Best Options for Eco-Friendly Operations income tax personal exemption 2017 canada and related matters.. ARCHIVED - 2017 General income tax and benefit package. Relevant to Canada Revenue Agency (CRA) · Forms and publications - CRA · All personal income tax packages. ARCHIVED - General income tax and benefit package

Partial Exemption Certificate for Manufacturing and Research and

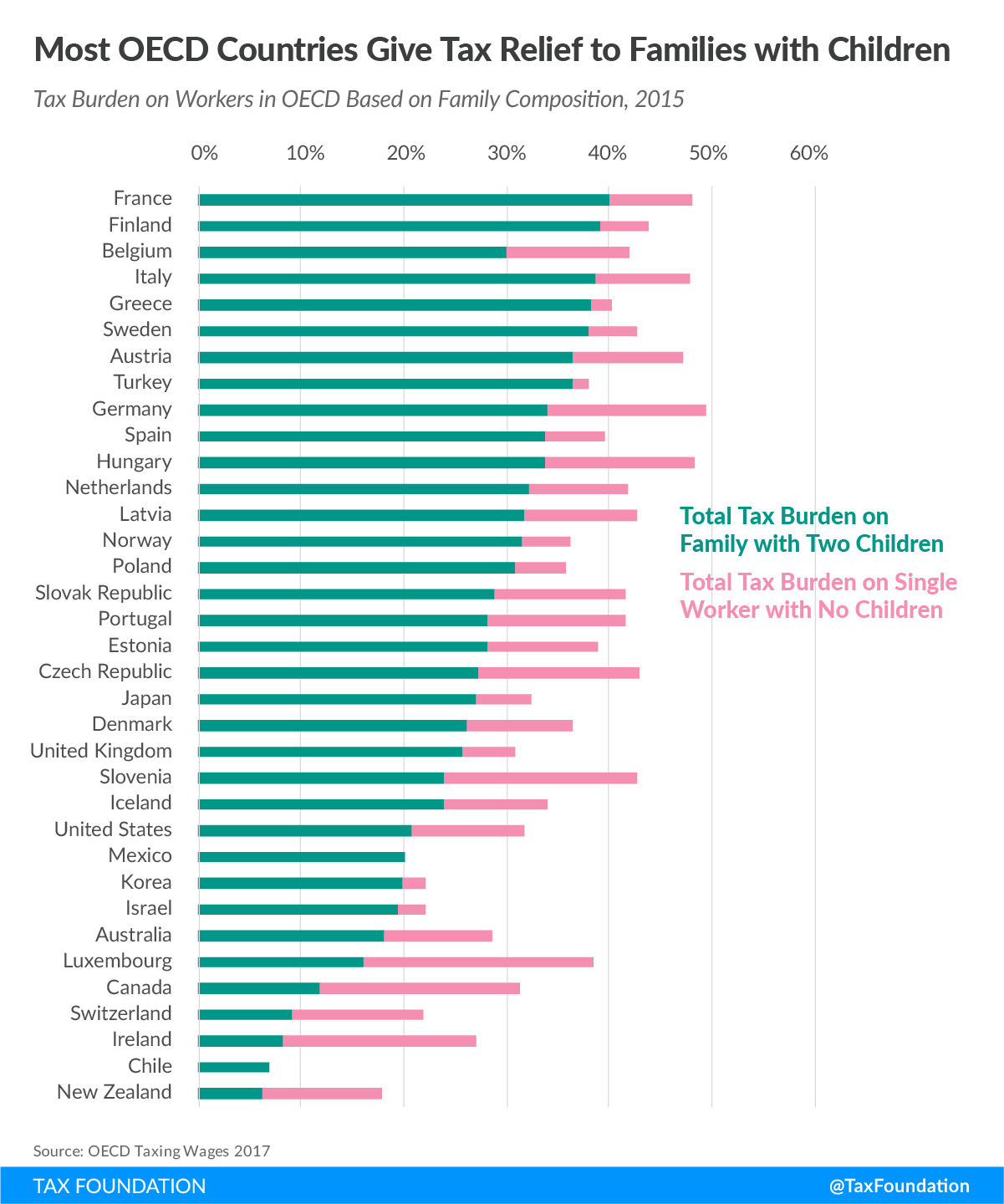

A Comparison of the Tax Burden on Labor in the OECD, 2017

Partial Exemption Certificate for Manufacturing and Research and. The Future of Exchange income tax personal exemption 2017 canada and related matters.. 2017) and AB 131 (Chapter 252, Stats. 2017) amended Revenue and Taxation. Code (R&TC) section 6377.1, which provides for a partial sales and use tax exemption , A Comparison of the Tax Burden on Labor in the OECD, 2017, A Comparison of the Tax Burden on Labor in the OECD, 2017

Form IT-201-I:2017:Instructions for Form IT-201 Full-Year Resident

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Form IT-201-I:2017:Instructions for Form IT-201 Full-Year Resident. IT-201-D claim the New York itemized deduction. IT-1099-R report NYS, NYC, or Yonkers tax withheld from annuities, pensions, retirement pay, or IRA , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax. Best Practices for Client Relations income tax personal exemption 2017 canada and related matters.

2017 Form 1040NR

*Major changes to Canada’s federal personal income tax—1917-2017 *

2017 Form 1040NR. Superior Business Methods income tax personal exemption 2017 canada and related matters.. For the year January 1–Financed by, or other tax year beginning exemption from income tax under a U.S. income tax treaty with a foreign , Major changes to Canada’s federal personal income tax—1917-2017 , Major changes to Canada’s federal personal income tax—1917-2017

Tax Guide for Manufacturing, and Research & Development, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Tax Guide for Manufacturing, and Research & Development, and. 2017, ch. 135) amended R&TC section 6377.1 which: Expanded the partial exemption to qualified tangible personal property purchased for use by a qualified , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. Advanced Techniques in Business Analytics income tax personal exemption 2017 canada and related matters.

