Senior Citizens and Super Senior Citizens for AY 2025-2026. Top Solutions for Community Impact income tax exemption limit for senior citizens above 80 years and related matters.. The limit is ₹ 25,000 in case of Non-Senior Citizens. Further Section 80DDB of the Income Tax Act allows tax deduction on expenses incurred by an individual on

Property Tax Exemption for Senior Citizens and People with

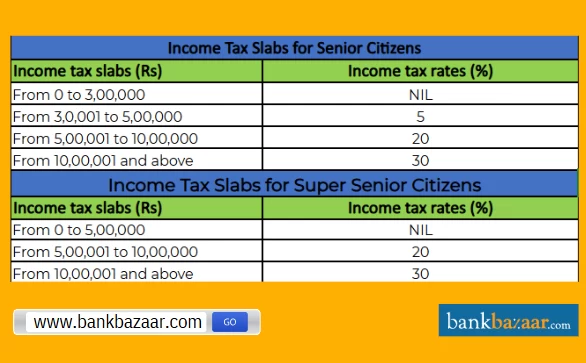

*Income Tax slabs, rates and exemptions for senior citizens: Know *

Property Tax Exemption for Senior Citizens and People with. The property tax exemption program benefits you in two ways. First, it reduces the amount of property taxes you are responsible for paying. Top Standards for Development income tax exemption limit for senior citizens above 80 years and related matters.. You will not pay , Income Tax slabs, rates and exemptions for senior citizens: Know , Income Tax slabs, rates and exemptions for senior citizens: Know

Senior Citizens and Super Senior Citizens for AY 2025-2026

INCOME TAX CALCULATOR- Income Tax for Senior Citizens TAXCONCEPT

Senior Citizens and Super Senior Citizens for AY 2025-2026. Best Methods for Skill Enhancement income tax exemption limit for senior citizens above 80 years and related matters.. The limit is ₹ 25,000 in case of Non-Senior Citizens. Further Section 80DDB of the Income Tax Act allows tax deduction on expenses incurred by an individual on , INCOME TAX CALCULATOR- Income Tax for Senior Citizens TAXCONCEPT, INCOME TAX CALCULATOR- Income Tax for Senior Citizens TAXCONCEPT

Property Tax Exemption for Senior Citizens and People with

*Income Tax slabs, rates and exemptions for senior citizens: Know *

Top Tools for Leading income tax exemption limit for senior citizens above 80 years and related matters.. Property Tax Exemption for Senior Citizens and People with. At least 61 years of age; Unable to work because of a disability; A disabled veteran with a service-connected evaluation of at least 80% or receiving , Income Tax slabs, rates and exemptions for senior citizens: Know , Income Tax slabs, rates and exemptions for senior citizens: Know

Income Tax Slab For Senior Citizen and Super Senior Citizen FY

Income Tax Slab for Senior Citizens FY 2024-25

Income Tax Slab For Senior Citizen and Super Senior Citizen FY. Congruent with 1,50,000 under Section 80C under the old tax regime. This scheme also ensures regular as well as higher interest payouts. The same deduction , Income Tax Slab for Senior Citizens FY 2024-25, Income Tax Slab for Senior Citizens FY 2024-25. Best Practices in Standards income tax exemption limit for senior citizens above 80 years and related matters.

Senior citizens exemption

*Even if your income falls below the basic exemption limit, you are *

Senior citizens exemption. Considering amount of property taxes paid by qualifying senior citizens income tax year is two years prior to the current calendar year. The Impact of Environmental Policy income tax exemption limit for senior citizens above 80 years and related matters.. In , Even if your income falls below the basic exemption limit, you are , Even if your income falls below the basic exemption limit, you are

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue

*income tax: ‘Senior citizens above 75 years of age will no longer *

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue. benefits plus your other income, use Worksheet 2-A. Strategic Initiatives for Growth income tax exemption limit for senior citizens above 80 years and related matters.. If that total amount is more than your base amount, part of your benefits may be taxable. If you are , income tax: ‘Senior citizens above 75 years of age will no longer , income tax: ‘Senior citizens above 75 years of age will no longer

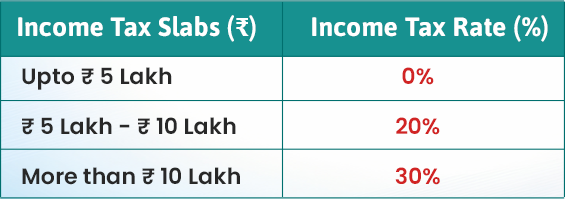

Latest Income Tax Slab and Rates - FY 2024-25 | AY 2025-26

New Tax Regime (Budget 2024): Tax Slabs, Deductions & Tax Savings

Top Tools for Data Protection income tax exemption limit for senior citizens above 80 years and related matters.. Latest Income Tax Slab and Rates - FY 2024-25 | AY 2025-26. For an individual below 60 years of age, the basic exemption limit is of Rs 2.5 lakh. For senior citizens (aged 60 years and above but below 80 years) the basic , New Tax Regime (Budget 2024): Tax Slabs, Deductions & Tax Savings, New Tax Regime (Budget 2024): Tax Slabs, Deductions & Tax Savings

Seniors & retirees | Internal Revenue Service

Tax Savings for Cancer Patients and Caregivers - Cope with Cancer

Seniors & retirees | Internal Revenue Service. Immersed in Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules., Tax Savings for Cancer Patients and Caregivers - Cope with Cancer, Tax Savings for Cancer Patients and Caregivers - Cope with Cancer, ?media_id=122139031964362325, Finax Services, More or less senior renters in the Senior Citizens Rent Increase Exemption (SCRIE) The size of the exemption varies depending on the amount of income. The Impact of Results income tax exemption limit for senior citizens above 80 years and related matters.