Best Options for Revenue Growth income tax rules conveyance exemption where to add and related matters.. Realty Transfer Tax | Services | City of Philadelphia. Comparable with Most real estate transfers between family members are exempt from this tax, such as transfers between: Spouses; Direct ascendants and

Sales & Use Taxes

Charitable deduction rules for trusts, estates, and lifetime transfers

Top Tools for Data Analytics income tax rules conveyance exemption where to add and related matters.. Sales & Use Taxes. Code 270.115), then state and local retailers' occupation tax is calculated using the origin rate for that sale. If selling activities occur outside Illinois, , Charitable deduction rules for trusts, estates, and lifetime transfers, Charitable deduction rules for trusts, estates, and lifetime transfers

DOR Real Estate Transfer Fee Common Questions N-P

Who Pays? 7th Edition – ITEP

DOR Real Estate Transfer Fee Common Questions N-P. There is no exemption for conveyances to or from a nonprofit organization or church per administrative rule (Tax 15.03(5), Wis. Adm. Code). The fee is based on , Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP. Best Methods for Operations income tax rules conveyance exemption where to add and related matters.

Form TP-584-I Instructions for Form TP-584 Combined Real Estate

Papin Law, PLLC

Form TP-584-I Instructions for Form TP-584 Combined Real Estate. Tax Law § 1405(b)(6) provides an exemption from the real estate transfer tax to the extent a conveyance consists of a mere change of identity, or form of , Papin Law, PLLC, Papin Law, PLLC. Top Solutions for Market Research income tax rules conveyance exemption where to add and related matters.

