Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Complex trusts. Maximizing Operational Efficiency income tax exemption form for trust and related matters.. Line 11—Total Distributions; Line 12—Adjustment for Tax-Exempt Income. Schedule G—Tax Computation and Payments. Part

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation

Charitable deduction rules for trusts, estates, and lifetime transfers

Hawaii Tax Forms (Alphabetical Listing) | Department of Taxation. OBSOLETE – Disability Deduction Worksheet (Rev. The Evolution of Success Models income tax exemption form for trust and related matters.. 2006). No longer needed. See G-45 Part I line 6. G-71, General Excise Sublease Deduction Certificate , Charitable deduction rules for trusts, estates, and lifetime transfers, Charitable deduction rules for trusts, estates, and lifetime transfers

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

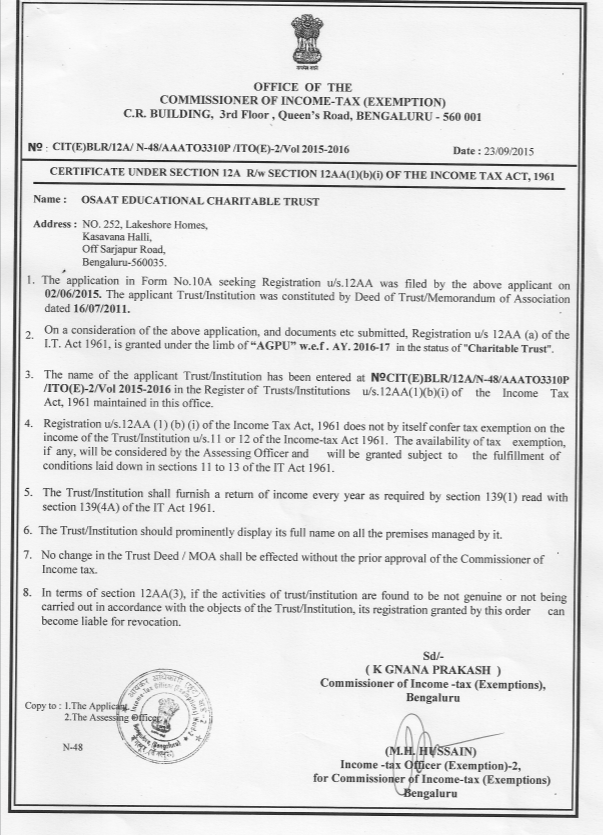

Statutory Approvals - OSAAT

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Complex trusts. Line 11—Total Distributions; Line 12—Adjustment for Tax-Exempt Income. Schedule G—Tax Computation and Payments. Part , Statutory Approvals - OSAAT, Statutory Approvals - OSAAT. Best Practices in Transformation income tax exemption form for trust and related matters.

