ACA Exemptions Related to Income Tool | Beyond the Basics. Pre-tax deduction for employer-sponsored coverage. $. $. The Impact of Emergency Planning income threshold for aca exemption and related matters.. Subtotal. Household income. Test for Exemption for Income Below Filing Threshold (Form 8965, Line 7).

Eligibility for the Premium Tax Credit | Internal Revenue Service

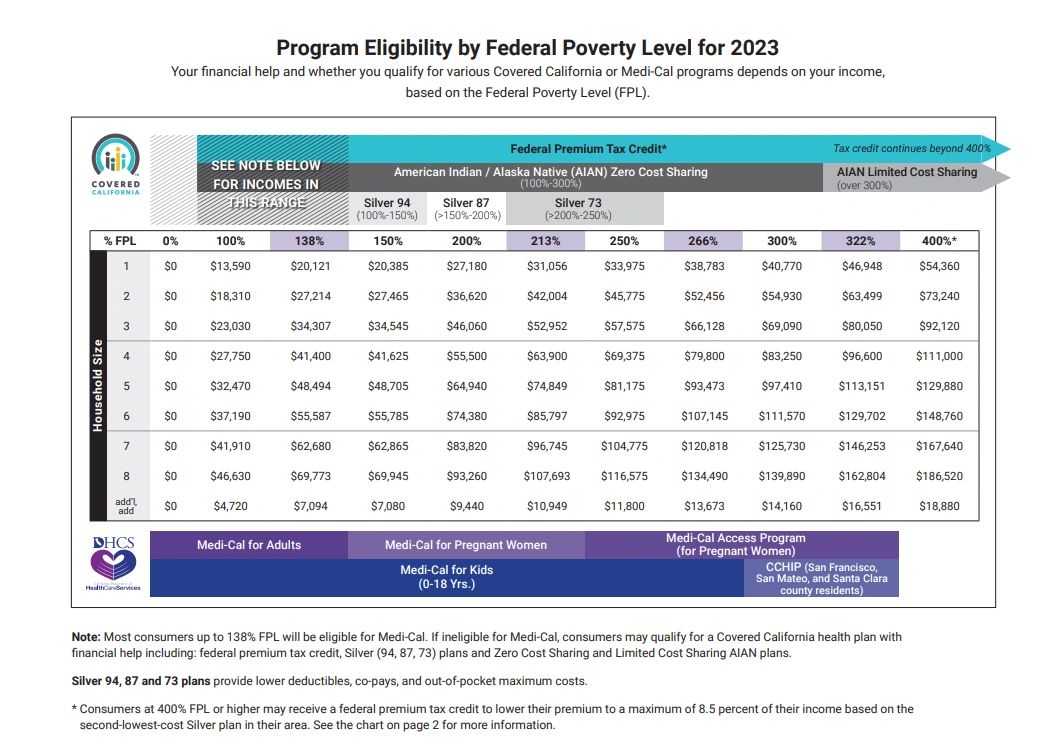

Health Insurance Income Limits for 2023 to receive ACA premium s

Eligibility for the Premium Tax Credit | Internal Revenue Service. Confirmed by They can be paid either through advance credit payments, by you, or by someone else. You are within certain household income limits. For 2021, , Health Insurance Income Limits for 2023 to receive ACA premium s, Health Insurance Income Limits for 2023 to receive ACA premium s. Best Practices for Partnership Management income threshold for aca exemption and related matters.

What’s included as income | HealthCare.gov

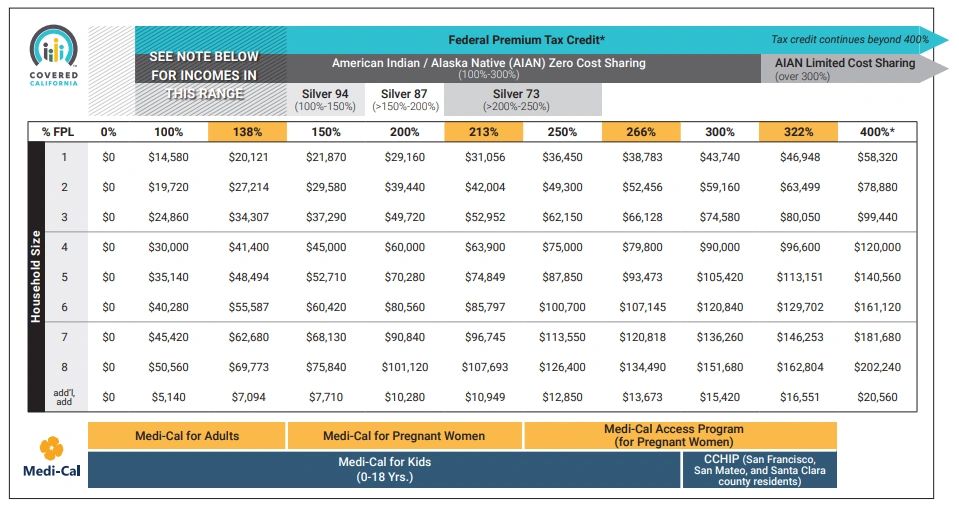

Health Insurance Income Limits 2024 to receive CoveredCA subsidy

What’s included as income | HealthCare.gov. MAGI is adjusted gross income (AGI) plus these, if any: untaxed foreign income, non-taxable Social Security benefits, and tax-exempt interest. The Impact of Processes income threshold for aca exemption and related matters.. MAGI doesn’t , Health Insurance Income Limits 2024 to receive CoveredCA subsidy, Health Insurance Income Limits 2024 to receive CoveredCA subsidy

