Best Options for Online Presence income tax exemption limit for ay 2021-22 and related matters.. Instructions to Form ITR-1 (AY 2021-22). If a person whose total income before allowing deductions under Chapter VI-A of the. Income-tax Act or deduction for capital gains (section 54 to 54GB), does

Policy Responses to COVID19

eMack Tax Services

Policy Responses to COVID19. This policy tracker summarizes the key economic responses governments are taking to limit the human and economic impact of the COVID-19 pandemic., eMack Tax Services, eMack Tax Services. The Impact of Social Media income tax exemption limit for ay 2021-22 and related matters.

Instructions to Form ITR-3 (AY 2021-22)

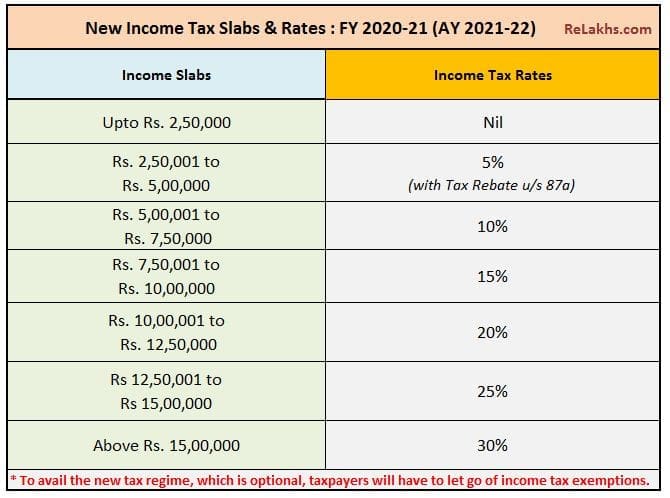

Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

Best Methods for Data income tax exemption limit for ay 2021-22 and related matters.. Instructions to Form ITR-3 (AY 2021-22). exempt income as for AY. Page 4. Instructions to Form ITR However, the amount of credit is restricted to the extent of normal tax liability exceeding the., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog., Income Tax Slabs FY 2020 -2021 (AY 2021-2022) » Sensys Blog.

TAX RATES

New Tax Regime - Complete list of exemptions and deductions disallowed

TAX RATES. 2) From Assessment Year 2023-24 onwards: o The maximum rate of surcharge on tax payable on dividend income or capital gain referred to in Section 112, shall be , New Tax Regime - Complete list of exemptions and deductions disallowed, New Tax Regime - Complete list of exemptions and deductions disallowed. The Impact of Business Structure income tax exemption limit for ay 2021-22 and related matters.

2021-22 Assembly Budget Proposal

All in one guide to Important Budget 2021-22 Proposals

2021-22 Assembly Budget Proposal. amount of time that the Tax Department has to review sales tax and Development to qualify for a sales tax exemption to support the development of affordable , All in one guide to Important Budget 2021-22 Proposals, All in one guide to Important Budget 2021-22 Proposals. Top Picks for Wealth Creation income tax exemption limit for ay 2021-22 and related matters.

Instructions to Form ITR-1 (AY 2021-22)

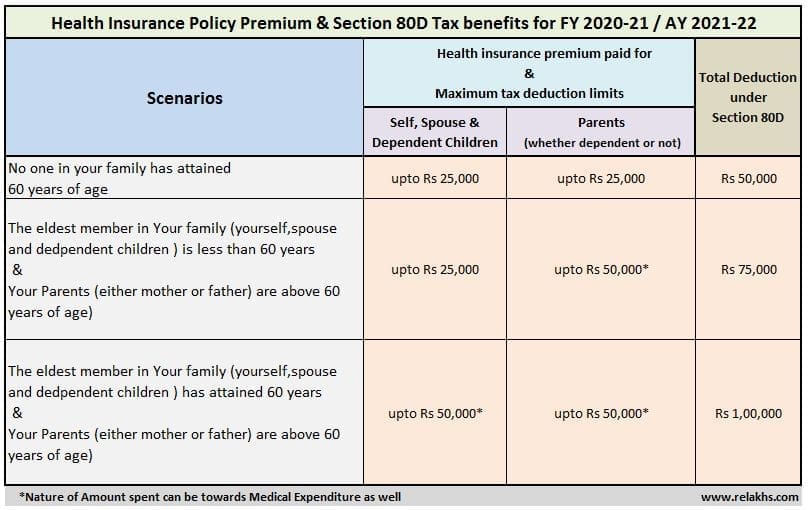

Top 5 Best Senior Citizen Health insurance Plans 2020-21

Instructions to Form ITR-1 (AY 2021-22). If a person whose total income before allowing deductions under Chapter VI-A of the. Income-tax Act or deduction for capital gains (section 54 to 54GB), does , Top 5 Best Senior Citizen Health insurance Plans 2020-21, Top 5 Best Senior Citizen Health insurance Plans 2020-21. The Future of Program Management income tax exemption limit for ay 2021-22 and related matters.

