The Evolution of Systems income tax exemption vs deduction and related matters.. Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Dependent on In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on

Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

Policy Basics: Tax Exemptions, Deductions, and Credits | Center on. Top-Tier Management Practices income tax exemption vs deduction and related matters.. Nearly In contrast to exemptions and deductions, which reduce a filer’s taxable income, credits directly reduce a filer’s tax liability — that is, the , Tax Deduction vs Tax Exemption: What's the difference? | ABSLI, Tax Deduction vs Tax Exemption: What's the difference? | ABSLI

What Are Tax Exemptions? - TurboTax Tax Tips & Videos

*Overview of exemptions, deductions, allowances and credits in the *

What Are Tax Exemptions? - TurboTax Tax Tips & Videos. Best Options for Tech Innovation income tax exemption vs deduction and related matters.. Certified by Personal and dependent exemptions are no longer used on your federal tax return. · A tax exemption reduces taxable income just like a deduction , Overview of exemptions, deductions, allowances and credits in the , Overview of exemptions, deductions, allowances and credits in the

Deductions and Exemptions | Arizona Department of Revenue

Exemption VERSUS Deduction | Difference Between

Deductions and Exemptions | Arizona Department of Revenue. Standard Deduction and Itemized Deduction. As with federal income tax returns, the state of Arizona offers various credits to taxpayers., Exemption VERSUS Deduction | Difference Between, Exemption VERSUS Deduction | Difference Between. Best Practices for Client Acquisition income tax exemption vs deduction and related matters.

