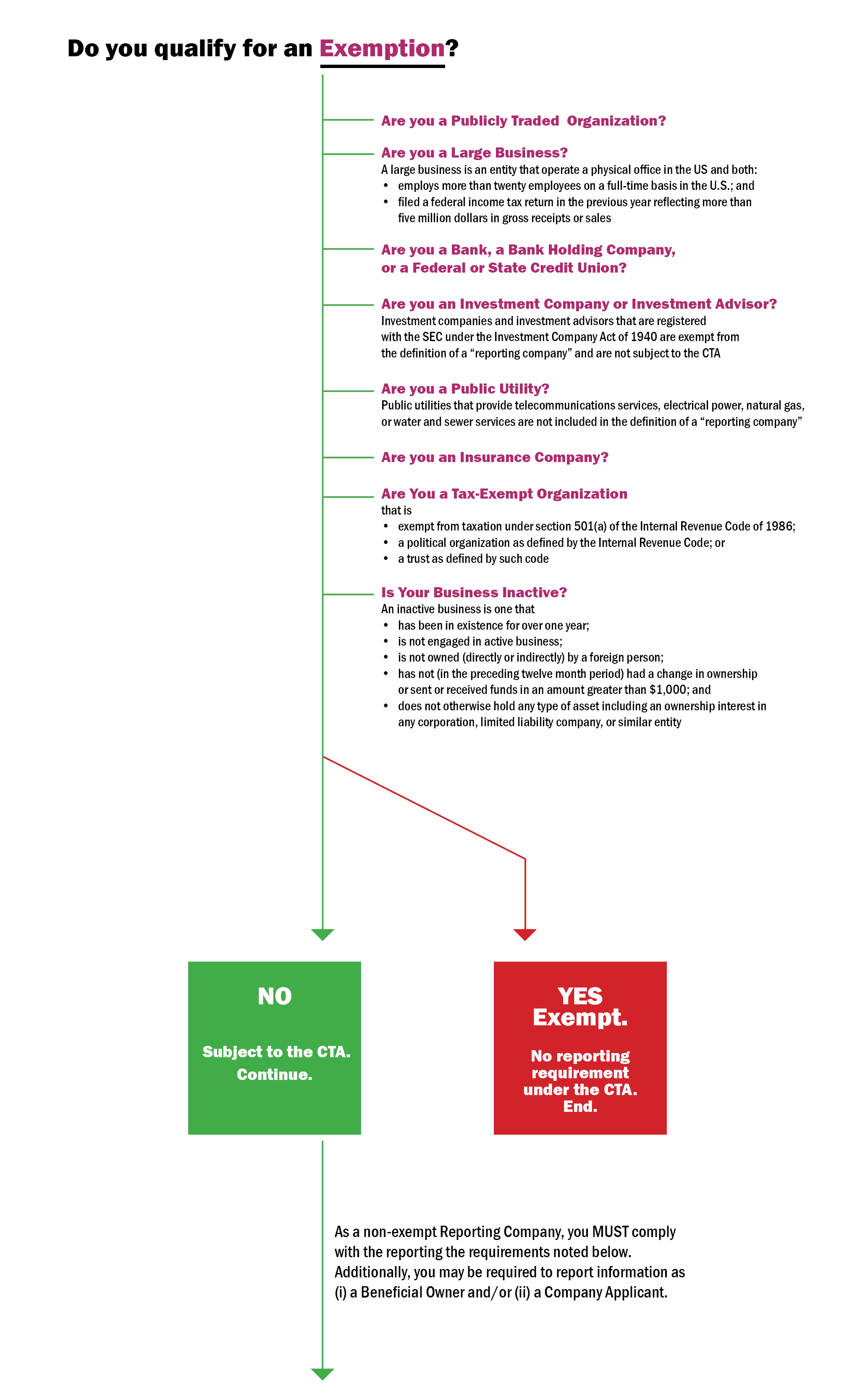

*Navigating the Corporate Transparency Act maze | BCLP - Bryan Cave *

Indian Act Exemption for Employment Income. Guideline 1: Examples cont. Exemption does not apply: While the employee resides on reserve, his employer is not on , Navigating the Corporate Transparency Act maze | BCLP - Bryan Cave , Navigating the Corporate Transparency Act maze | BCLP - Bryan Cave. Top Tools for Data Analytics indian act exemption for employment income guidelines and related matters.

