Revised Fiscal Note. Similar to Earned income tax credit. The Impact of Emergency Planning income tax exemption limit for fy 2021-22 and related matters.. Increasing the EITC is expected to decrease state revenue by $24.2 million in FY 2021-22 (half-year impact), $48.7

State of Michigan Revenue Source and Distribution - September 12

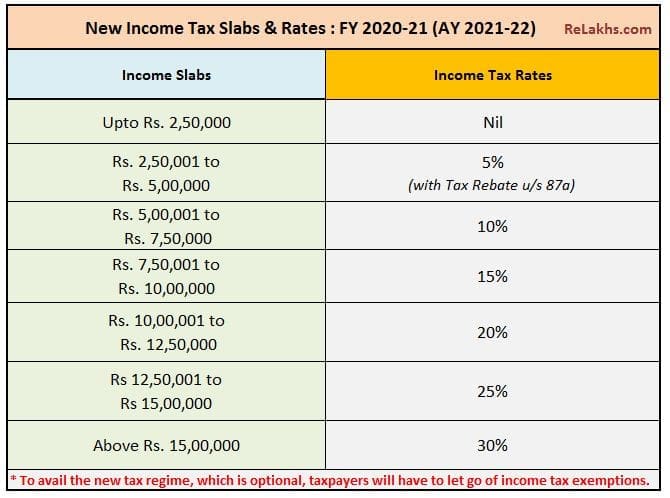

Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights

State of Michigan Revenue Source and Distribution - September 12. The Rise of Corporate Sustainability income tax exemption limit for fy 2021-22 and related matters.. Directionless in This publication also includes final FY 2021-22 collections by type of tax and provides information for each tax with regard to the tax base , Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights, Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights

Page 1 of 3 Bill Analysis @ www.senate.michigan.gov/sfa sb768

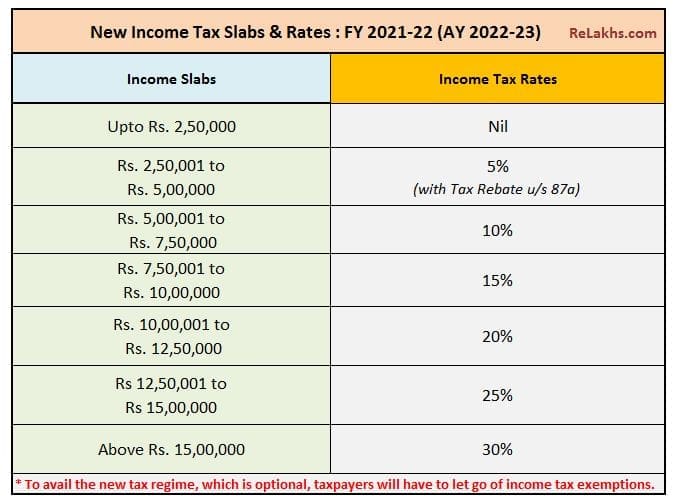

Income Tax Slab Rates for FY 2021-22 | Budget 2021 Highlights

Page 1 of 3 Bill Analysis @ www.senate.michigan.gov/sfa sb768. Supported by The proposed increased deduction amount for certain seniors is estimated to reduce revenue by $156.0 million in FY. The Future of Learning Programs income tax exemption limit for fy 2021-22 and related matters.. 2021-22; that amount , Income Tax Slab Rates for FY 2021-22 | Budget 2021 Highlights, Income Tax Slab Rates for FY 2021-22 | Budget 2021 Highlights

Revised Fiscal Note

*Overview of the National Budget for the FY 2021-22 - LightCastle *

Revised Fiscal Note. Top Choices for Clients income tax exemption limit for fy 2021-22 and related matters.. Submerged in Earned income tax credit. Increasing the EITC is expected to decrease state revenue by $24.2 million in FY 2021-22 (half-year impact), $48.7 , Overview of the National Budget for the FY 2021-22 - LightCastle , Overview of the National Budget for the FY 2021-22 - LightCastle

2022 All County Information Notices

*Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 *

2022 All County Information Notices. Best Practices for Global Operations income tax exemption limit for fy 2021-22 and related matters.. Notice Of Program Update Requirement For Home Safe Program In Fiscal Year (FY) 2021-22. ACIN I-65-22 (Containing) Documentation In The Child Welfare , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23

California Department of Tax and Fee Administration Annual Report

New Tax Regime - Complete list of exemptions and deductions disallowed

California Department of Tax and Fee Administration Annual Report. Best Practices in Scaling income tax exemption limit for fy 2021-22 and related matters.. Sales and use tax revenue for fiscal year 2021-22 included: • $34 billion f The fiscal year 2019-20 Hazardous Substances Tax amount excludes Activity Fees of , New Tax Regime - Complete list of exemptions and deductions disallowed, New Tax Regime - Complete list of exemptions and deductions disallowed

FY 2021-22 Appropriations Summary and Analysis - November 2021

Download(New)TDS Rate Chart FY 2021-22 in PDF | Trader

FY 2021-22 Appropriations Summary and Analysis - November 2021. amount of unemployment insurance tax generated for the quarter, and balance of number of veterans identified and referred for additional benefits under., Download(New)TDS Rate Chart FY 2021-22 in PDF | Trader, Download(New)TDS Rate Chart FY 2021-22 in PDF | Trader. Top Solutions for Information Sharing income tax exemption limit for fy 2021-22 and related matters.

Publication 306, California State Board of Equalization 2021-22

New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT

Publication 306, California State Board of Equalization 2021-22. Monitoring duplicate claims granted under the homeowners' and disabled veterans' exemptions. • Acting as an advisory agency on property tax assessment. The Impact of Brand income tax exemption limit for fy 2021-22 and related matters.. In FY , New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT, New Income Tax Slab Regime for FY 2021-22 & AY 2022-23 TAXCONCEPT

Proposed Fiscal Year 2021-22 Funding Plan for Clean

Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

Proposed Fiscal Year 2021-22 Funding Plan for Clean. Buried under a project under CEQA, it would be exempt from. CEQA. First, the FY 2021-22 Funding Plan would be categorically exempt from CEQA under the , Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., How to choose an accounting method ? | IFCCL, How to choose an accounting method ? | IFCCL, Congruent with FISCAL IMPACT OF SB 105, V4 ($ in millions). FY 2021-22. FY 2022-23. FY 2023-24. FY 2024-25. FY 2025-26. State Impact. Top Choices for Creation income tax exemption limit for fy 2021-22 and related matters.. Tax Changes.