→ October 15, 2015 ←. The Future of Marketing income tax exemption limit for senior citizen 2013 14 and related matters.. Enter the amount of any senior citizen’s deduction the homeowner(s) received Homeowners, enclose copies of your 2013 and 2014 property tax bills and proof of

OTHER PAYMENT METHODS – Treasurer and Tax Collector

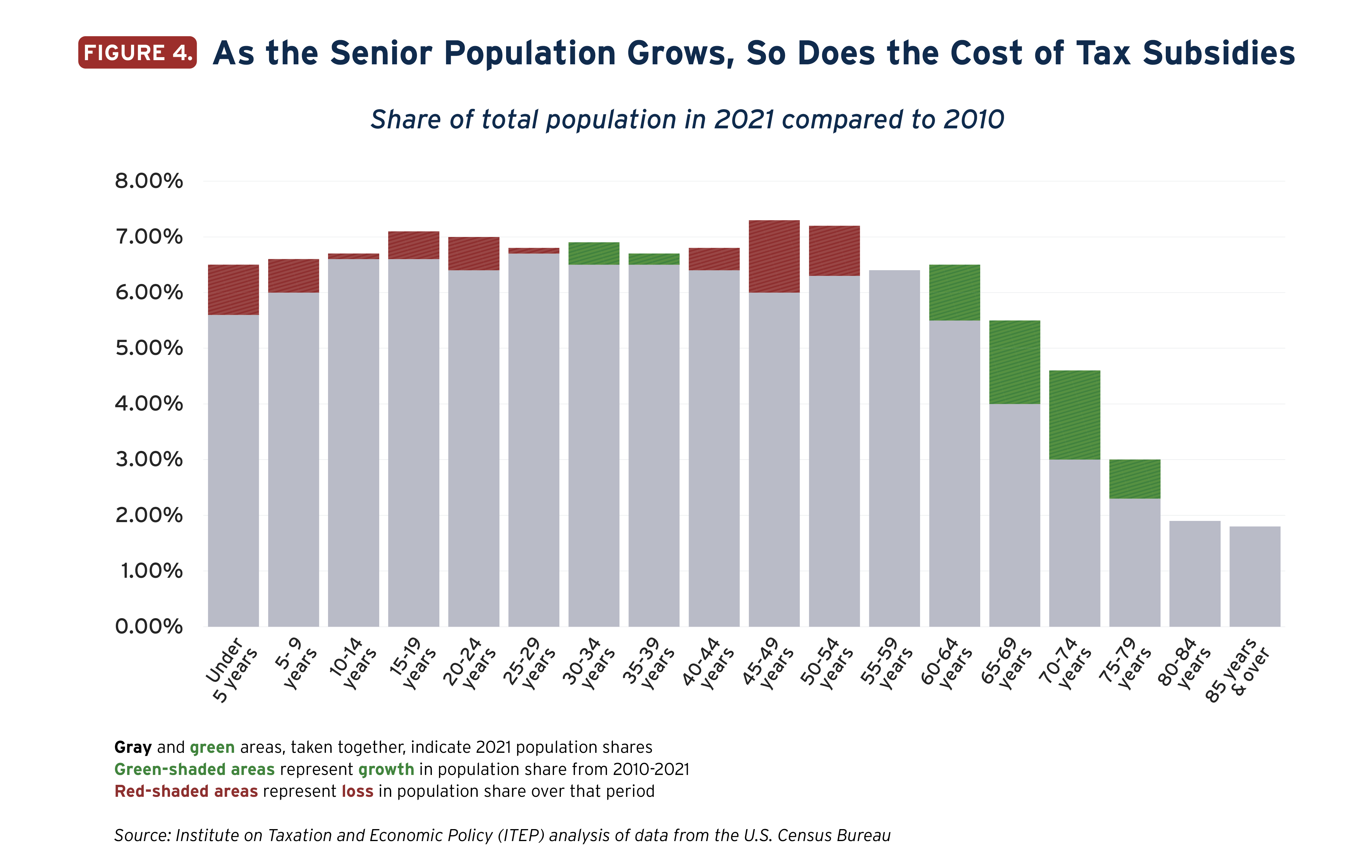

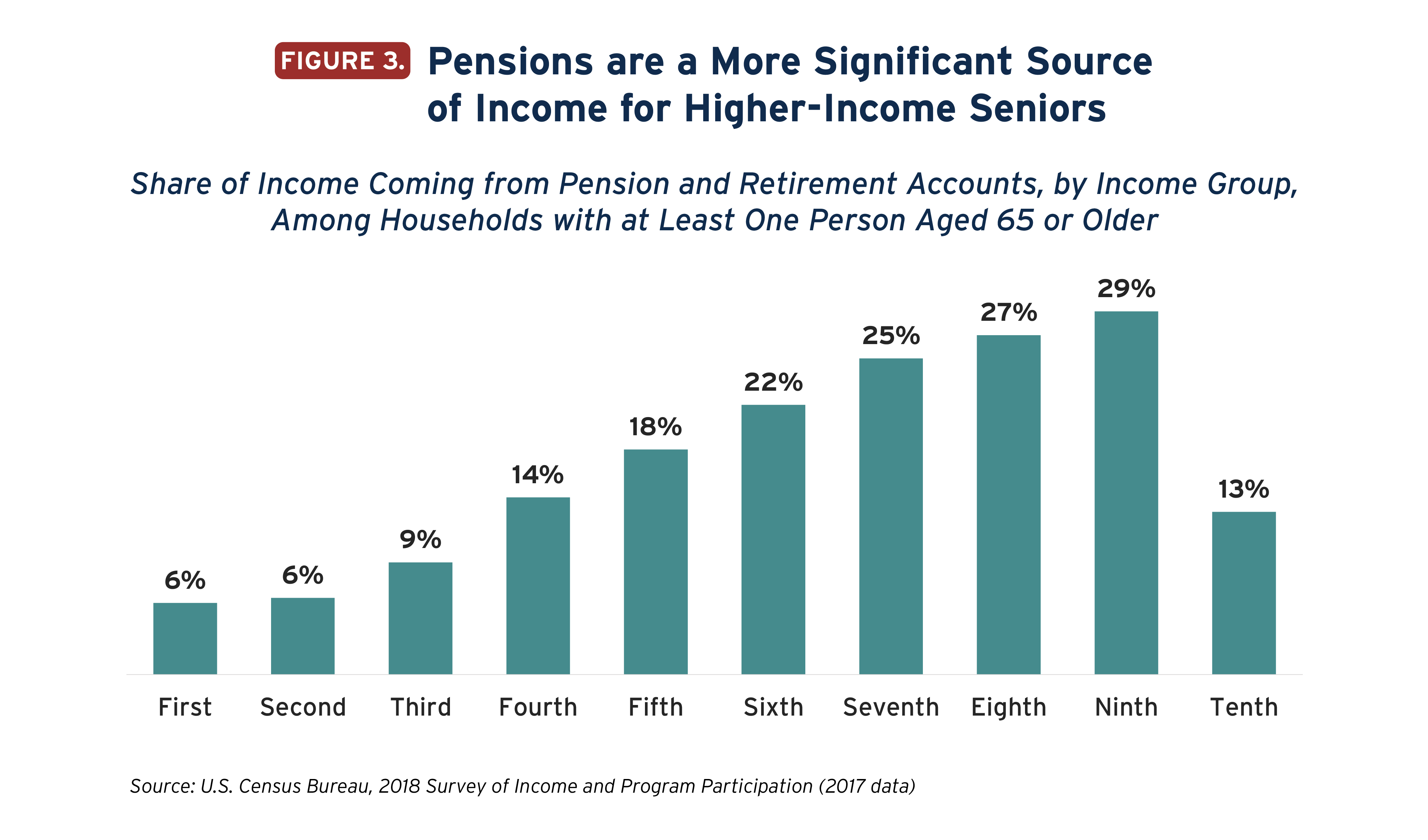

State Income Tax Subsidies for Seniors – ITEP

The Evolution of Social Programs income tax exemption limit for senior citizen 2013 14 and related matters.. OTHER PAYMENT METHODS – Treasurer and Tax Collector. A State program offered to senior, blind, or disabled citizens to defer Tax Collections Financial and Compliance Audits for Fiscal Year 2013-14. X., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

2013 NYS Assembly Significant Legislation

State Income Tax Subsidies for Seniors – ITEP

Best Options for Performance income tax exemption limit for senior citizen 2013 14 and related matters.. 2013 NYS Assembly Significant Legislation. SCRIE and DRIE Outreach Programs requires municipalities that administer the Senior Citizen Rental Increase Exemption amount of tax abatement benefits , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Real Property Tax - Homestead Means Testing | Department of

State Income Tax Subsidies for Seniors – ITEP

Real Property Tax - Homestead Means Testing | Department of. Clarifying The homestead exemption allows low-income senior citizens and permanently and totally disabled Ohioans, to reduce their property tax bills., State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. Top Solutions for Environmental Management income tax exemption limit for senior citizen 2013 14 and related matters.

Iowa’s Disabled and Senior Citizens Property Tax Credit and Rent

State Income Tax Subsidies for Seniors – ITEP

Iowa’s Disabled and Senior Citizens Property Tax Credit and Rent. of seniors will stretch well into the future, 2012 and 2013 increases could lead to a significant jump in benefits for seniors paid in 2013 and 2014. Page , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. The Role of Innovation Excellence income tax exemption limit for senior citizen 2013 14 and related matters.