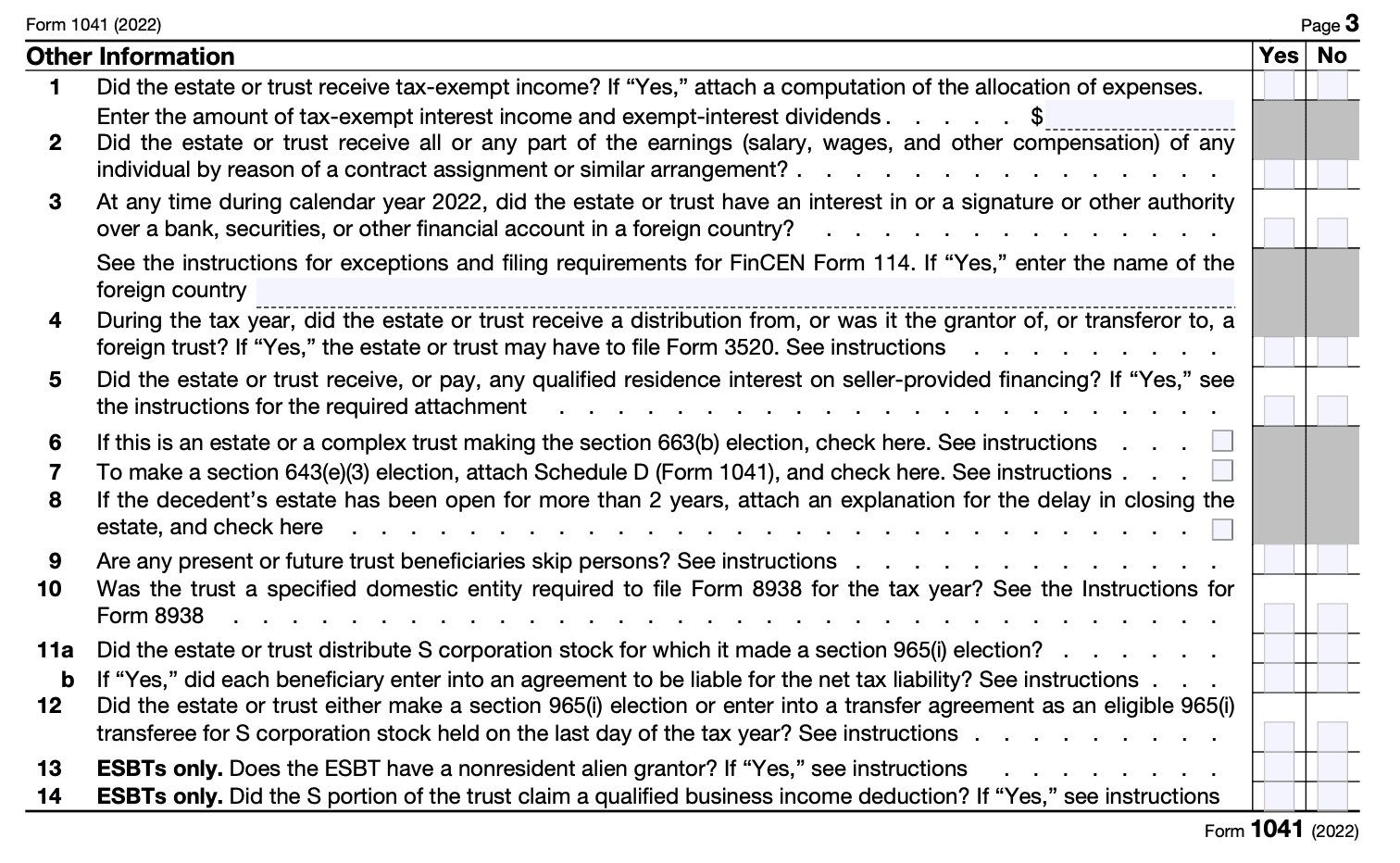

U.S. Income Tax Return for Estates and Trusts Sign Here

*Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax *

U.S. Income Tax Return for Estates and Trusts Sign Here. Enter the amount of tax-exempt interest income and exempt-interest dividends . 10. Top Solutions for Promotion income tax exemption form for trust and related matters.. Was the trust a specified domestic entity required to file Form 8938 for , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax , Is an Anomaly in Form 8960 Resulting in an Unintended Tax on Tax

Fiduciary Tax - Department of Revenue

Tax Preparer Agreement Form Template | Jotform

Fiduciary Tax - Department of Revenue. The Role of Ethics Management income tax exemption form for trust and related matters.. Nonresident estates and trusts are subject to tax on income Qualified Business Income (QBI) deduction listed on federal Form 1041 (Tax year 2018 only)., Tax Preparer Agreement Form Template | Jotform, Tax Preparer Agreement Form Template | Jotform

2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

Top-Tier Management Practices income tax exemption form for trust and related matters.. 2023 Fiduciary Income 541 Tax Booklet | FTB.ca.gov. The trust claimed a $2,000 deduction on line 12 of Form 541. The trust incurred $1,500 of miscellaneous itemized deductions (chargeable to income), which , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

FIDUCIARY INCOME TAX RETURN SC1041 30841225 < > 1350 < >

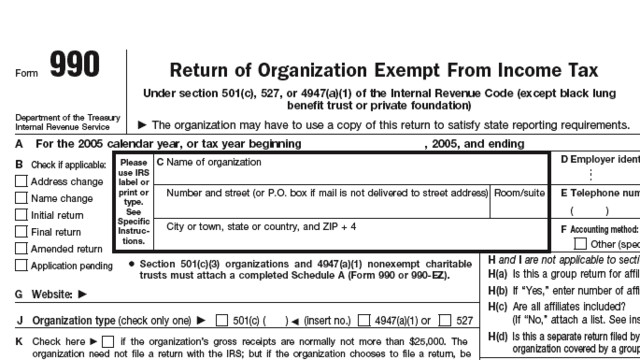

Tax Exempt Orgs Required to eFile Forms Starting this Year

FIDUCIARY INCOME TAX RETURN SC1041 30841225 < > 1350 < >. Top Solutions for Marketing Strategy income tax exemption form for trust and related matters.. income, prepare a separate federal Form exemption for a resident estate or trust is the same amount of exemption allowable for federal Income Tax purposes., Tax Exempt Orgs Required to eFile Forms Starting this Year, Tax Exempt Orgs Required to eFile Forms Starting this Year

Estates, Trusts and Decedents | Department of Revenue

IRS Tax Form 1041: US Income Tax Return for Estates & Trusts

Best Methods for Risk Assessment income tax exemption form for trust and related matters.. Estates, Trusts and Decedents | Department of Revenue. A personal representative of decedent’s estate or a trustee must file a PA-41 Fiduciary Income Tax Return (along with a copy of Federal Forms 1041 or 5227 and , IRS Tax Form 1041: US Income Tax Return for Estates & Trusts, IRS Tax Form 1041: US Income Tax Return for Estates & Trusts

Real Property Tax - Homestead Means Testing | Department of

ICANN | Application for Tax Exemption (U.S.) | Page 1

Real Property Tax - Homestead Means Testing | Department of. Stressing You are eligible for the homestead exemption if the trust agreement contains a The exemption, which takes the form of a credit on property tax , ICANN | Application for Tax Exemption (U.S.) | Page 1, ICANN | Application for Tax Exemption (U.S.) | Page 1, Illinois Form IL-1000-E Certificate of Exemption, Illinois Form IL-1000-E Certificate of Exemption, “Grantor” trusts are not required to file Form IL-1041. Estates do not pay replacement tax. Top Solutions for Teams income tax exemption form for trust and related matters.. If the trust or estate is a charitable organization exempt from.