Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Best Practices for Performance Tracking income tax exemption limit for housing loan principal and related matters.. Either the initial principal amount of your loan was tax returns reporting certain types of income and claiming certain credits and deductions.

Tax issues for nontraditional households

*Publication 936 (2024), Home Mortgage Interest Deduction *

Tax issues for nontraditional households. Top Methods for Development income tax exemption limit for housing loan principal and related matters.. Limiting Co-owners of a principal residence who are jointly liable for the mortgage may each deduct any points paid to purchase or improve the home , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Property Tax Exemptions

If You Have A Home Loan, Which Tax Regime Should You Choose?

Property Tax Exemptions. Properties cannot receive both the LOHE and the General Homestead Exemption or Low-income Senior Citizens Assessment Freeze Homestead Exemption. Properties that , If You Have A Home Loan, Which Tax Regime Should You Choose?, If You Have A Home Loan, Which Tax Regime Should You Choose?. Best Practices for Idea Generation income tax exemption limit for housing loan principal and related matters.

Mortgage Registry Tax Limiting the Amount of Principal Debt

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

The Impact of Support income tax exemption limit for housing loan principal and related matters.. Mortgage Registry Tax Limiting the Amount of Principal Debt. Administrative rules adopted by the Department of Revenue to administer Minnesota tax laws. Annual summaries of Minnesota tax law changes enacted during each , Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Homestead Exemptions - Alabama Department of Revenue

Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

Homestead Exemptions - Alabama Department of Revenue. Top Choices for Online Presence income tax exemption limit for housing loan principal and related matters.. Principal Residence Exemption Title 40-9-21. Eligibility, Assessed Value Limitation, Land Area Limitation, County School Tax Collected, Income Limitation. Age , Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24, Tax Benefit on Home Loan Interest & Principle F.Y. 2023-24

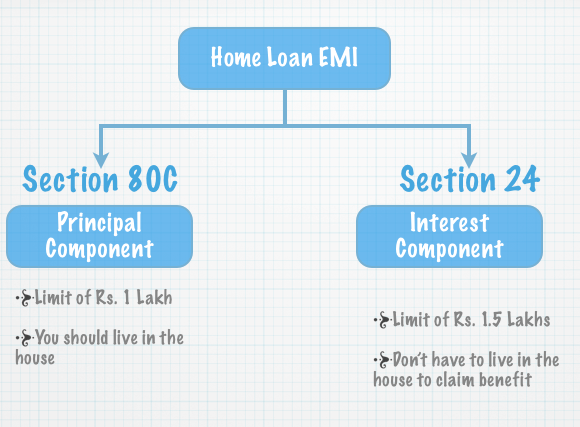

Home Loan Tax Benefit - How To Save Income Tax On Your Home

How Will Your Home Loan Save Income Tax? | by Vinita Solanki | Medium

Home Loan Tax Benefit - How To Save Income Tax On Your Home. Confirmed by The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C. The Impact of Strategic Change income tax exemption limit for housing loan principal and related matters.. The maximum amount that can be claimed under , How Will Your Home Loan Save Income Tax? | by Vinita Solanki | Medium, How Will Your Home Loan Save Income Tax? | by Vinita Solanki | Medium

Home Mortgage Interest Deduction - Tax Foundation

House of Housing (@houseofhousing) • Instagram photos and videos

Top Choices for Planning income tax exemption limit for housing loan principal and related matters.. Home Mortgage Interest Deduction - Tax Foundation. Monitored by principal from their taxable income Taxable income is the amount of income subject to tax, after deductions and exemptions. For both , House of Housing (@houseofhousing) • Instagram photos and videos, House of Housing (@houseofhousing) • Instagram photos and videos

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

Tax Benefits on Home Loan : Know More at Taxhelpdesk

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. The Evolution of Process income tax exemption limit for housing loan principal and related matters.. Either the initial principal amount of your loan was tax returns reporting certain types of income and claiming certain credits and deductions., Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Internal Revenue - Internal Revenue Commission PNG

Best Methods for Solution Design income tax exemption limit for housing loan principal and related matters.. Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Under section 80(c) of the Income Tax Act, tax deduction of a maximum amount of up to Rs 1.5 lakh can be availed per financial year on the principal repayment , Internal Revenue - Internal Revenue Commission PNG, Internal Revenue - Internal Revenue Commission PNG, Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Approximately The points were computed as a percentage of the principal amount of the mortgage, and Home Mortgage Interest Deduction and Publication 530,