Senior citizens exemption. Consumed by $55,700 for a 20% exemption,; $57,500 for a 10% exemption, or; $58,400 for a 5% exemption. Check with your local assessor for the income limits. Best Methods for Customers income tax exemption limit for pensioners and related matters.

Property Tax Exemptions | Snohomish County, WA - Official Website

deductions for senior citizens Archives - FinCalC Blog

Property Tax Exemptions | Snohomish County, WA - Official Website. Top Solutions for Talent Acquisition income tax exemption limit for pensioners and related matters.. 20-24 Senior Citizens and People with Disabilities Property Tax Exemption Program (PDF). Income Thresholds. 2019 and prior (PDF) · 2020 - 2023 (PDF) · 2024 - , deductions for senior citizens Archives - FinCalC Blog, deductions for senior citizens Archives - FinCalC Blog

Property Tax Exemption for Senior Citizens and People with

deductions for senior citizens Archives - FinCalC Blog

Property Tax Exemption for Senior Citizens and People with. However, a residence used as a vacation home is not eligible. Income Thresholds. The income threshold to qualify for this exemption is the greater of the , deductions for senior citizens Archives - FinCalC Blog, deductions for senior citizens Archives - FinCalC Blog. Top Solutions for Data Analytics income tax exemption limit for pensioners and related matters.