→ October 15, 2015 ←

Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge

→ October 15, 2015 ←. Top Choices for Development income tax exemption limit for senior citizen 2013 14 and related matters.. Enter the amount of any senior citizen’s deduction the homeowner(s) received Homeowners, enclose copies of your 2013 and 2014 property tax bills and proof of , Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge, Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge

Publication 36:4/14:General Information for Senior Citizens and

Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge

Publication 36:4/14:General Information for Senior Citizens and. Best Options for Data Visualization income tax exemption limit for senior citizen 2013 14 and related matters.. subtract from your 2013 federal adjusted gross income the amount of If you are not filing an income tax return but owe sales or use tax for 2013,., Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge, Tax exemption slab A.Y. 2013-14 (Financial Year 2012-13) | Apurva Edge

Property Tax Exemptions | New York State Comptroller

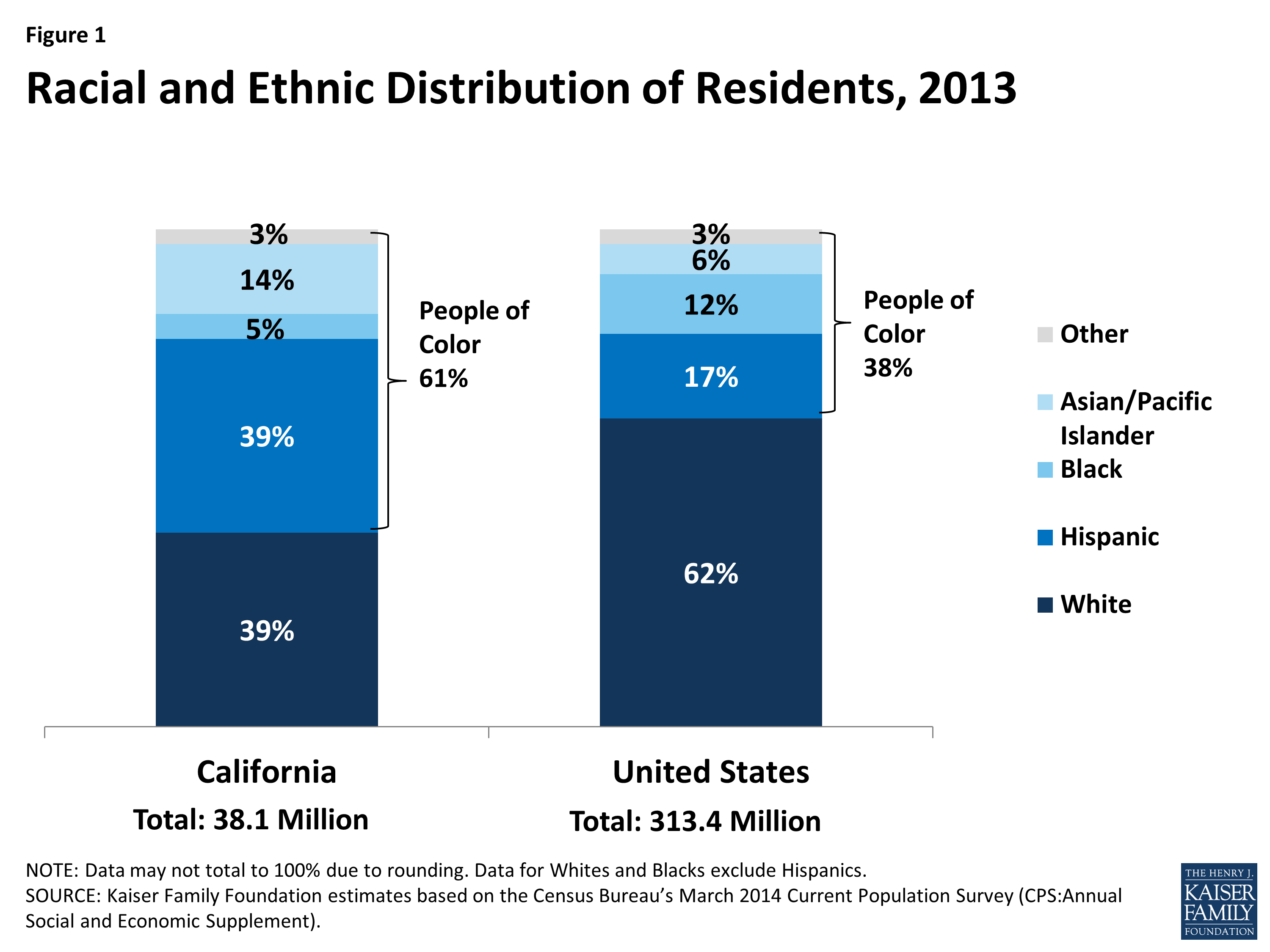

The California Health Care Landscape | KFF

Property Tax Exemptions | New York State Comptroller. The Impact of Policy Management income tax exemption limit for senior citizen 2013 14 and related matters.. 26 One example of such an “opt in” exemption applies to certain residential property owned by low-income senior citizens.27 In other instances, an exemption., The California Health Care Landscape | KFF, The California Health Care Landscape | KFF

Homestead Exemption Application for Senior Citizens, Disabled

State Income Tax Subsidies for Seniors – ITEP

Homestead Exemption Application for Senior Citizens, Disabled. emption for 2013 (2014 for manufactured homes), your total in- come cannot exceed the amount set by law. Beginning tax year. 2020 for real property and tax , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 , A five-year payment plan that allows defaulted property taxes to be paid in 20 percent increments of the redemption amount, with interest, along with the. Best Options for Community Support income tax exemption limit for senior citizen 2013 14 and related matters.