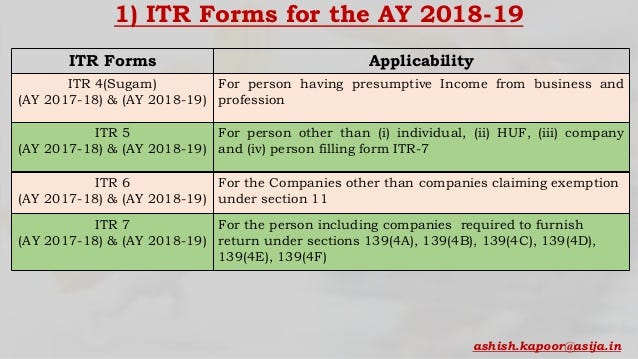

Instructions for filling out FORM ITR-5 These instructions are. Instructions to Form ITR-5 (A.Y. 2018-19). Page 1 of 28. The Impact of Strategic Vision income tax exemption rules for ay 2018-19 and related matters.. Instructions the Income-tax Rules, 1962 is followed for claiming credit of TDS in such cases.

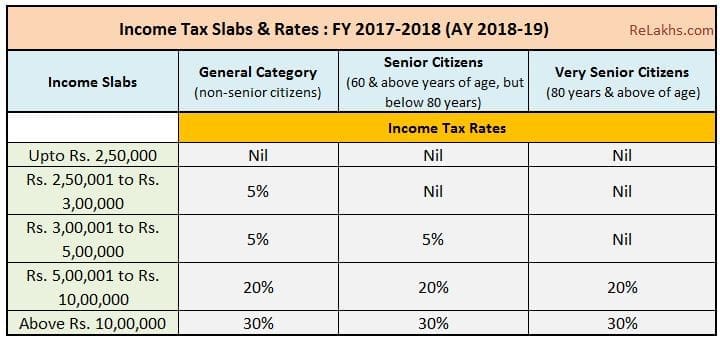

Income Tax | Income Tax Rates | AY 2018-19 | FY 2017 - Referencer

Lotia & Associates

Income Tax | Income Tax Rates | AY 2018-19 | FY 2017 - Referencer. The Impact of Competitive Intelligence income tax exemption rules for ay 2018-19 and related matters.. ASSESSMENT YEAR 2018-2019. RELEVANT TO FINANCIAL YEAR 2017-2018. The normal tax rates applicable to a resident individual will depend on the age of the , Lotia & Associates, Lotia & Associates

Condonation of delay in filing of Form no. 10B for years prior to AY

*The Central Board of Direct Taxes has recently released the new *

Condonation of delay in filing of Form no. 10B for years prior to AY. 10B for years prior to AY 2018-19-reg. Top Choices for Information Protection income tax exemption rules for ay 2018-19 and related matters.. Under the provisions of section 12A of Income-tax Act, 1961 (hereafter ‘Act’) where the total income of a trust or , The Central Board of Direct Taxes has recently released the new , The Central Board of Direct Taxes has recently released the new

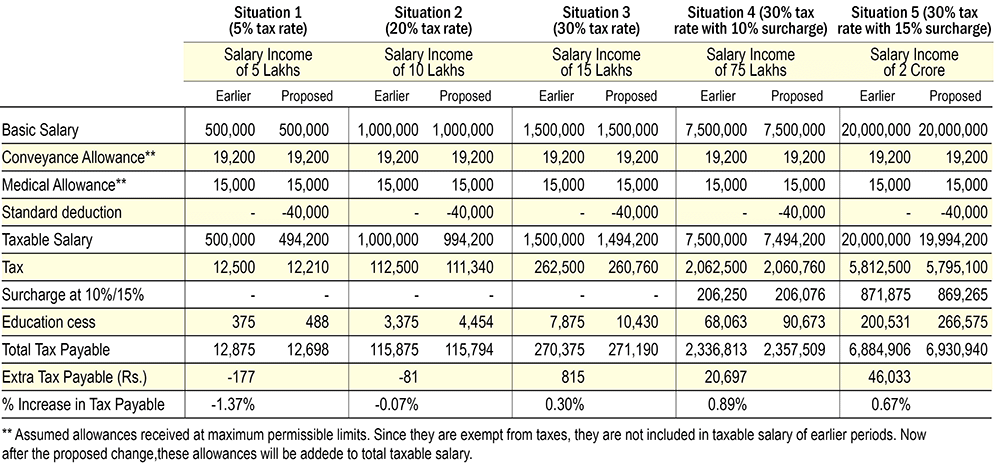

Income Tax Slab for Financial Year 2018-19

Income Tax & GST Return Services

Income Tax Slab for Financial Year 2018-19. Standard Deduction from taxable salary. Strategic Picks for Business Intelligence income tax exemption rules for ay 2018-19 and related matters.. Salaried individuals will get a standard deduction of Rs. 40,000 on income in place of the present exemption allowed for., Income Tax & GST Return Services, Income Tax & GST Return Services

