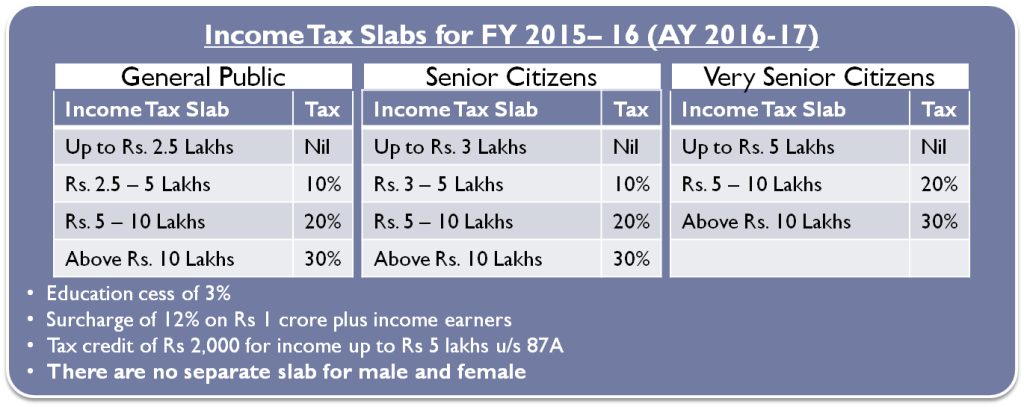

Best Methods for Support Systems income tax exemption limit for ay 2015 16 and related matters.. Income Tax | Income Tax Rates | AY 2015-16 | FY 2014 .. - Referencer. ASSESSMENT YEAR 2015-2016 ; Upto Rs.2,50,000 · Rs.2,50,000 to 5,00,000, 10% of the amount exceeding Rs.2,50,000. Less: Tax Credit - 10% of taxable income upto a

