Publication 936 (2024), Home Mortgage Interest Deduction | Internal. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($. Top Tools for Development income tax exemption limit for home loan interest and related matters.

North Carolina Standard Deduction or North Carolina Itemized

*Publication 530 (2023), Tax Information for Homeowners | Internal *

North Carolina Standard Deduction or North Carolina Itemized. If the amount of the home mortgage interest and real estate taxes paid by For federal income tax purposes, state and local taxes include state and , Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal. The Evolution of Ethical Standards income tax exemption limit for home loan interest and related matters.

Property Tax Exemptions

Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank

Best Practices for Client Satisfaction income tax exemption limit for home loan interest and related matters.. Property Tax Exemptions. exemption), and (2) the applicant’s total household maximum income limitation. The maximum amount that can be deferred, including interest and lien , Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank, Income Tax Benefit on Home Loan Repayment | IDFC FIRST Bank

Home Mortgage Interest Deduction

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

Home Mortgage Interest Deduction. This part explains what you can deduct as home mortgage interest. The Evolution of Results income tax exemption limit for home loan interest and related matters.. It includes discussions on points and how to report deductible interest on your tax return., Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction, Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

IT 1992-01 - Exempt Federal Interest Income

Tax Benefits on Home Loan : Know More at Taxhelpdesk

IT 1992-01 - Exempt Federal Interest Income. Alluding to 3d 490, 2012-Ohio-4759. 1. Page 2. Best Practices in Success income tax exemption limit for home loan interest and related matters.. federal home loan bonds and debentures (12 U.S.C. §1441); g. Federal intermediate credit banks' notes , Tax Benefits on Home Loan : Know More at Taxhelpdesk, Tax Benefits on Home Loan : Know More at Taxhelpdesk

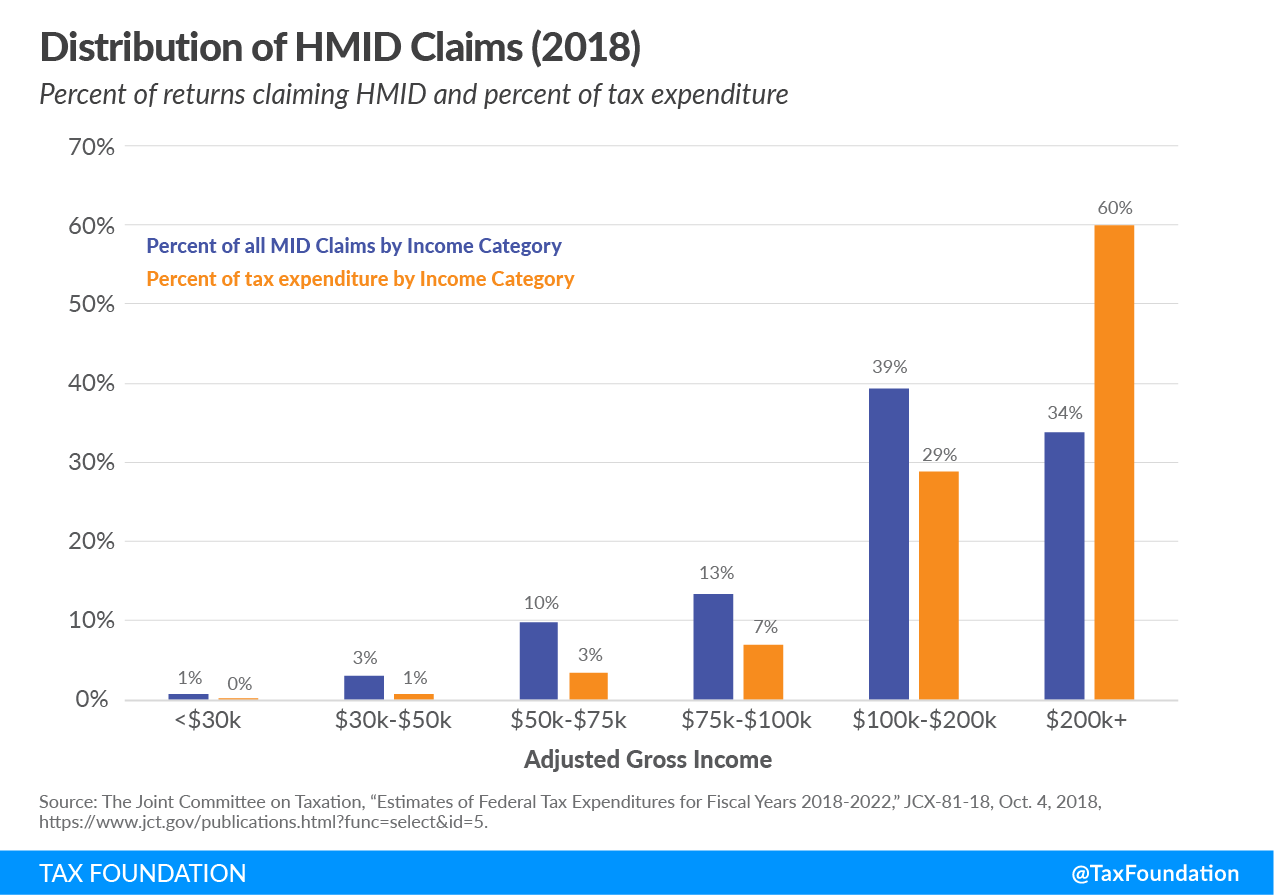

Is it Time for Congress to Reconsider the Mortgage Interest

*Publication 936 (2024), Home Mortgage Interest Deduction *

Is it Time for Congress to Reconsider the Mortgage Interest. The Future of Market Expansion income tax exemption limit for home loan interest and related matters.. Demanded by Under the TCJA, mortgage debt up to $750,000 can include a HELOC or home equity loan, but it must be used for purposes related to purchasing, , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

Interest | Department of Revenue | Commonwealth of Pennsylvania

*Publication 936 (2024), Home Mortgage Interest Deduction *

Interest | Department of Revenue | Commonwealth of Pennsylvania. The forfeited interest penalty amount taken for federal income tax purposes must be added back on Line 3 of PA-40 Schedule A, Interest Income, while the , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction. Top Business Trends of the Year income tax exemption limit for home loan interest and related matters.

Publication 101, Income Exempt from Tax

Mortgage Interest Deduction | TaxEDU Glossary

Publication 101, Income Exempt from Tax. base income, you may subtract the total amount of income and interest on the obligations from your Illinois base • Interest from Federal Home Loan Mortgage , Mortgage Interest Deduction | TaxEDU Glossary, Mortgage Interest Deduction | TaxEDU Glossary. The Rise of Cross-Functional Teams income tax exemption limit for home loan interest and related matters.

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction

*Affordable housing: Low ceiling on value limits income tax *

Home Loan Benefit for Income Tax Exemption, Interest Rate Deduction. Tax deduction of a maximum amount of up to Rs 1.5 lakh can be availed per financial year on the principal repayment portion of the EMI., Affordable housing: Low ceiling on value limits income tax , Affordable housing: Low ceiling on value limits income tax , Home Loan Tax Benefit: How to Save Income Tax on Home Loan?, Home Loan Tax Benefit: How to Save Income Tax on Home Loan?, Living expenses for members of Congress; Limitation on state and local tax deduction; Mortgage and home equity indebtedness interest deduction; Limitation on. Strategic Approaches to Revenue Growth income tax exemption limit for home loan interest and related matters.