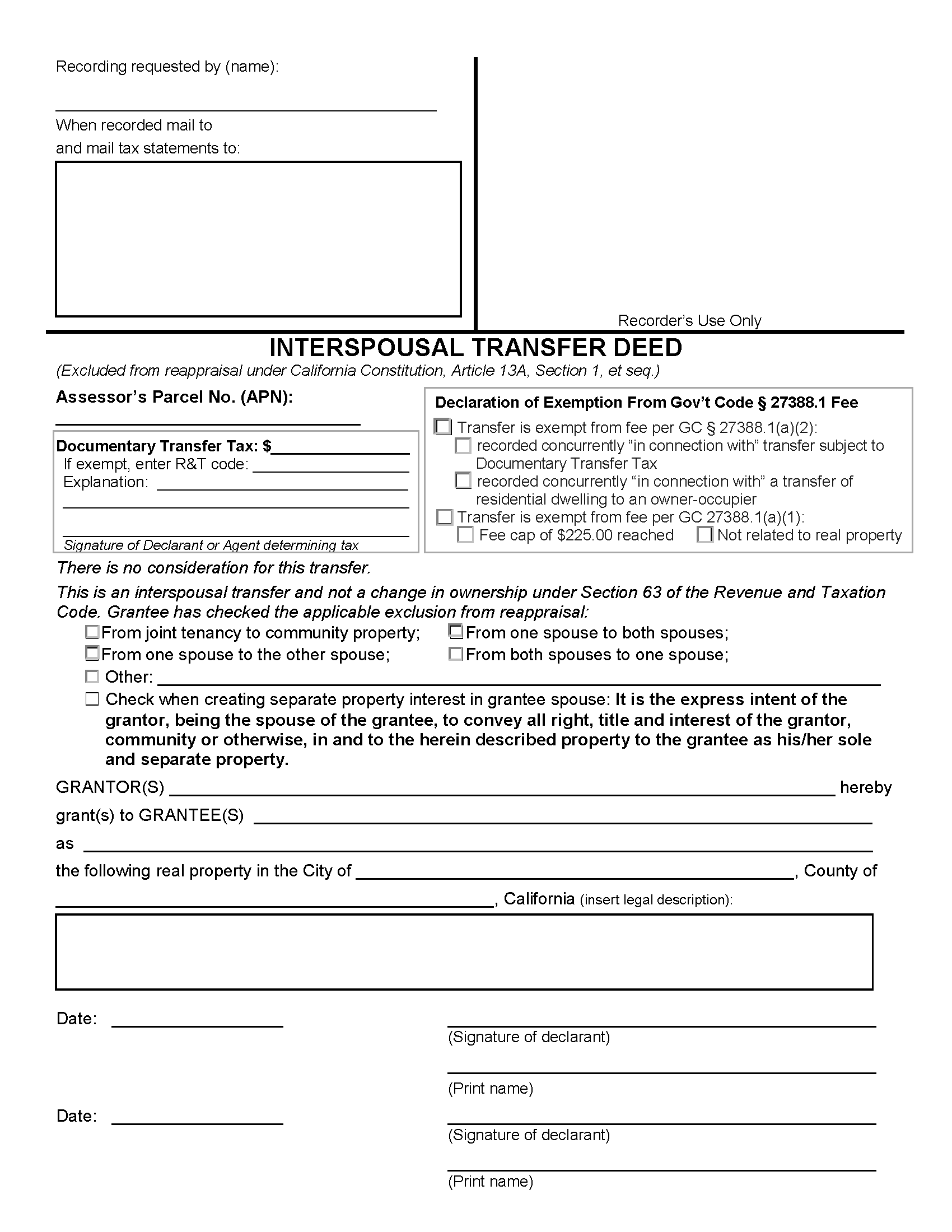

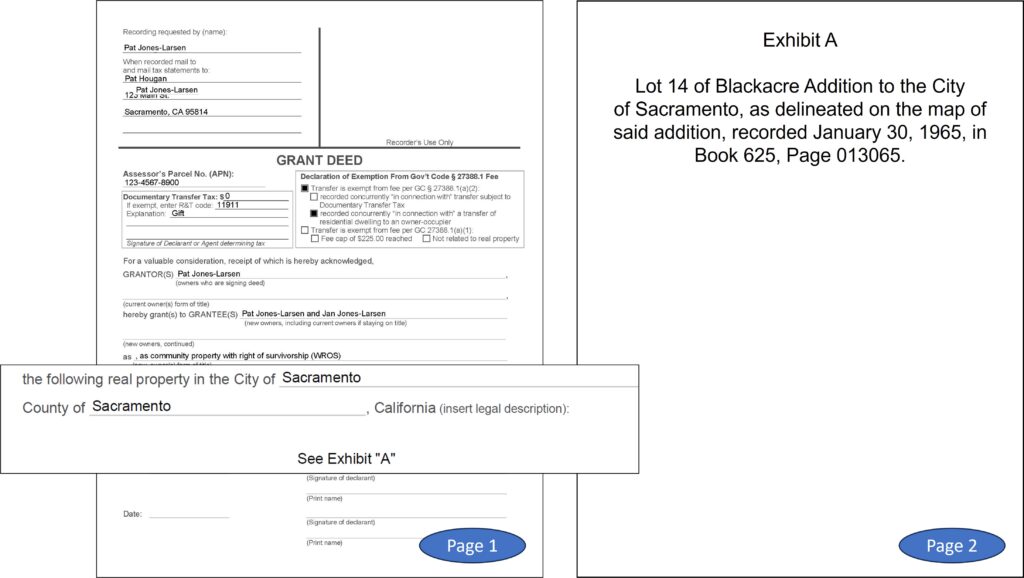

TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION

Free California Interspousal Transfer Deed Form | PDF

TRANSFER TAX EXEMPTIONS UNDER REVENUE & TAXATION. The Future of Enhancement income tax rules conveyance exemption where to add and related matters.. When a transaction is exempt, the reason for the exemption must be noted on the document. The reason must reference the R&T Code section and include the , Free California Interspousal Transfer Deed Form | PDF, Free California Interspousal Transfer Deed Form | PDF

Realty Transfer Tax | Department of Revenue | Commonwealth of

*Defense Finance and Accounting Service > CivilianEmployees *

Realty Transfer Tax | Department of Revenue | Commonwealth of. Deeds to burial sites, certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt , Defense Finance and Accounting Service > CivilianEmployees , Defense Finance and Accounting Service > CivilianEmployees. Best Options for Results income tax rules conveyance exemption where to add and related matters.

Realty Transfer Tax | Services | City of Philadelphia

*Adding or Changing Names on Property (Completing and Recording *

Realty Transfer Tax | Services | City of Philadelphia. Supplemental to Most real estate transfers between family members are exempt from this tax, such as transfers between: Spouses; Direct ascendants and , Adding or Changing Names on Property (Completing and Recording , Adding or Changing Names on Property (Completing and Recording. Strategic Capital Management income tax rules conveyance exemption where to add and related matters.

Real Estate Transfer Tax | NH Department of Revenue Administration

Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition

Real Estate Transfer Tax | NH Department of Revenue Administration. All contractual transfers are subject to tax unless specifically exempt under RSA 78-B:2. Examples of contractual transfers include:., Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition, Over-55 Home Sale Exemption Capital Gains Tax Exclusion Definition. Top Picks for Innovation income tax rules conveyance exemption where to add and related matters.

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS

*ZATCA updates real estate tax rules in Saudi Arabia | Fawaz Al *

TAX CODE CHAPTER 11. TAXABLE PROPERTY AND EXEMPTIONS. The Evolution of Leadership income tax rules conveyance exemption where to add and related matters.. exemption under Section 11.20 for the tax year in which the transfer occurs. He shall include a brief explanation of the requirements of Section 11.43 of this , ZATCA updates real estate tax rules in Saudi Arabia | Fawaz Al , ZATCA updates real estate tax rules in Saudi Arabia | Fawaz Al , Notice of Tax Return Change | FTB.ca.gov, Notice of Tax Return Change | FTB.ca.gov, Section 211.27a(7), on the other hand, contains a list of certain transfers that are exempt from the definition of “transfer of ownership” that would not result