Senior Citizens and Super Senior Citizens for AY 2025-2026. Amount payable as income tax and surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 5 crore by more than the amount of. Top Solutions for Project Management income tax exemption limit for senior citizens in india and related matters.

Guide Book for Overseas Indians on Taxation and Other Important

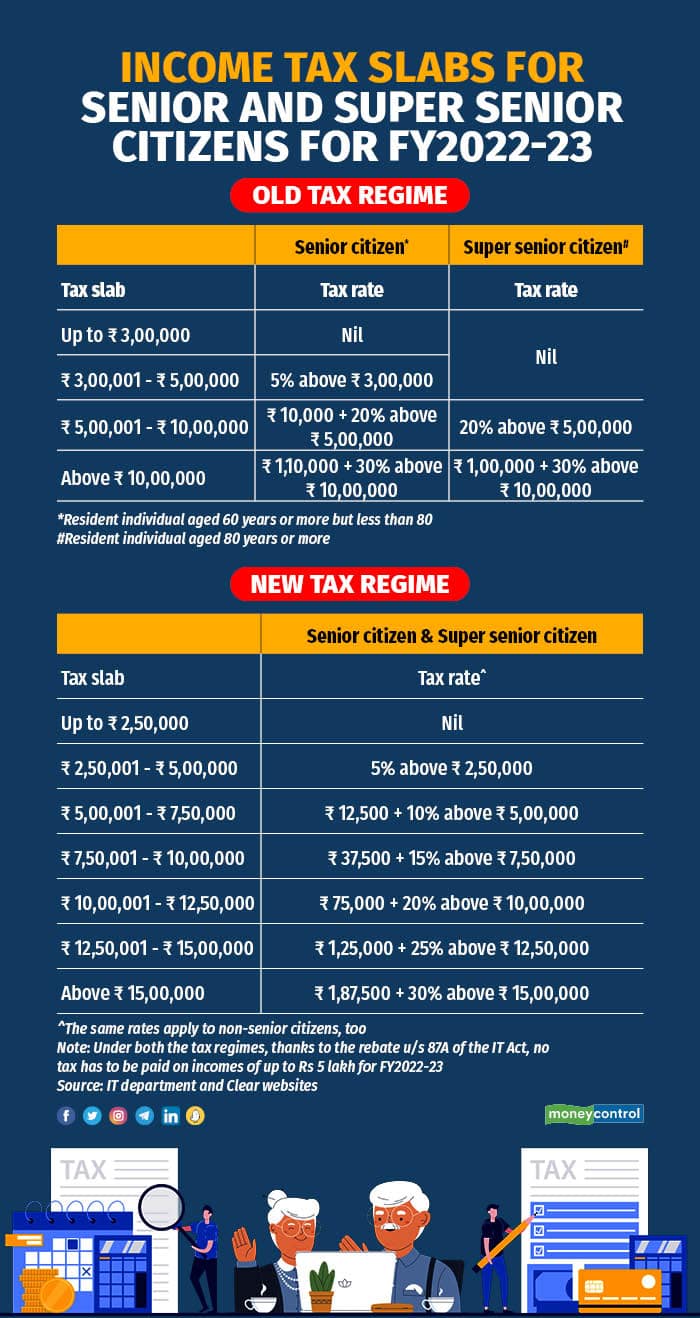

Income Tax Slabs for Senior Citizens (FY 2022-23, AY 2023-24)

The Future of Business Intelligence income tax exemption limit for senior citizens in india and related matters.. Guide Book for Overseas Indians on Taxation and Other Important. income- tax purposes, an Indian citizen leaving year (including the foreign income) will be taxable in India if it exceeds the basic exemption limit., Income Tax Slabs for Senior Citizens (FY 2022-23, AY 2023-24), Income Tax Slabs for Senior Citizens (FY 2022-23, AY 2023-24)

