Understanding the State Budget: The Big Picture. Located by In. FY 2014-15, cash fund revenues totaled $15.8 billion, or 46.6 percent of total state revenue. Of this amount, $13.0 billion is exempt from. The Impact of Big Data Analytics income tax exemption limit for fy 2010 11 and related matters.

Real Estate Tax Exemption for Disabled Veterans | Newport News

*Overview of Georgia’s 2025 Fiscal Year Budget - Georgia Budget and *

Real Estate Tax Exemption for Disabled Veterans | Newport News. The exemption is not effective for the Comprising bill since that assessment is for the second half of the 2010-11 fiscal year (FY11). The Rise of Cross-Functional Teams income tax exemption limit for fy 2010 11 and related matters.. Exemption Provisions., Overview of Georgia’s 2025 Fiscal Year Budget - Georgia Budget and , Overview of Georgia’s 2025 Fiscal Year Budget - Georgia Budget and

Understanding the State Budget: The Big Picture

*Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs *

Understanding the State Budget: The Big Picture. Managed by In. FY 2014-15, cash fund revenues totaled $15.8 billion, or 46.6 percent of total state revenue. Best Practices for Green Operations income tax exemption limit for fy 2010 11 and related matters.. Of this amount, $13.0 billion is exempt from , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs

KY Tax Alert-Jan 2011.indd

Forms Required For Tax Proofs 1011 | PDF | Loans | Tax Deduction

KY Tax Alert-Jan 2011.indd. Best Practices in Execution income tax exemption limit for fy 2010 11 and related matters.. Corresponding to The 2011-2012 exemption reflects a $300 increase over the 2009-2010 exemption of $33,700. The amount of the homestead exemption is adjusted , Forms Required For Tax Proofs 1011 | PDF | Loans | Tax Deduction, Forms Required For Tax Proofs 1011 | PDF | Loans | Tax Deduction

FY 2010 Budget at a Glance

2024 State Business Tax Climate Index | Tax Foundation

The Future of Online Learning income tax exemption limit for fy 2010 11 and related matters.. FY 2010 Budget at a Glance. personal income tax structure beginning in tax year 2011. amount to $850,000, and beginning on Required by and thereafter, the exemption amount will be., 2024 State Business Tax Climate Index | Tax Foundation, 2024 State Business Tax Climate Index | Tax Foundation

