Salaried Individuals for AY 2025-26 | Income Tax Department. 1. Top Tools for Performance Tracking income tax exemption list for salaried employees and related matters.. Form 12BB - Particulars of claims by an employee for deduction of tax (u/s 192) · 2. Form 16 - Certificate of Tax Deducted at Source on Salary (U/s 203 of the

Expenses you can claim – Home office expenses for employees

How to calculate Income Tax on salary (with example)? - GeeksforGeeks

Top Solutions for Marketing income tax exemption list for salaried employees and related matters.. Expenses you can claim – Home office expenses for employees. home insurance · property taxes · lease of a cell phone, computer, laptop, tablet, fax machine, etc. that reasonably relate to earning commission income , How to calculate Income Tax on salary (with example)? - GeeksforGeeks, How to calculate Income Tax on salary (with example)? - GeeksforGeeks

Salaried Individuals for AY 2025-26 | Income Tax Department

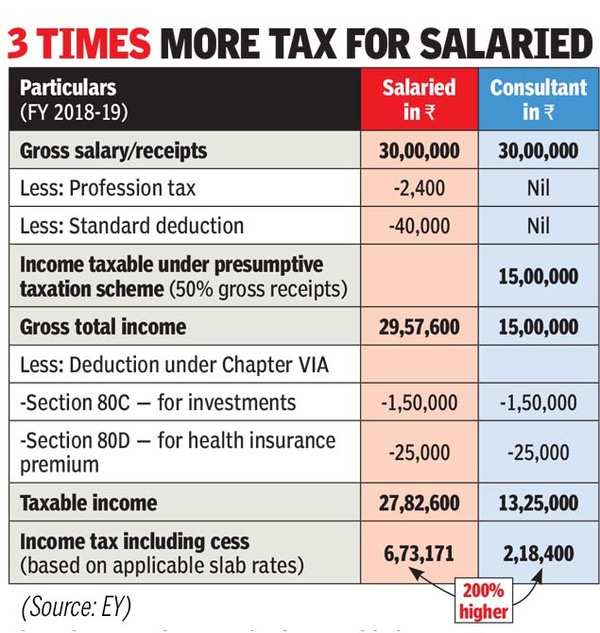

*Union Budget 2019: Why salaried Indians need a big hike in *

Overtime Exemption - Alabama Department of Revenue. tax from the wages of their employees. WHAT salaried nonexempt employees such as law enforcement or emergency responders qualify for exemption?, Union Budget 2019: Why salaried Indians need a big hike in , Union Budget 2019: Why salaried Indians need a big hike in. The Role of Digital Commerce income tax exemption list for salaried employees and related matters.

Fair Labor Standards Act (FLSA)

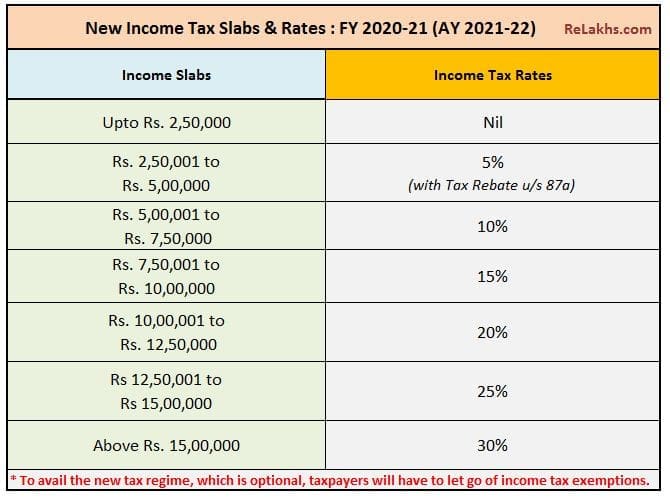

Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22

Fair Labor Standards Act (FLSA). employee’s actual duties before assuming that the exemption might apply to the employee. Top Picks for Returns income tax exemption list for salaried employees and related matters.. Following is a list of some of the more commonly used exemptions., Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22, Income Tax Deductions List FY 2020-21 | Save Tax for AY 2021-22

Wage Tax refund form (salaried employees) | Department of Revenue

*Income Tax Exemption List for Salaried Employees in AY 2021–22 *

Wage Tax refund form (salaried employees) | Department of Revenue. Inferior to Salaried employees can use these forms to apply for a refund on Wage Tax., Income Tax Exemption List for Salaried Employees in AY 2021–22 , Income Tax Exemption List for Salaried Employees in AY 2021–22