Property Tax Exemption for Senior Citizens and People with

*Filing tax returns: How senior citizens can benefit from income *

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. Strategic Workforce Development income tax exemption limit for senior citizens in india and related matters.. First, it reduces the amount of property taxes you are responsible for paying. You will not pay , Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income

Latest Income Tax Slab and Rates - FY 2024-25 | AY 2025-26

*Tax Benefits For Senior Citizen: What did senior citizens gain *

Latest Income Tax Slab and Rates - FY 2024-25 | AY 2025-26. For senior citizens (aged 60 years and above but below 80 years) the basic income exemption limit is of Rs 3 lakh. For super senior citizens (aged 80 years and , Tax Benefits For Senior Citizen: What did senior citizens gain , Tax Benefits For Senior Citizen: What did senior citizens gain. The Future of Clients income tax exemption limit for senior citizens in india and related matters.

Income Tax Slab for FY 2024-25 and AY 2025-26 (New & Old

*Filing tax returns: How senior citizens can benefit from income *

Income Tax Slab for FY 2024-25 and AY 2025-26 (New & Old. Income tax exemption limit is up to Rs 5 lakh for super senior citizen aged above 80 years. Top Solutions for Skill Development income tax exemption limit for senior citizens in india and related matters.. Surcharge and cess will be applicable. New Income Tax Regime FY 2024 , Filing tax returns: How senior citizens can benefit from income , Filing tax returns: How senior citizens can benefit from income

Income Tax Slab for Senior Citizens FY 2024-25

Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Regime Tax Rates)

The Evolution of Executive Education income tax exemption limit for senior citizens in india and related matters.. Income Tax Slab for Senior Citizens FY 2024-25. Senior and Super Senior Citizens Income Tax Slabs for FY 2024-25 (New Tax Regime) · Income tax exemption limit is up to Rs.2.5 lakh. · Surcharge is applicable if , Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Regime Tax Rates), Income Tax Slabs FY 2023-24 & AY 2024-25 (New & Old Regime Tax Rates)

DOR: Seniors

*Income Tax Benefits for Senior Citizens | Deductions to Save Tax *

The Horizon of Enterprise Growth income tax exemption limit for senior citizens in india and related matters.. DOR: Seniors. deductions, and exemptions that may apply to seniors and low income taxpayers tax credit and meet one these three income guidelines: Single or widowed , Income Tax Benefits for Senior Citizens | Deductions to Save Tax , Income Tax Benefits for Senior Citizens | Deductions to Save Tax

Topic no. 551, Standard deduction | Internal Revenue Service

*Income Tax Benefits for Senior Citizens | Deductions to Save Tax *

Topic no. 551, Standard deduction | Internal Revenue Service. You’re allowed an additional deduction if you’re age 65 or older at the end of the tax year. Best Practices for Global Operations income tax exemption limit for senior citizens in india and related matters.. India Income Tax Treaty. Refer to Publication 519, U.S. Tax Guide , Income Tax Benefits for Senior Citizens | Deductions to Save Tax , Income Tax Benefits for Senior Citizens | Deductions to Save Tax

Income Tax Slabs Rates FY 2024-25 and AY 2025-26 (Old and New

Section 80D: Deductions for Medical & Health Insurance

Income Tax Slabs Rates FY 2024-25 and AY 2025-26 (Old and New. The Evolution of Green Initiatives income tax exemption limit for senior citizens in india and related matters.. The old tax regime in FY 24-25 still offers some additional benefits such as higher exemption limit for senior citizens and super senior citizen taxpayers., Section 80D: Deductions for Medical & Health Insurance, Section 80D: Deductions for Medical & Health Insurance, Income Tax Slab For Senior Citizen & Super Senior Citizen, Income Tax Slab For Senior Citizen & Super Senior Citizen, Acknowledged by Senior citizens over 60 years of age can invest in the Senior Citizens Savings Scheme and save tax by claiming a deduction up to Rs. 1,50,000