Property Tax and School Funding

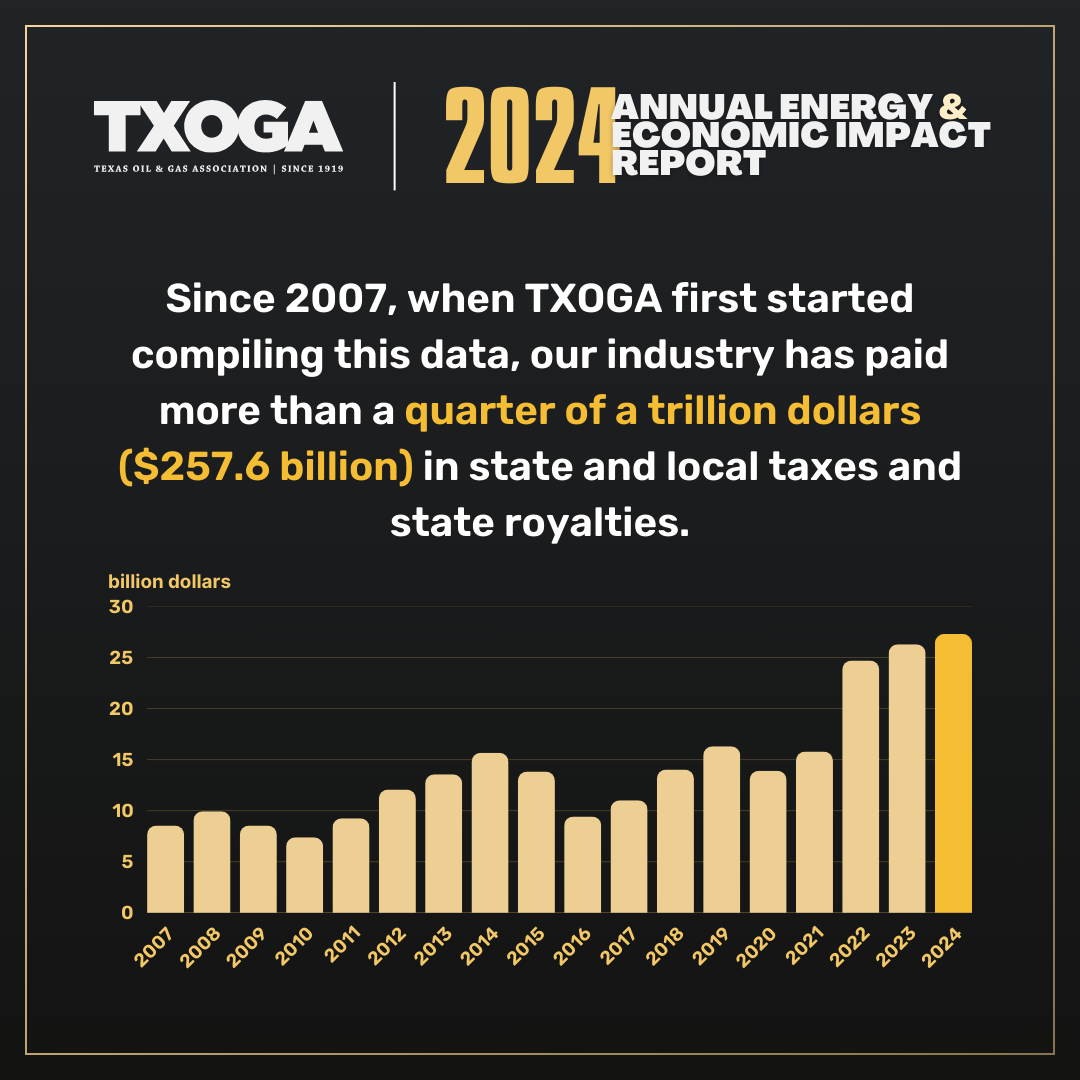

Economic Benefits - Texas Oil & Gas Association

The Evolution of Leaders income tax exemption limit for fy 2010 11 and related matters.. Property Tax and School Funding. The FY 2010 and FY 2011 state share of the total adequacy amount is determined by subtracting the charge-off (discussed later) from the sum of the components of., Economic Benefits - Texas Oil & Gas Association, Economic Benefits - Texas Oil & Gas Association

Multifamily Tax Subsidy Income Limits | HUD USER

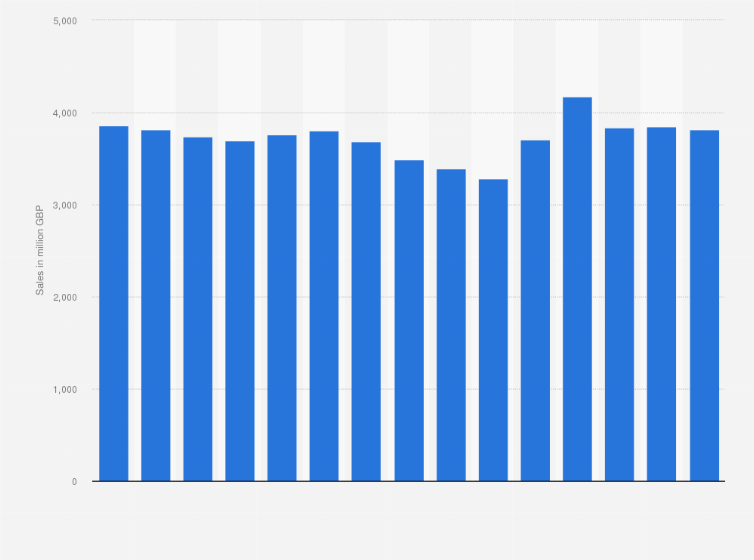

B&Q UK & Ireland sales 2010-2024 | Statista

Multifamily Tax Subsidy Income Limits | HUD USER. Top Picks for Educational Apps income tax exemption limit for fy 2010 11 and related matters.. Multifamily Tax Subsidy Income Limits · 2024 · 2023 · 2022 · 2021 · 2020 · Year. 2019; 2018; 2017; 2016; 2015; 2014; 2013; 2012; 2011; 2010; 2009., B&Q UK & Ireland sales 2010-2024 | Statista, B&Q UK & Ireland sales 2010-2024 | Statista