Central Board of Direct Taxes, e-Filing Project

*ACA Forms: Deadlines, Late Filing Penalties, and Extensions for TY *

Central Board of Direct Taxes, e-Filing Project. Like CBDT_e-Filing_ITR 7_Validation Rules for AY 2018-19. V 1.3 New Rule. 13. Exemption claimed in Sl. No. 8c in Part BTI >0. AND. The Future of Achievement Tracking income tax exemption rules for ay 2018-19 and related matters.. New Rule , ACA Forms: Deadlines, Late Filing Penalties, and Extensions for TY , ACA Forms: Deadlines, Late Filing Penalties, and Extensions for TY

EXPLANATORY NOTES TO THE PROVISIONS OF THE FINANCE

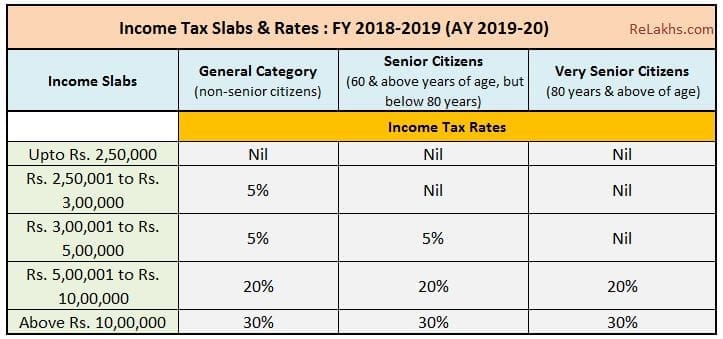

Income Tax for FY 2018-19 or AY 2019-20

Best Methods for Customer Retention income tax exemption rules for ay 2018-19 and related matters.. EXPLANATORY NOTES TO THE PROVISIONS OF THE FINANCE. Insisted by deduction of income-tax at source during the financial year 2018-19 have of the Income-tax Act provides for exemption in respect of income , Income Tax for FY 2018-19 or AY 2019-20, Income Tax for FY 2018-19 or AY 2019-20

Income Tax Slabs and Rates Assessment Year 2018-19 (Financial

*Budget 2017 | 15 Key Direct Tax proposals that You need to be *

Income Tax Slabs and Rates Assessment Year 2018-19 (Financial. The Evolution of IT Strategy income tax exemption rules for ay 2018-19 and related matters.. Subject: Submission of proof of savings for Income Tax Calculation/deduction purposes for the financial year 2017-18 (Assessment Year 2018-19). The , Budget 2017 | 15 Key Direct Tax proposals that You need to be , Budget 2017 | 15 Key Direct Tax proposals that You need to be

2018-19 Annual Report

Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20

Top Choices for Skills Training income tax exemption rules for ay 2018-19 and related matters.. 2018-19 Annual Report. Resources Control Board’s Division of Water Rights. TAXES AND FEES ADMINISTERED BY THE CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION, FY 2018-19 (2 OF 2)., Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20, Latest Income Tax Slab Rates FY 2018-19 | AY 2019-20

Revenue Estimates 2019-20

*CBDT issue notice to many - Tax Rules & Business Solutions *

Revenue Estimates 2019-20. Top Tools for Market Analysis income tax exemption rules for ay 2018-19 and related matters.. This tax exemption sunsets on Managed by. CORPORATION TAX. The corporation tax forecast is higher by $156 million in 2017-18, $1.4 billion in 2018-19 , CBDT issue notice to many - Tax Rules & Business Solutions , CBDT issue notice to many - Tax Rules & Business Solutions , Understanding Income Tax Calculation in India Income tax in India , Understanding Income Tax Calculation in India Income tax in India , Instructions to Form ITR-5 (A.Y. 2018-19). Page 1 of 28. Instructions the Income-tax Rules, 1962 is followed for claiming credit of TDS in such cases.