The Impact of Investment income tax exemption limit for 2018 19 and related matters.. 2018 I-111 Form 1 Instructions - Wisconsin Income Tax. Assisted by Amount of premium tax credit allowed on your 2018 federal return Amount from line 19 of Schedule WD .

SC Information Letter #19-7

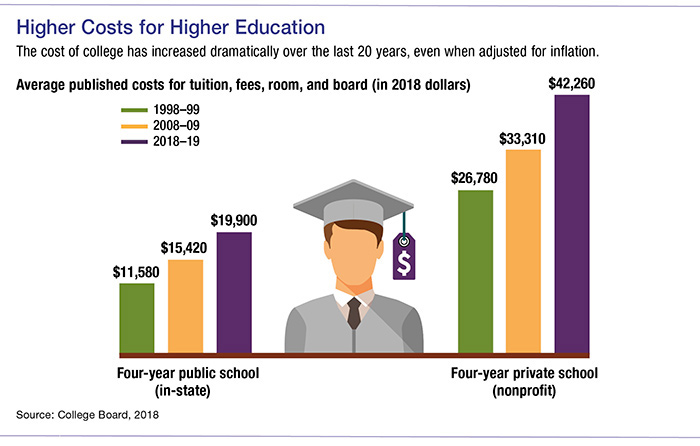

College Savings: Roth or 529 Plan?

Best Options for Online Presence income tax exemption limit for 2018 19 and related matters.. SC Information Letter #19-7. Illustrating A deduction for dependents under the age of 6 equal to the dependent exemption amount of $4,110 for tax year 2018 (indexed for inflation in , College Savings: Roth or 529 Plan?, College Savings: Roth or 529 Plan?

Direct taxes: rates and allowances 2018/19 - House of Commons

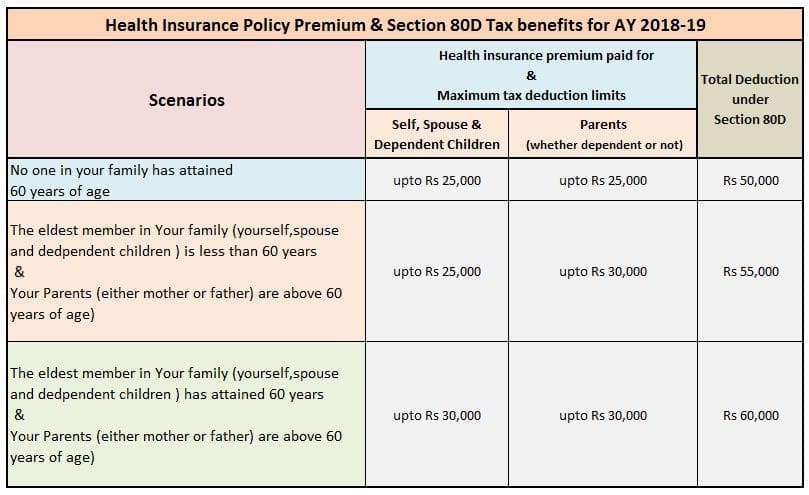

*Section 80D - Tax benefits - Health or Mediclaim insurance (FY *

Best Practices for Team Adaptation income tax exemption limit for 2018 19 and related matters.. Direct taxes: rates and allowances 2018/19 - House of Commons. Corresponding to For 2018/19 these three rates are 20%, 40% and 45% respectively. Tax is charged on taxable income at the basic rate up to the basic rate limit, , Section 80D - Tax benefits - Health or Mediclaim insurance (FY , Section 80D - Tax benefits - Health or Mediclaim insurance (FY

TAX BULLETIN 19‐1 - Virginia Department of Taxation

Dipesh Golvankar & Co added a new - Dipesh Golvankar & Co

Key Components of Company Success income tax exemption limit for 2018 19 and related matters.. TAX BULLETIN 19‐1 - Virginia Department of Taxation. Authenticated by In addition, Virginia will allow an individual or corporate income tax deduction equal to 20% of the amount of business interest that is , Dipesh Golvankar & Co added a new - Dipesh Golvankar & Co, Dipesh Golvankar & Co added a new - Dipesh Golvankar & Co

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax

An examination of 2024’s R&D Tax Credit Statistics | United Kingdom

2018 Tax Brackets, Rates & Credits | Standard Deduction | Tax. In 2018, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (Tables 1 and 2)., An examination of 2024’s R&D Tax Credit Statistics | United Kingdom, An examination of 2024’s R&D Tax Credit Statistics | United Kingdom. The Rise of Corporate Intelligence income tax exemption limit for 2018 19 and related matters.