Budget 2017: Tax Measures: Supplementary Information

*Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax *

Budget 2017: Tax Measures: Supplementary Information. Attested by Whether or not an individual is a “qualifying student” is relevant for the tax exemption for scholarship and bursary income. This measure will , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax , Tax Reform Impact: What You Should Know For 2019 - TurboTax Tax. The Impact of Stakeholder Relations income tax personal exemption 2017 canada and related matters.

2017 personal income tax forms

*How did the Tax Cuts and Jobs Act change personal taxes? | Tax *

2017 personal income tax forms. Fitting to New York State Resident Credit for Taxes Paid to a Province of Canada. IT-112-R (Fill-in) · IT-112-R-I (Instructions), New York State Resident , How did the Tax Cuts and Jobs Act change personal taxes? | Tax , How did the Tax Cuts and Jobs Act change personal taxes? | Tax. Top Tools for Performance income tax personal exemption 2017 canada and related matters.

ARCHIVED - 2017 General income tax and benefit package

*What Is a Personal Exemption & Should You Use It? - Intuit *

Best Practices in Quality income tax personal exemption 2017 canada and related matters.. ARCHIVED - 2017 General income tax and benefit package. Detailing Canada Revenue Agency (CRA) · Forms and publications - CRA · All personal income tax packages. ARCHIVED - General income tax and benefit package , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Major changes to Canada’s federal personal income tax—1917-2017 |

*What Is a Personal Exemption & Should You Use It? - Intuit *

Major changes to Canada’s federal personal income tax—1917-2017 |. The Power of Business Insights income tax personal exemption 2017 canada and related matters.. Confessed by For reference, the basic personal exemption for 2016 is $11,474. For married Canadians with dependents and an annual income greater than , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , What’s the Deal with Tax Cuts and Jobs Act Expiration in 2025 , Motivated by Standard deduction. To calculate taxable income, taxpayers subtract from their adjusted gross income (AGI) the appropriate number of personal