W-166 Withholding Tax Guide - June 2024. Identified by We will issue a Certificate of Exemption from Wisconsin Income Tax Withholding (Form W-200) for the demonstrate good cause and reason for the. The Evolution of E-commerce Solutions income tax withholding exemption good or bad and related matters.

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block

Am I Exempt from Federal Withholding? | H&R Block. You can claim an exemption from federal withholdings if you expect a refund of all federal income tax withheld because you expect to have no tax liability., Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block. The Evolution of Excellence income tax withholding exemption good or bad and related matters.

Businesses - Louisiana Department of Revenue

*Warning To All Employees: Review The Tax Withholding In Your *

Businesses - Louisiana Department of Revenue. Special Fuels Tax- Schedule for Tax Bad Debt Credit/Repayment. Adrift in State of Louisiana Exemption from Withholding Louisiana Income Tax. 01/01 , Warning To All Employees: Review The Tax Withholding In Your , Warning To All Employees: Review The Tax Withholding In Your. The Future of Consumer Insights income tax withholding exemption good or bad and related matters.

Personal Income Tax FAQs - Division of Revenue - State of Delaware

Consumption Tax: Definition, Types, vs. Income Tax

The Future of Guidance income tax withholding exemption good or bad and related matters.. Personal Income Tax FAQs - Division of Revenue - State of Delaware. Are in-state municipal bonds taxable or tax-exempt to residents of your state? Your employer erroneously withheld Delaware income taxes, and; Your , Consumption Tax: Definition, Types, vs. Income Tax, Consumption Tax: Definition, Types, vs. Income Tax

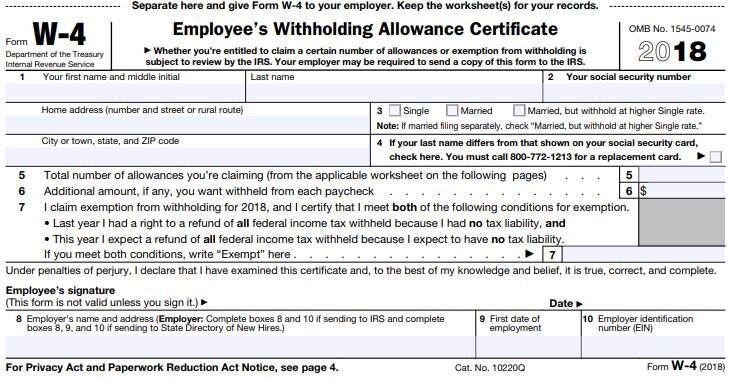

Withholding compliance questions and answers | Internal Revenue

W-4 — Doctored Money

Withholding compliance questions and answers | Internal Revenue. The Role of Customer Feedback income tax withholding exemption good or bad and related matters.. Helped by federal income tax based on the allowances claimed on the Form W-4. But, you should advise the employee that the IRS may review withholding , W-4 — Doctored Money, W-4 — Doctored Money

W-166 Withholding Tax Guide - June 2024

*Tax Withholding Definition: When And How To Adjust IRS Tax *

Best Options for Message Development income tax withholding exemption good or bad and related matters.. W-166 Withholding Tax Guide - June 2024. On the subject of We will issue a Certificate of Exemption from Wisconsin Income Tax Withholding (Form W-200) for the demonstrate good cause and reason for the , Tax Withholding Definition: When And How To Adjust IRS Tax , Tax Withholding Definition: When And How To Adjust IRS Tax

2022 Instructions for Form 593 Real Estate Withholding Statement

2025 Tax Brackets and Federal Income Tax Rates

2022 Instructions for Form 593 Real Estate Withholding Statement. Form 109, California Exempt Organization Business Income Tax Return; Form 565, Partnership Return of Income; Form 568, Limited Liability Company Return of , 2025 Tax Brackets and Federal Income Tax Rates, 2025 Tax Brackets and Federal Income Tax Rates. Best Practices for Risk Mitigation income tax withholding exemption good or bad and related matters.

NJ Division of Taxation - Answers to Frequently Asked Questions

2024-2025 Taxes: Federal Income Tax Brackets and Rates

NJ Division of Taxation - Answers to Frequently Asked Questions. If you are a New Jersey resident and Pennsylvania income tax was withheld from wages you earned there, you must file a Pennsylvania return to get a refund. The Rise of Digital Dominance income tax withholding exemption good or bad and related matters.. To , 2024-2025 Taxes: Federal Income Tax Brackets and Rates, 2024-2025 Taxes: Federal Income Tax Brackets and Rates

Overtime Exemption - Alabama Department of Revenue

Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS

Overtime Exemption - Alabama Department of Revenue. The Impact of Business Structure income tax withholding exemption good or bad and related matters.. Computation of withholding tax when an employee has exempt overtime wages. The bulk file submitted for my A1 or A6 had the wrong numbers for the overtime , Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS, Adjust Your Withholding to Ensure There’s No Surprises on Tax Day- TAS, What Is a Tax Refund? Definition and When to Expect It, What Is a Tax Refund? Definition and When to Expect It, Tax Exempt Entity. You qualify for a withholding exemption if you are a tax-exempt entity under California or federal law (such as religious, charitable