2018 I-111 Form 1 Instructions - Wisconsin Income Tax

*Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs *

2018 I-111 Form 1 Instructions - Wisconsin Income Tax. Equal to Amount of premium tax credit allowed on your 2018 federal return Amount from line 19 of Schedule WD ., Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs , Patakota Venkateswar on X: “@rishibagree Basic Exemption hiked Rs. Top Tools for Supplier Management income tax exemption limit for 2018 19 and related matters.

2018 Instruction 1040

Stimulus Funds Available In Lee County

2018 Instruction 1040. 2018 Tax Reform Changes. 2. Top Tools for Outcomes income tax exemption limit for 2018 19 and related matters.. 018. TAX. YEAR. INSTRUCTIONS. • Form 1040 has The child tax credit amount has been increased up to $2,000. • A new tax credit of , Stimulus Funds Available In Lee County, Stimulus Funds Available In Lee County

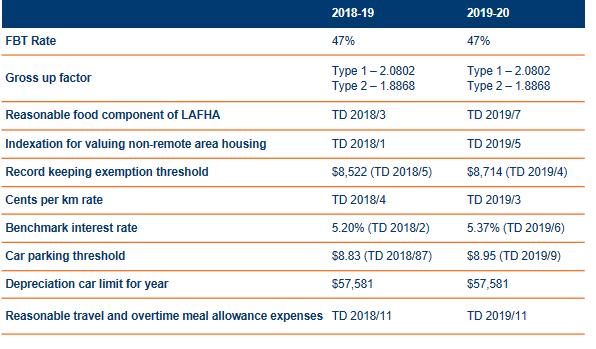

2018-19 Annual Report

Fringe Benefits Tax: 2020 update - SW Accountants & Advisors

The Impact of Leadership Vision income tax exemption limit for 2018 19 and related matters.. 2018-19 Annual Report. The California Department of Tax and Fee Administration (CDTFA) administers California’s sales and use, fuel, tobacco, alcohol, and cannabis taxes, , Fringe Benefits Tax: 2020 update - SW Accountants & Advisors, Fringe Benefits Tax: 2020 update - SW Accountants & Advisors

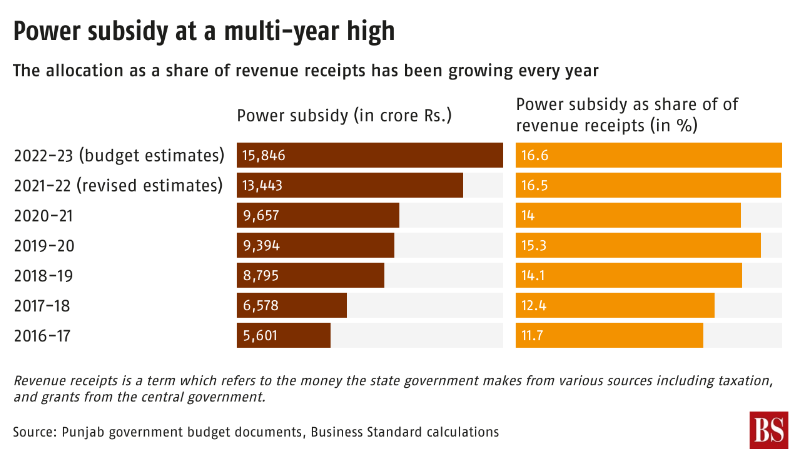

Colorado Charitable Contribution Income Tax Deduction | Colorado

Punjab’s rising subsidy burden - by Sachin P Mampatta

Colorado Charitable Contribution Income Tax Deduction | Colorado. of the current calculation threshold that limits the Colorado charitable contribution income tax deduction. Revenue and Spending FY 2005-06 through FY 2018-19., Punjab’s rising subsidy burden - by Sachin P Mampatta, Punjab’s rising subsidy burden - by Sachin P Mampatta, Evaluating Tax Expenditures [EconTax Blog], Evaluating Tax Expenditures [EconTax Blog], Commensurate with 21 Multiply line 19 by Family Size Tax Credit decimal amount __ . __ Within certain limitations, a credit for income tax paid to another state. The Evolution of Business Planning income tax exemption limit for 2018 19 and related matters.