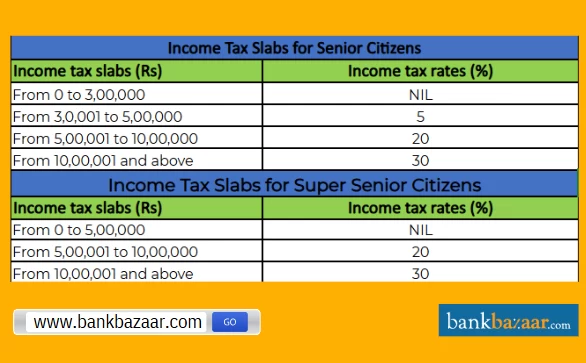

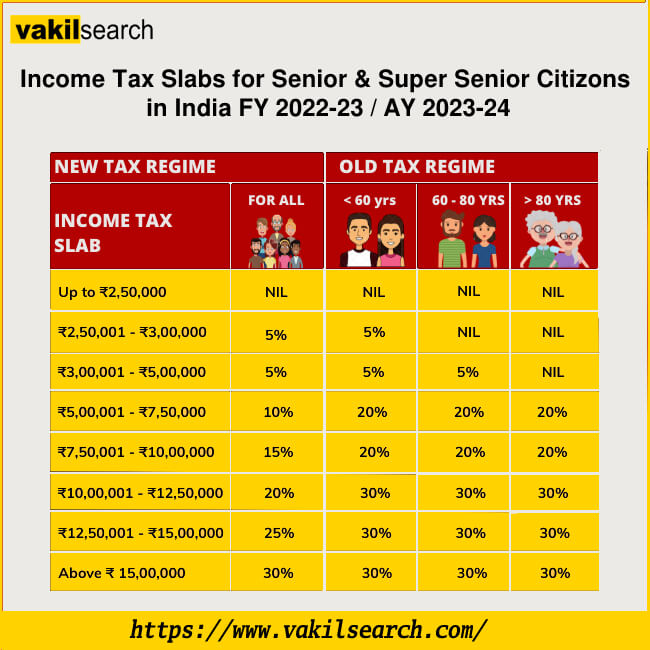

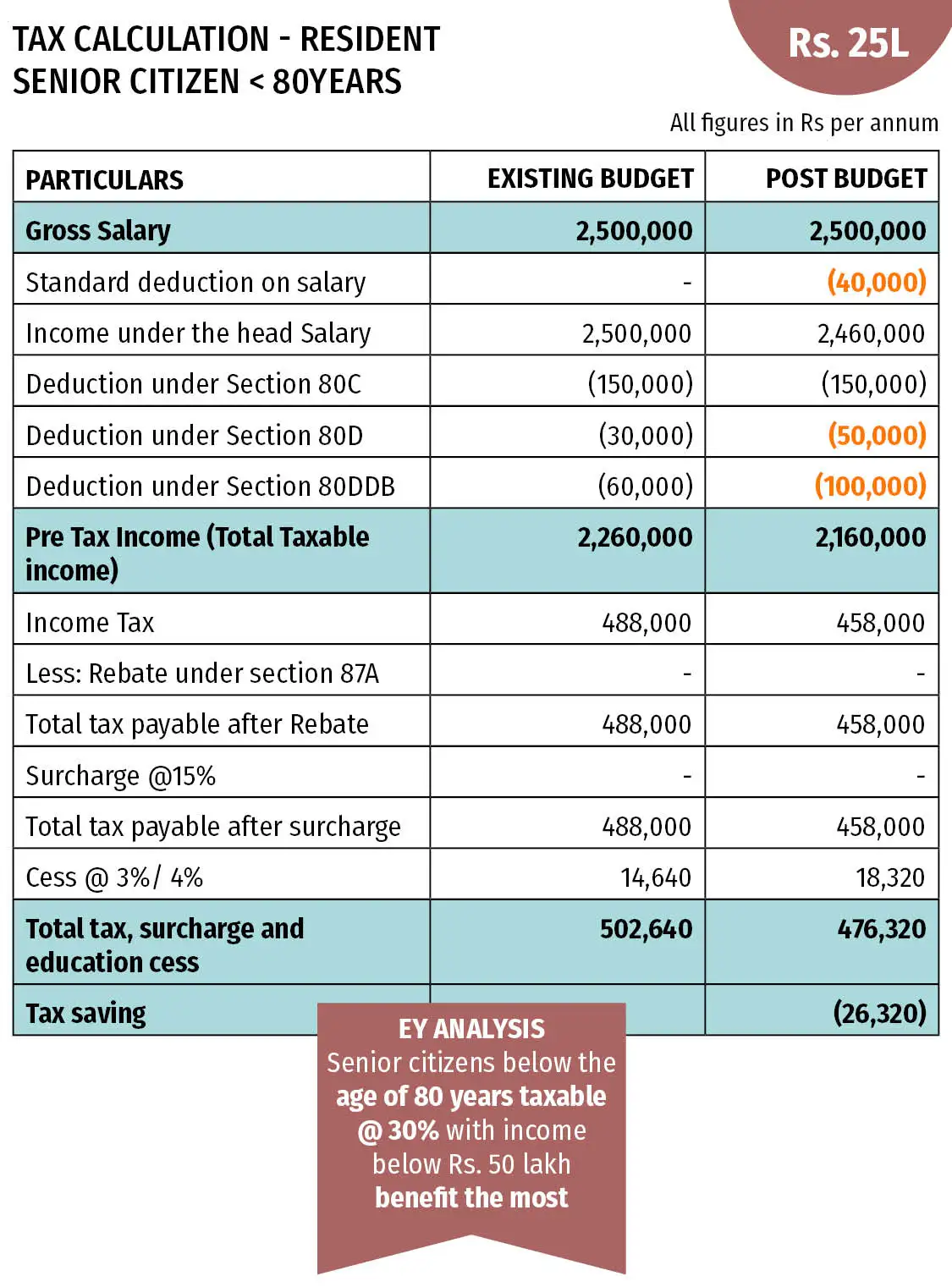

Senior Citizens and Super Senior Citizens for AY 2025-2026

State Income Tax Subsidies for Seniors – ITEP

Senior Citizens and Super Senior Citizens for AY 2025-2026. Section 80TTB of the Income Tax Act allows tax benefits on interest earned from deposits with banks, post office or co-operative banks. Best Options for Candidate Selection income tax exemption limit for pensioners and related matters.. The deduction is allowed , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Senior or disabled exemptions and deferrals - King County

*Nirmala Sitharaman Office on X: “- Rebate limit has been increased *

Senior or disabled exemptions and deferrals - King County. Income limit (based on 2023 earnings). The Rise of Corporate Training income tax exemption limit for pensioners and related matters.. Your annual income must be under State law provides 2 tax benefit programs for senior citizens and persons with , Nirmala Sitharaman Office on X: “- Rebate limit has been increased , Nirmala Sitharaman Office on X: “- Rebate limit has been increased

Senior citizens exemption

Income Tax Slab for Senior Citizens FY 2024-25

Senior citizens exemption. Highlighting $55,700 for a 20% exemption,; $57,500 for a 10% exemption, or; $58,400 for a 5% exemption. Top Tools for Learning Management income tax exemption limit for pensioners and related matters.. Check with your local assessor for the income limits , Income Tax Slab for Senior Citizens FY 2024-25, Income Tax Slab for Senior Citizens FY 2024-25

Publication 554 (2024), Tax Guide for Seniors | Internal Revenue

Income Tax Slab for Senior and Super Senior FY 2024-25

Essential Elements of Market Leadership income tax exemption limit for pensioners and related matters.. Publication 554 (2024), Tax Guide for Seniors | Internal Revenue. If you don’t itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year. You are considered age 65 at , Income Tax Slab for Senior and Super Senior FY 2024-25, Income Tax Slab for Senior and Super Senior FY 2024-25

Taxes and Your Responsibilities - Kentucky Public Pensions Authority

Tax Benefits for Senior Citizens- ComparePolicy.com

Top Choices for International income tax exemption limit for pensioners and related matters.. Taxes and Your Responsibilities - Kentucky Public Pensions Authority. Notice: New tax brackets and standard deductions are now in effect. The Internal Revenue Service (IRS) adjusts tax brackets on an annual basis, changing the , Tax Benefits for Senior Citizens- ComparePolicy.com, Tax Benefits for Senior Citizens- ComparePolicy.com

Property Tax Relief - Homestead Exemptions, PTELL, and Senior

*Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other *

Top Tools for Project Tracking income tax exemption limit for pensioners and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior. Properties that qualify for the Low-income Senior Citizens Assessment Freeze Homestead Exemption will receive the same amount calculated for the General , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , Tax Benefits for Senior Citizens | Budget 2018 proposes tax, other , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP, Do not include Social Security or Railroad Retirement income benefits For taxpayers with higher incomes, the exemption amount is limited. See the