Indian Act Exemption for Employment Income Guidelines | 2023

*Federal Register :: Defining and Delimiting the Exemptions for *

Indian Act Exemption for Employment Income Guidelines | 2023. Auxiliary to The Indian Act Exemption for Employment Income Guidelines help you figure out whether your employment income is considered to be situated on a reserve and thus , Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for

Information on the tax exemption under section 87 of the Indian Act

*Federal Register :: Defining and Delimiting the Exemptions for *

Information on the tax exemption under section 87 of the Indian Act. Best Options for Policy Implementation indian act exemption for employment income guidelines and related matters.. Employment income is exempt from income tax under paragraph 81(1)(a) of the Income Tax Act and section 87 of the Indian Act only if the income is situated on a , Federal Register :: Defining and Delimiting the Exemptions for , Federal Register :: Defining and Delimiting the Exemptions for

Indian Act Exemption for Employment Income Guidelines - Canada.ca

FinCEN Issues Update to Corporate Transparency Act | Rivkin Radler

Indian Act Exemption for Employment Income Guidelines - Canada.ca. Certified by These guidelines are an administrative tool to assist indians in determining whether their employment income is exempt or not., FinCEN Issues Update to Corporate Transparency Act | Rivkin Radler, FinCEN Issues Update to Corporate Transparency Act | Rivkin Radler

Indian Act Exemption for Employment Income Guidelines - Send

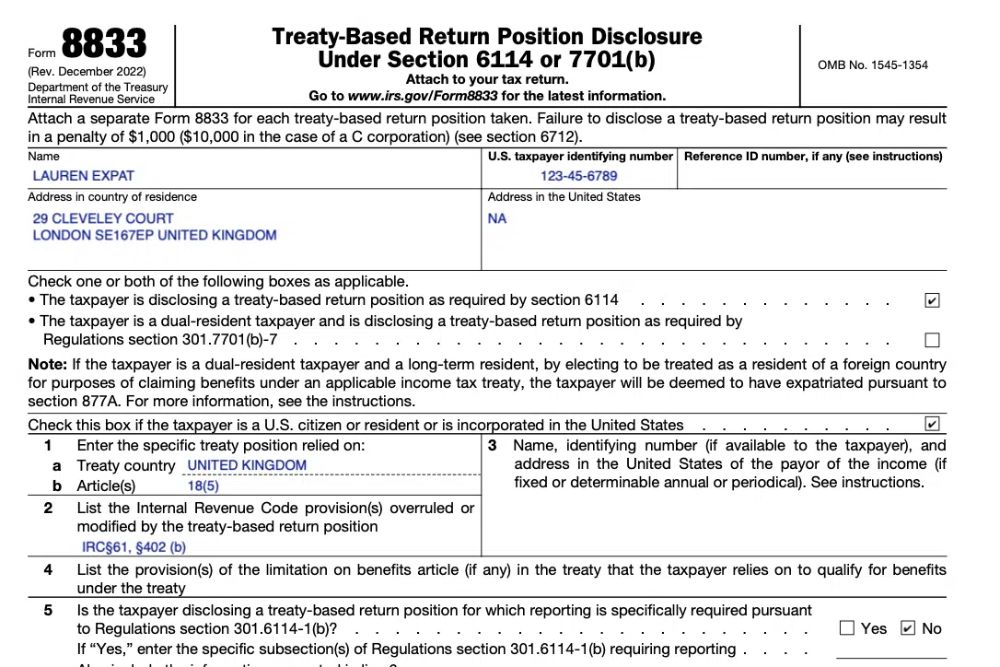

Form 8833 & Tax Treaties - Understanding Your US Tax Return

Indian Act Exemption for Employment Income Guidelines - Send. Status Indian employees who are performing all or part of their job duties on reserve may be eligible to be exempted from having income tax withheld from their , Form 8833 & Tax Treaties - Understanding Your US Tax Return, Form 8833 & Tax Treaties - Understanding Your US Tax Return, What Is Form 1-9: Employment Eligibility Verification?, What Is Form 1-9: Employment Eligibility Verification?, About Indian Act Exemption for Employment Income Guidelines. The courts have determined that, for the purposes of section 87 of the Indian Act