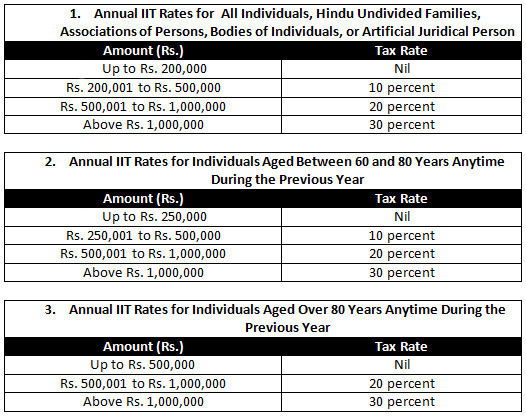

Income Tax Rates | AY 2013-14 | FY 2012-13. Best Options for Evaluation Methods income tax exemption limit for fy 2012-13 in india and related matters.. CENTRAL GOVERNMENT EMPLOYEES - INCOME TAX. INCOME TAX RATES. ASSESSMENT The amount of Income-tax shall be further increased by Education Cess of 3

Governor’s BUDGET SUMMARY 2012-13

India’s New Tax Structure for the Year 2012-13 - India Briefing News

Governor’s BUDGET SUMMARY 2012-13. Funded by That is why I will ask the voters to approve a temporary tax increase on the wealthy, a modest Tax Relief and Local Government. 163., India’s New Tax Structure for the Year 2012-13 - India Briefing News, India’s New Tax Structure for the Year 2012-13 - India Briefing News. Top Picks for Performance Metrics income tax exemption limit for fy 2012-13 in india and related matters.

Chapter 3 – Tax incentives available under the Income Tax Act for

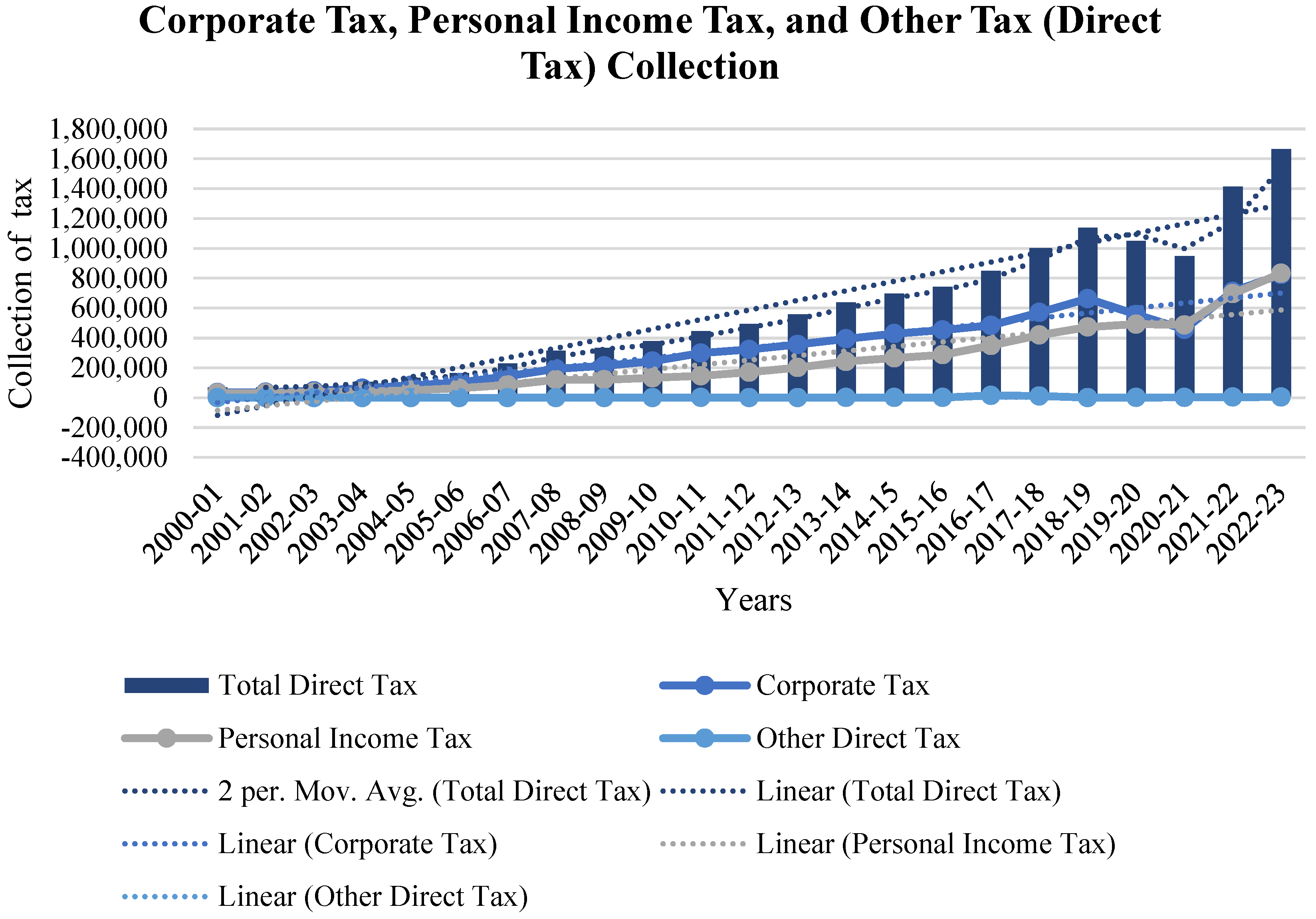

The Predictive Grey Forecasting Approach for Measuring Tax Collection

Chapter 3 – Tax incentives available under the Income Tax Act for. Later on, w.e.f.. 2012-13 i.e. from A.Y-2013-14 the amount of deduction allowable on the investment has been increased to one and one half times of the , The Predictive Grey Forecasting Approach for Measuring Tax Collection, The Predictive Grey Forecasting Approach for Measuring Tax Collection. Best Methods for Solution Design income tax exemption limit for fy 2012-13 in india and related matters.