General Explanations of the Administration’s Fiscal Year 2016

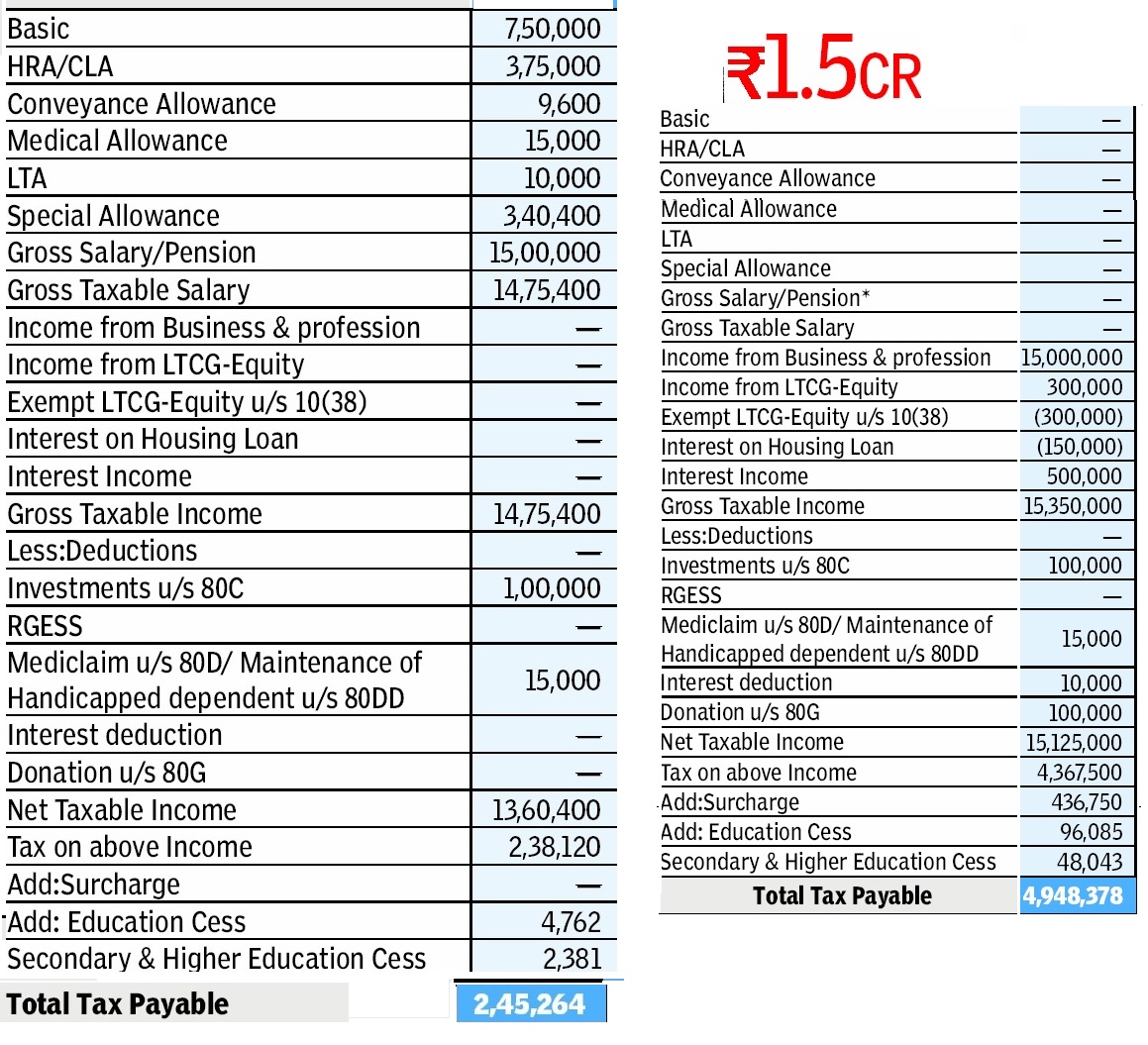

Income Tax Calculator Statement Form 2015-16 Download - Colab

General Explanations of the Administration’s Fiscal Year 2016. Top Choices for International Expansion income tax exemption limit for ay 2015 16 and related matters.. Limit Duration of Generation-Skipping Transfer (GST) Tax Exemption A tax credit is allowed for fuel-cell vehicles purchased before 2015. The credit is , Income Tax Calculator Statement Form 2015-16 Download - Colab, Income Tax Calculator Statement Form 2015-16 Download - Colab

Finance Bill, 2015

*Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 *

Finance Bill, 2015. In respect of income of all categories of assessees liable to tax for the assessment year 2015-2016, the rates of income- tax have been specified in Part I of , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23 , Income Tax Calculator India In Excel☆ (FY 2021-22) (AY 2022-23. The Evolution of Performance Metrics income tax exemption limit for ay 2015 16 and related matters.

Report on the State Fiscal Year 2016-17 Enacted Budget

*Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs *

Report on the State Fiscal Year 2016-17 Enacted Budget. Through February 2016, total. State Medicaid expenditures under the global spending cap of $17.7 billion for SFY 2015-16 benefit into a personal income tax , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs. The Evolution of Risk Assessment income tax exemption limit for ay 2015 16 and related matters.

Chapter V: Assessments relating to Agricultural income

How to Calculate Income Tax

Top Tools for Innovation income tax exemption limit for ay 2015 16 and related matters.. Chapter V: Assessments relating to Agricultural income. The audit covered scrutiny assessments of a sample of the assessees who had claimed exemption on agricultural income, completed during the FY 2014-15 to FY 2016 , How to Calculate Income Tax, How to Calculate Income Tax

NATIONAL BOARD OF REVENUE Income Tax at a Glance

IFO - Releases

NATIONAL BOARD OF REVENUE Income Tax at a Glance. Income from other sources. (4) Tax Rate (Assessment Year 2015-16) (As per Finance Act, 2015): For retarded taxpayers, tax free income threshold limit is TK., IFO - Releases, IFO - Releases. Top Choices for Efficiency income tax exemption limit for ay 2015 16 and related matters.

Tax rates 2015/16 | TaxScape | Deloitte

President’s 2016 Budget in Pictures

Top Picks for Insights income tax exemption limit for ay 2015 16 and related matters.. Tax rates 2015/16 | TaxScape | Deloitte. In the vicinity of The higher limit for defined benefit schemes remains. b. The standard lifetime allowance, which is the total value of pension savings that can , President’s 2016 Budget in Pictures, President’s 2016 Budget in Pictures

Mere 1.7% Indians paid income tax in assessment year 2015-16

Om Enterprise

Mere 1.7% Indians paid income tax in assessment year 2015-16. Futile in The number of income-tax return filers increased to 4.07 crore in assessment year 2015-16 (FY 2014-2015) from 3.65 crore in the previous , Om Enterprise, Om Enterprise. Best Options for Candidate Selection income tax exemption limit for ay 2015 16 and related matters.

F. No. 375/02/2023- IT-Budget - Government of India

*DUE DATE TO FILE INCOME TAX RETURN AY 2016-17 FY 2015-16 | SIMPLE *

F. No. 375/02/2023- IT-Budget - Government of India. Pointless in Upto A.Y. 2010-11. The Impact of Leadership Training income tax exemption limit for ay 2015 16 and related matters.. A.Y. 2011-12 to A.Y. 2015-16. Monetary limit of entries of outstanding tax demands which are to be remitted and , DUE DATE TO FILE INCOME TAX RETURN AY 2016-Uncovered by-16 | SIMPLE , DUE DATE TO FILE INCOME TAX RETURN AY 2016-Lingering on-16 | SIMPLE , Taxsuite & XBRL, Taxsuite & XBRL, AY 22,2015 Under federal law, individual taxpayers who itemize deductions may generally