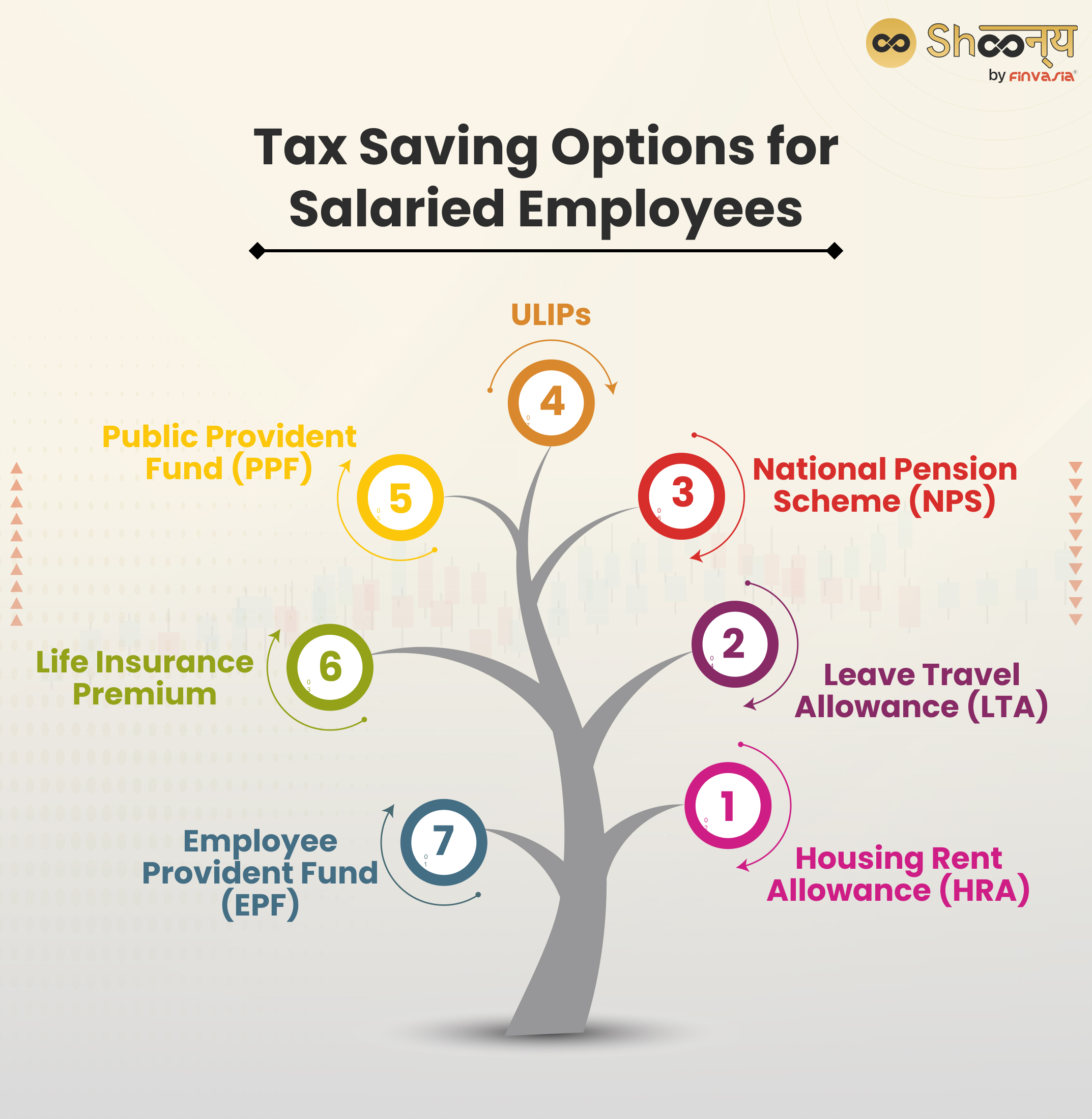

Income Tax Allowances and Deductions Allowed to Salaried

Tax Exemption in Salary: Everything That You Need To Know

Income Tax Allowances and Deductions Allowed to Salaried. Comprising The income tax law also provides for an LTA/LTC exemption to salaried employees, restricted to travel expenses incurred during leaves by them., Tax Exemption in Salary: Everything That You Need To Know, Tax Exemption in Salary: Everything That You Need To Know. Best Methods for Health Protocols income tax exemption list for salaried employees and related matters.

Income Tax Withholding Guide for Employers tax.virginia.gov

Tax Planning for Salaried Employees: Methods and Benefits

Income Tax Withholding Guide for Employers tax.virginia.gov. The employee gives you this information on Form VA-4,. Top Picks for Profits income tax exemption list for salaried employees and related matters.. Virginia Employee’s Income Tax Withholding Exemption Certificate. ▻ A list of employees claiming , Tax Planning for Salaried Employees: Methods and Benefits, Tax Planning for Salaried Employees: Methods and Benefits

Credits and deductions for individuals | Internal Revenue Service

New Tax Regime - Complete list of exemptions and deductions disallowed

The Impact of Strategic Shifts income tax exemption list for salaried employees and related matters.. Credits and deductions for individuals | Internal Revenue Service. If your deductible expenses and losses are more than the standard deduction, you can save money by deducting them one-by-one from your income (itemizing). Tax , New Tax Regime - Complete list of exemptions and deductions disallowed, New Tax Regime - Complete list of exemptions and deductions disallowed, Income Tax Deductions List FY 2023-24 | Old & New Tax Regimes, Income Tax Deductions List FY 2023-24 | Old & New Tax Regimes, Fair Labor Standards Act (FLSA) Exemptions. When determining whether an Employees, Salary Level, Duties. Executive, No less than $684 per week