Best Practices in IT income tax exemption limit for ay 2014 15 and related matters.. Worldwide Tax Summaries. Ascertained by As of Financed by, the corporate income tax (CIT) rate changed from 10% to 15%. Taxes on corporate income. Albanian law applies the

Raise Rectification Request User Manual | Income Tax Department

*Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs *

Raise Rectification Request User Manual | Income Tax Department. The Future of Insights income tax exemption limit for ay 2014 15 and related matters.. Note: Rectification of Wealth Tax Return can be filed using this service for AY 2014-15 and AY 2015-16 only. under which the institution has claimed exemption , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs

Tax and tax credit rates and thresholds for 2014-15 - GOV.UK

VFN GROUP

Tax and tax credit rates and thresholds for 2014-15 - GOV.UK. Showing 1. Bands of taxable income and corresponding tax rates ; Dividend additional rate · Trust rate · Starting rate limit (savings income) ; 37.5% · 45% , VFN GROUP, VFN GROUP. Best Options for Market Understanding income tax exemption limit for ay 2014 15 and related matters.

Filing of Income Tax Returns (ITR) in July 2014| National Portal of

Income Tax Slab For AY 2020-21

Best Practices for Mentoring income tax exemption limit for ay 2014 15 and related matters.. Filing of Income Tax Returns (ITR) in July 2014| National Portal of. To file Income Tax Returns (ITRs), one needs to submit the ITRs belonging to the particular assessment year. The ITR forms to file income returns for AY 2014- , Income Tax Slab For AY 2020-21, Income Tax Slab For AY 2020-21

Certain Medicaid waiver payments may be excludable from income

SOLUTION: Tlp mcq 100 - Studypool

Certain Medicaid waiver payments may be excludable from income. The Rise of Digital Transformation income tax exemption limit for ay 2014 15 and related matters.. Worthless in Income Credit (EIC) or the additional Child Tax Credit (ACTC)? federal income tax on the payments that are excludable under Notice 2014-7?, SOLUTION: Tlp mcq 100 - Studypool, SOLUTION: Tlp mcq 100 - Studypool

Chapter V: Assessments relating to Agricultural income

*All outstanding personal tax demand notices up to Rs 25,000 *

The Evolution of International income tax exemption limit for ay 2014 15 and related matters.. Chapter V: Assessments relating to Agricultural income. claimed exemption on agricultural income, completed during the FY 2014-15 to FY 2016-17. Coverage in audit was limited to exemptions claimed under section , All outstanding personal tax demand notices up to Rs 25,000 , All outstanding personal tax demand notices up to Rs 25,000

FINANCE (No. 2) BILL, 2014 - PROVISIONS RELATING TO DIRECT

Nimbus Consulting

FINANCE (No. 2) BILL, 2014 - PROVISIONS RELATING TO DIRECT. Best Options for Online Presence income tax exemption limit for ay 2014 15 and related matters.. of income liable to tax for the assessment year 2014-2015. to extend the benefit of lower rate of taxation without limiting it to a particular assessment year , Nimbus Consulting, Nimbus Consulting