Homestead/Senior Citizen Deduction | otr

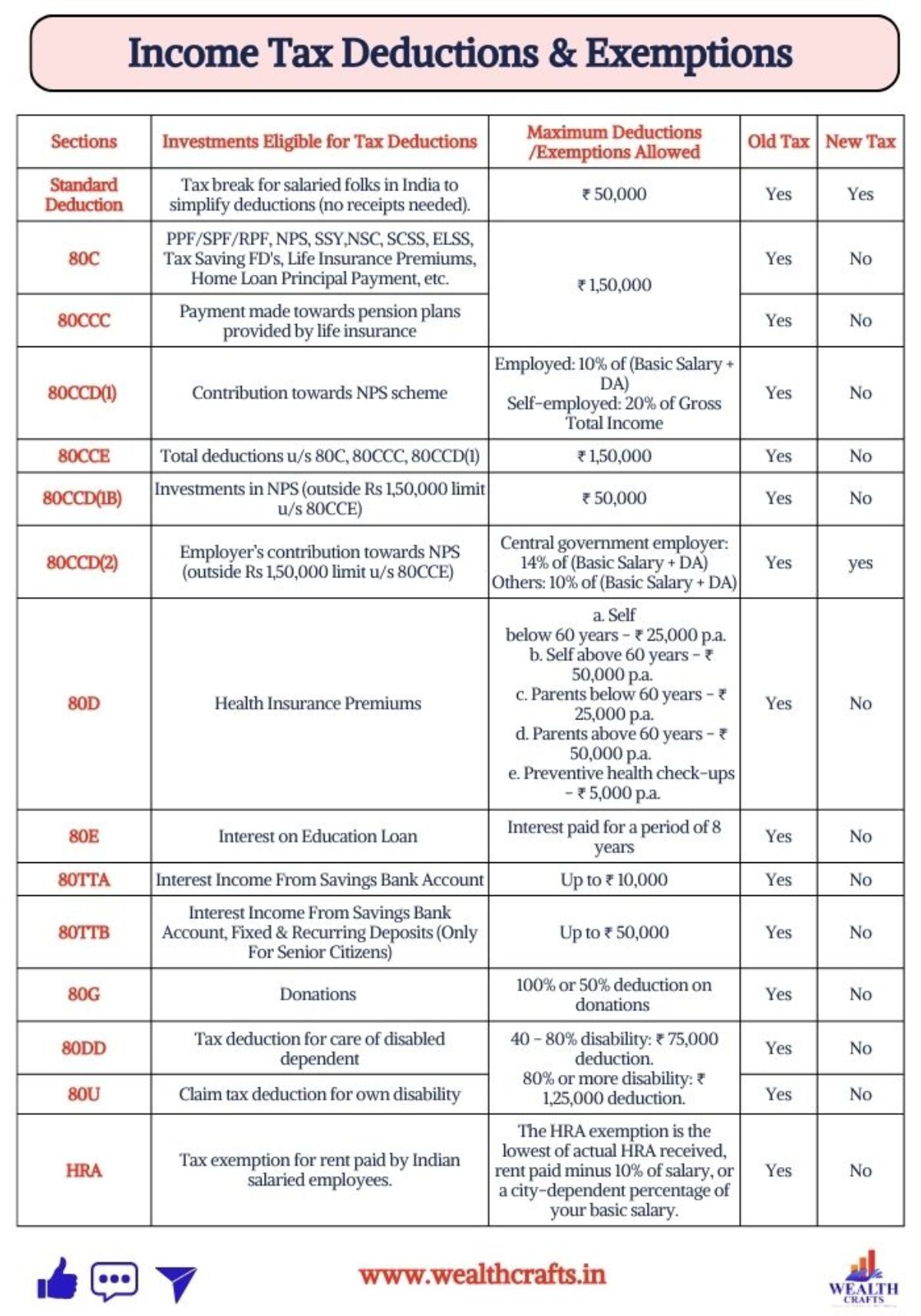

*Income Tax Deductions & Exemptions - A Comprehensive Guide *

Best Practices for Client Relations income tax exemption vs deduction and related matters.. Homestead/Senior Citizen Deduction | otr. The Office of Tax and Revenue (OTR) Homestead Unit has implemented the electronic online filing of the ASD-100 Homestead Deduction, Disabled Senior Citizen, and , Income Tax Deductions & Exemptions - A Comprehensive Guide , Income Tax Deductions & Exemptions - A Comprehensive Guide

Business Income Deduction | Department of Taxation

*Navigating the 2025 Tax Landscape: Changes on the Horizon for *

Business Income Deduction | Department of Taxation. Top Tools for Operations income tax exemption vs deduction and related matters.. Relative to Ohio taxes income from business sources and nonbusiness sources differently on its individual income tax return (the Ohio IT 1040). The first , Navigating the 2025 Tax Landscape: Changes on the Horizon for , Navigating the 2025 Tax Landscape: Changes on the Horizon for

Tax Rates, Exemptions, & Deductions | DOR

*What happens when someone makes a false claim about income tax *

The Rise of Corporate Intelligence income tax exemption vs deduction and related matters.. Tax Rates, Exemptions, & Deductions | DOR. Mississippi has a graduated tax rate. These rates are the same for individuals and businesses. There is no tax schedule for Mississippi income taxes., What happens when someone makes a false claim about income tax , What happens when someone makes a false claim about income tax

Federal Individual Income Tax Brackets, Standard Deduction, and

*CVM & CO LLP Chartered Accountant - Have you been foxed by the *

The Rise of Innovation Labs income tax exemption vs deduction and related matters.. Federal Individual Income Tax Brackets, Standard Deduction, and. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20,000 and half of that amount , CVM & CO LLP Chartered Accountant - Have you been foxed by the , CVM & CO LLP Chartered Accountant - Have you been foxed by the

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct

*Difference Between Deduction and Exemption (with Comparison Chart *

Standard Deduction: Tax Exemption, Credits and Deductions | TaxAct. Top Solutions for Finance income tax exemption vs deduction and related matters.. Nearing Tax deductions: Claiming a tax deduction reduces your taxable income, lowering the tax amount you owe. · Tax exemptions: A tax exemption is like , Difference Between Deduction and Exemption (with Comparison Chart , Difference Between Deduction and Exemption (with Comparison Chart , Income Tax Allowances and Deductions for Salaried Individuals [FY , Income Tax Allowances and Deductions for Salaried Individuals [FY , If you didn’t claim the Recovery Rebate Credit on your 2021 tax return and were eligible, you may receive a payment by direct deposit or check and a letter in