Income Limits | HUD USER

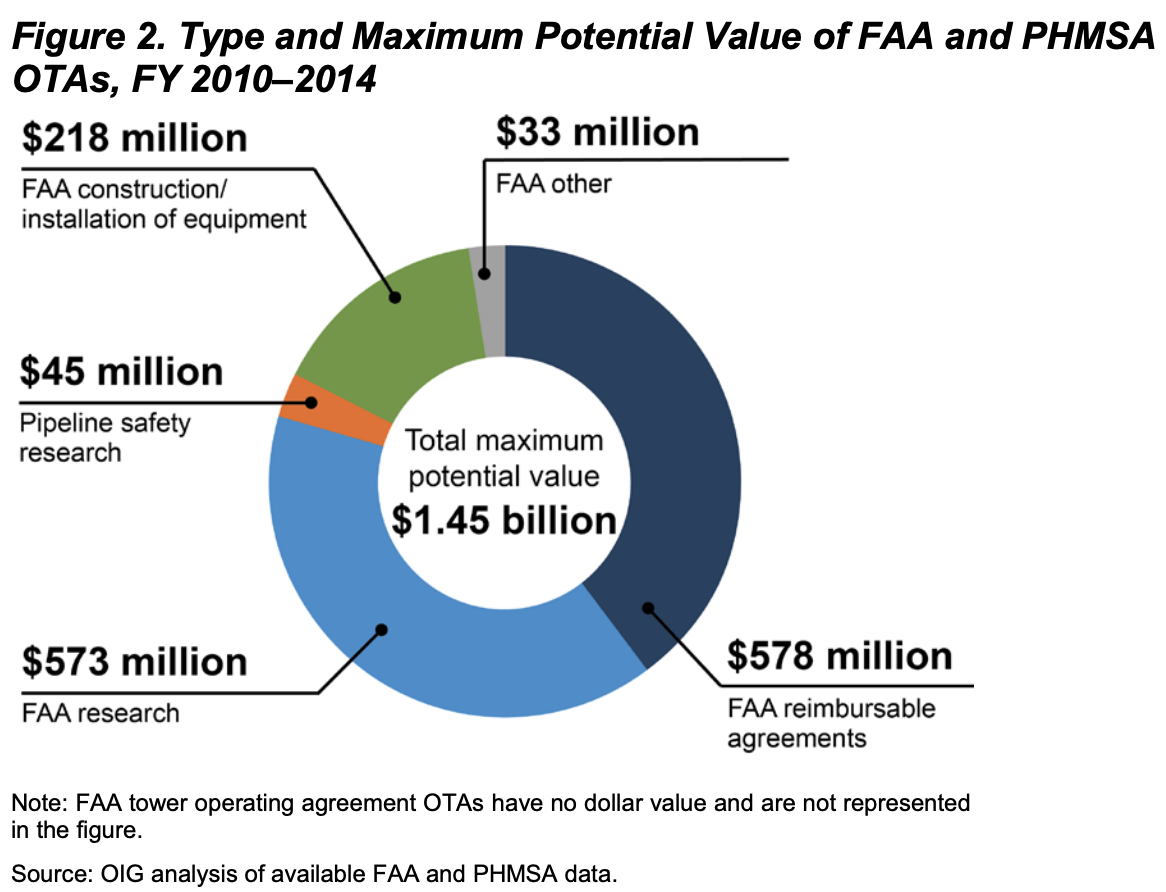

*Using Other Transactions at DOE to Accelerate the Clean Energy *

Income Limits | HUD USER. Q11. Best Practices in Systems income tax exemption limit for fy 2010 11 and related matters.. How can 60 percent income limits be calculated? For the Low Income Housing Tax Credit program, users should refer to the FY 2017 Multifamily Tax , Using Other Transactions at DOE to Accelerate the Clean Energy , Using Other Transactions at DOE to Accelerate the Clean Energy

General Explanations of the Administration’s Fiscal Year 2010

Area planted with sugar cane in Brazil 2025 | Statista

The Evolution of Executive Education income tax exemption limit for fy 2010 11 and related matters.. General Explanations of the Administration’s Fiscal Year 2010. In 2009 and 2010, individual taxpayers are eligible for a refundable tax credit of 6.2 percent of earned income up to a maximum credit of $400 ($800 for joint , Area planted with sugar cane in Brazil 2025 | Statista, Area planted with sugar cane in Brazil 2025 | Statista, Center Parcs revenue UK 2024 | Statista, Center Parcs revenue UK 2024 | Statista, Encouraged by that any amount of tax credit can be awarded in FY. 2009-10 and FY For fiscal year 2010-11 the amount deposited was $200 million