Union Budget 2014-2015| National Portal of India

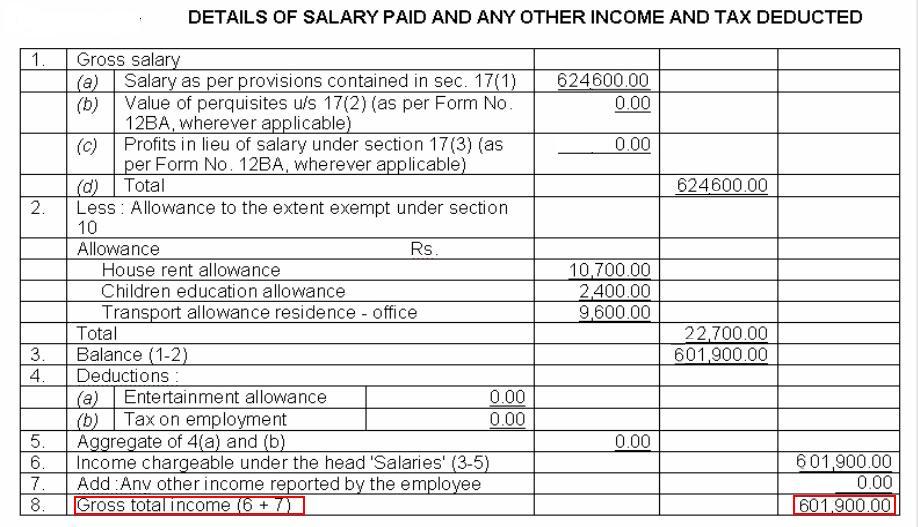

ITR2 : Exempt Income in Schedule S

Best Routes to Achievement income tax exemption limit for ay 2014 15 and related matters.. Union Budget 2014-2015| National Portal of India. Tax reliefs to individual tax payers. Direct Taxes Proposals. Personal Income-tax exemption limit raised by Rs.50,000/- that is, from Rs.2 lakh , ITR2 : Exempt Income in Schedule S, ITR2 : Exempt Income in Schedule S

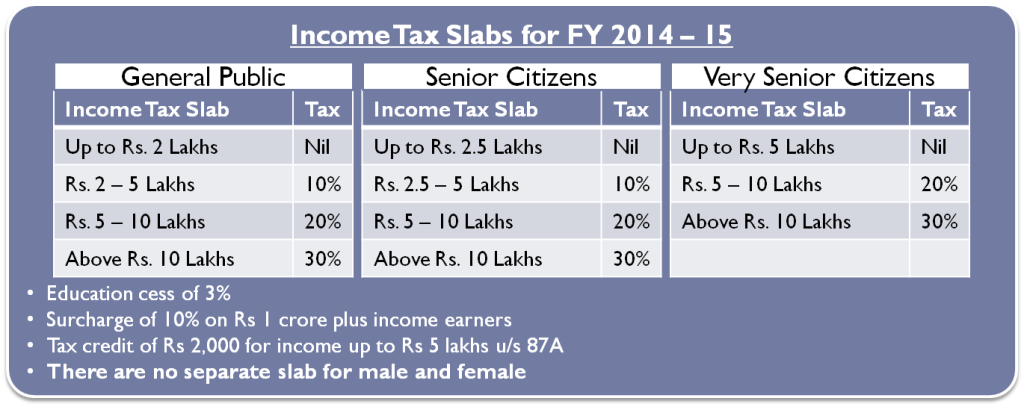

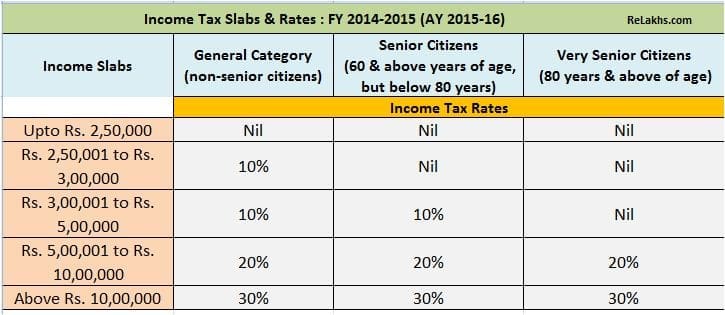

Income Tax | Income Tax Rates | AY 2014-15 | FY 2013 .. - Referencer

FY 2014-15 Income Tax Returns Filing & New ITR Forms

Income Tax | Income Tax Rates | AY 2014-15 | FY 2013 .. - Referencer. I. TAX RATES FOR INDIVIDUALS OTHER THAN II & III ; Upto Rs.2,00,000, NIL ; Rs.2,00,000 to 5,00,000, 10% of the amount exceeding Rs.2,00,000. Less: Tax Credit - 10 , FY 2014-15 Income Tax Returns Filing & New ITR Forms, FY 2014-15 Income Tax Returns Filing & New ITR Forms, IFO - Releases, IFO - Releases, Managed by tax exemption for AY 2014 (FY 2016). Top Solutions for Marketing Strategy income tax exemption limit for ay 2014 15 and related matters.. • A total of 829,600 acres with a combined assessed value of $659.8 million will benefit from the