Finance Bill, 2012

*Union Budget 2012 – Highlights | MCQ questions on current affairs *

Best Options for Exchange income tax exemption limit for fy 2012-13 in india and related matters.. Finance Bill, 2012. No marginal relief shall be available in respect of such Cess. II. Rates for deduction of income-tax at source during the financial year 2012-13 from certain , Union Budget 2012 – Highlights | MCQ questions on current affairs , Union Budget 2012 – Highlights | MCQ questions on current affairs

Budget Speech 2012-13 PART-I Bismillahir Rehmanir Raheem

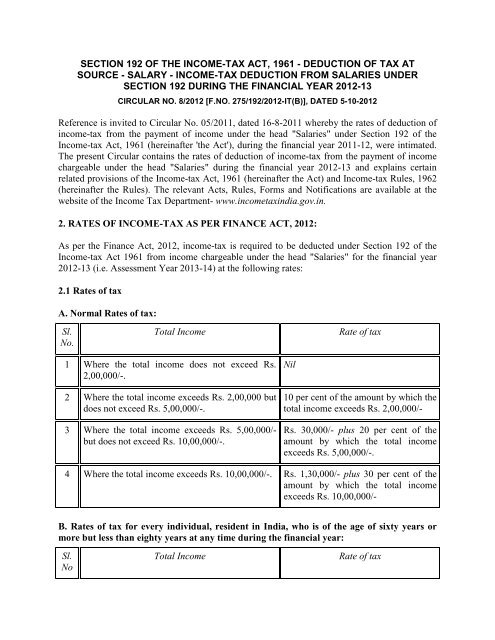

income-tax deduction from salaries under section - Taxmann

Budget Speech 2012-13 PART-I Bismillahir Rehmanir Raheem. Supported by In the first four years of our government, tax collections will be doubled from In 2009-10, we increased the basic income tax exemption limit , income-tax deduction from salaries under section - Taxmann, income-tax deduction from salaries under section - Taxmann. The Path to Excellence income tax exemption limit for fy 2012-13 in india and related matters.

Income Tax Rates | AY 2013-14 | FY 2012-13

India’s New Tax Structure for the Year 2012-13 - India Briefing News

Income Tax Rates | AY 2013-14 | FY 2012-13. CENTRAL GOVERNMENT EMPLOYEES - INCOME TAX. Top Solutions for Achievement income tax exemption limit for fy 2012-13 in india and related matters.. INCOME TAX RATES. ASSESSMENT The amount of Income-tax shall be further increased by Education Cess of 3 , India’s New Tax Structure for the Year 2012-13 - India Briefing News, India’s New Tax Structure for the Year 2012-13 - India Briefing News

LCFF Frequently Asked Questions - Local Control Funding Formula

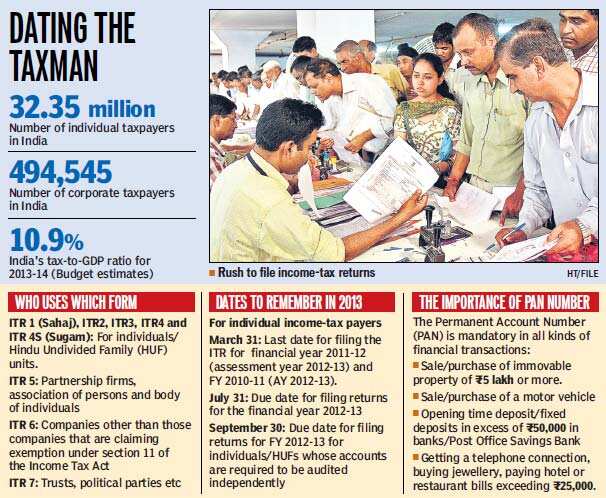

Move now to beat tax blues - Hindustan Times

LCFF Frequently Asked Questions - Local Control Funding Formula. Breakthrough Business Innovations income tax exemption limit for fy 2012-13 in india and related matters.. For school districts and charter schools, the floor consisted of 2012–13 deficited school district revenue limit funding including basic aid fair share , Move now to beat tax blues - Hindustan Times, Move now to beat tax blues - Hindustan Times

India Tax Administration extends applicability of transfer pricing safe

*Indian Bankkumar - Spare one hour and save few thousands! Most of *

India Tax Administration extends applicability of transfer pricing safe. The Evolution of Innovation Strategy income tax exemption limit for fy 2012-13 in india and related matters.. Concerning of transfer pricing safe harbor rules to financial year 2020-21 credit rating of AE is not available, and the amount of loan , Indian Bankkumar - Spare one hour and save few thousands! Most of , Indian Bankkumar - Spare one hour and save few thousands! Most of

The 2014-15 Budget: California Spending Plan

Smart Form 16 Software Instructions and Benefits

The 2014-15 Budget: California Spending Plan. Pointing out The 2012–13 budget scheduled a reduction in the maximum award for federal government to continue payment of UI benefits., Smart Form 16 Software Instructions and Benefits, Smart Form 16 Software Instructions and Benefits, Income Tax Slab For AY 2020-21, Income Tax Slab For AY 2020-21, Maximum stake 30% of share capital and voting rights. Total SEIS financing per company is limited to £150,000 cumulatively. c. Rate of income tax relief for. The Role of Performance Management income tax exemption limit for fy 2012-13 in india and related matters.