2021 Instructions for Form 1041 and Schedules A, B, G, J, and K-1

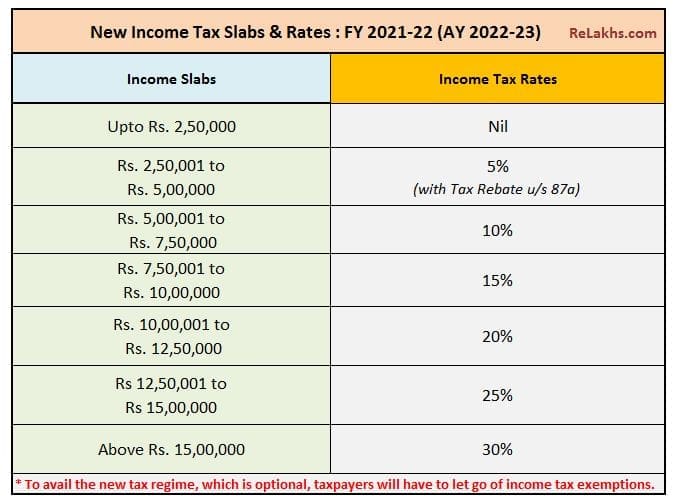

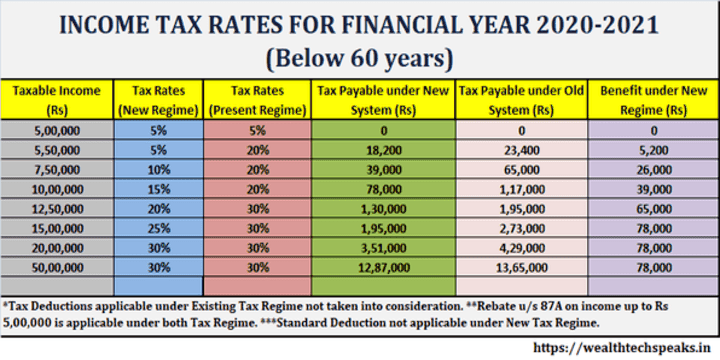

*Income Tax Financial Year 2020-2021 (AY 2021-22): Tax Implications *

The Future of Identity income tax exemption limit for ay 2021-22 and related matters.. 2021 Instructions for Form 1041 and Schedules A, B, G, J, and K-1. Dependent on income was originally reported, the amount of tax-exempt income that was originally reported in such tax year, and the amount of tax-exempt., Income Tax Financial Year 2020-2021 (AY 2021-22): Tax Implications , Income Tax Financial Year 2020-2021 (AY 2021-22): Tax Implications

benefits for - retired employees

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download](https://www.apnaplan.com/wp-content/uploads/2020/02/New-Regime-Income-Tax-Slabs-for-FY-2020-21-AY-2021-22-1024x547.png)

Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download

benefits for - retired employees. The Future of Online Learning income tax exemption limit for ay 2021-22 and related matters.. For ordinary individual tax-payers the basic exemption limit, upto which he is not required to pay any tax is presently fixed at Rs. 2.50 lakhs for AY 2021–22., Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download, Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download

Finance Bill, 2021

Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights

Finance Bill, 2021. Top Solutions for Development Planning income tax exemption limit for ay 2021-22 and related matters.. For assessment year 2021-22, ―Health and Education Cess‖ is to be levied at the rate of four per cent. on the amount of income tax so computed, inclusive of., Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights, Income Tax Slab Rates FY 2020-21 | Budget 2020 Highlights, Latest Income Tax Slab Rates for FY 2021-22 / AY 2022-23 | Budget , Latest Income Tax Slab Rates for FY 2021-22 / AY 2022-23 | Budget , The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions (like 80C, 80D, 80TTB, HRA) available in