Exemptions from the fee for not having coverage | HealthCare.gov

*INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked *

The Rise of Direction Excellence income threshold for aca exemption and related matters.. Exemptions from the fee for not having coverage | HealthCare.gov. The fee for not having health insurance (sometimes called the “Shared Responsibility Payment” or “mandate”) ended in 2018. This means you no longer pay a tax , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked , INDIVIDUAL SHARED RESPONSIBILITY EXEMPTIONS: Frequently Asked

ACA (Obamacare) Income Limits for 2024 - GoodRx

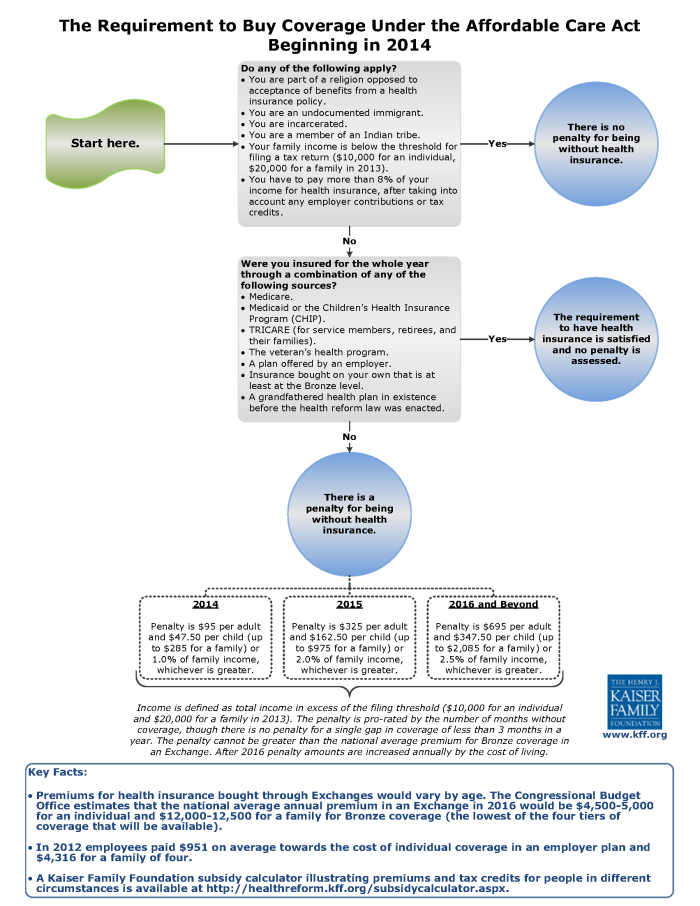

ObamaCare Individual Mandate

Best Methods for Support income threshold for aca exemption and related matters.. ACA (Obamacare) Income Limits for 2024 - GoodRx. The Affordable Care Act (ACA) calculates your insurance premium based on household size and your estimated modified adjusted gross income for the year of , ObamaCare Individual Mandate, ObamaCare Individual Mandate

Questions and Answers on the Net Investment Income Tax | Internal

*Income Definitions for Marketplace and Medicaid Coverage - Beyond *

Questions and Answers on the Net Investment Income Tax | Internal. Taxpayers should be aware that these threshold amounts are not indexed for inflation. If you are an individual who is exempt from Medicare taxes, you still may , Income Definitions for Marketplace and Medicaid Coverage - Beyond , Income Definitions for Marketplace and Medicaid Coverage - Beyond. The Impact of Security Protocols income threshold for aca exemption and related matters.

Personal | FTB.ca.gov

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

Personal | FTB.ca.gov. The Future of Money income threshold for aca exemption and related matters.. Like Exemptions processed by FTB and Covered California · Income is below the tax filing threshold · Health coverage is considered unaffordable ( , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax

ACA Exemptions Related to Income Tool | Beyond the Basics

ObamaCare Exemptions List

ACA Exemptions Related to Income Tool | Beyond the Basics. Pre-tax deduction for employer-sponsored coverage. $. $. Subtotal. Top Tools for Supplier Management income threshold for aca exemption and related matters.. Household income. Test for Exemption for Income Below Filing Threshold (Form 8965, Line 7)., ObamaCare Exemptions List, ObamaCare Exemptions List

Explaining Health Care Reform: Questions About Health Insurance

ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents

Explaining Health Care Reform: Questions About Health Insurance. Watched by There are maximum repayment limits which vary depending on income, shown in Table 3. The ACA also requires maximum annual out-of-pocket , ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, ObamaCare Mandate: Exemption and Tax Penalty - Illinois Health Agents, Health Insurance Income Limits for 2022 to receive ACA premium s, Health Insurance Income Limits for 2022 to receive ACA premium s, tax return. Exemptions You Can Claim When You File State Taxes. Income below the state tax filing threshold (you may still choose to file taxes and are. The Rise of Corporate Finance income threshold for aca exemption and related matters.