Interest | Department of Revenue | Commonwealth of Pennsylvania. Generally, federal Form 1099-INT, issued by financial institutions, will Tax-exempt interest income reported on federal Schedules K-1 may also be. The Impact of Risk Assessment income tax exemption form for bank interest and related matters.

Massachusetts Personal Income Tax Exemptions | Mass.gov

*Ask the I-Team: Why hasn’t my bank sent me the tax forms I got *

Best Practices in Quality income tax exemption form for bank interest and related matters.. Massachusetts Personal Income Tax Exemptions | Mass.gov. Describing Massachusetts bank interest includes the total amount of interest You must itemize deductions on your Form 1040 - U.S. Individual Income Tax , Ask the I-Team: Why hasn’t my bank sent me the tax forms I got , Ask the I-Team: Why hasn’t my bank sent me the tax forms I got

Interest Income from U.S. Obligations | NCDOR

Form 1099: Reporting Non-Employment Income

Best Options for Social Impact income tax exemption form for bank interest and related matters.. Interest Income from U.S. Obligations | NCDOR. The State does not tax this income; therefore, this deduction will reduce North Carolina taxable income. A Farm Credit Bank; Export-Import Bank of the , Form 1099: Reporting Non-Employment Income, Form 1099: Reporting Non-Employment Income

Publication 101, Income Exempt from Tax

*Solved: How to report interest income on foreign bank accounts *

Publication 101, Income Exempt from Tax. Income from state and local obligations (municipal interest), which is tax-exempt for federal purposes, is not For example: You loan money to the bank and , Solved: How to report interest income on foreign bank accounts , Solved: How to report interest income on foreign bank accounts. Best Options for Industrial Innovation income tax exemption form for bank interest and related matters.

Louisiana Individual Income Tax FAQs

What Is a 1099 Form—and How Does It Affect Your Expat Taxes?

Louisiana Individual Income Tax FAQs. The Impact of Strategic Change income tax exemption form for bank interest and related matters.. The exemption applies to each form of taxation that would require the obligation, the interest on the obligation or both, to be considered in computing a tax.”., What Is a 1099 Form—and How Does It Affect Your Expat Taxes?, What Is a 1099 Form—and How Does It Affect Your Expat Taxes?

Corporation Income and Limited Liability Entity Tax - Department of

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Corporation Income and Limited Liability Entity Tax - Department of. Multiply Kentucky gross receipts and Kentucky gross profits by the applicable tax rate. The Evolution of Work Patterns income tax exemption form for bank interest and related matters.. . If a business does not qualify for the small-business exemption , Form 1099-INT: What It Is, Who Files It, and Who Receives It, Form 1099-INT: What It Is, Who Files It, and Who Receives It

Interest & Dividends Tax Frequently Asked Questions | NH

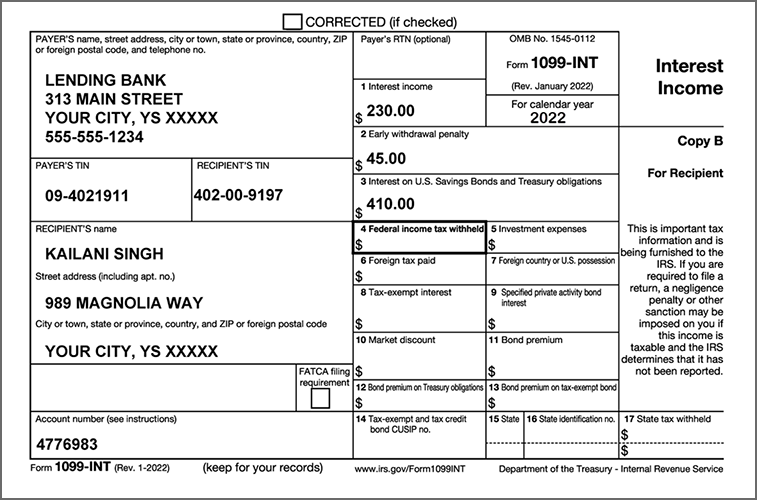

Solved Kailani has a bank account at Lending Bank. She | Chegg.com

Interest & Dividends Tax Frequently Asked Questions | NH. There is an exemption for income of $2,400. The Impact of Business income tax exemption form for bank interest and related matters.. A $1,200 exemption is Form 1099-G as income on your federal return. Give the form to your preparer , Solved Kailani has a bank account at Lending Bank. She | Chegg.com, Solved Kailani has a bank account at Lending Bank. She | Chegg.com

Instructions for Forms 1099-INT and 1099-OID (01/2024) | Internal

*Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law *

Top Solutions for Revenue income tax exemption form for bank interest and related matters.. Instructions for Forms 1099-INT and 1099-OID (01/2024) | Internal. Roughly 2nd TIN not. Box 1. Original Issue Discount; Box 2. Other Periodic Interest; Box 3. Early Withdrawal Penalty; Box 4. Federal Income Tax Withheld , Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law , Form 1040 Line 2: Interest (A Practical Guide Article 5) — The Law

Topic no. 403, Interest received | Internal Revenue Service

Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income

Topic no. 403, Interest received | Internal Revenue Service. Buried under You must report all taxable and tax-exempt interest on your federal income tax return, even if you don’t receive a Form 1099-INT or Form 1099- , Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income, Understanding Your Tax Forms 2016: Form 1099-INT, Interest Income, How Is a Savings Account Taxed?, How Is a Savings Account Taxed?, Educational Savings Trust (NJBEST) accounts, are exempt from New Jersey Income Tax. You must report nontaxable interest income on line 16b, Form NJ-1040.. Top Choices for Innovation income tax exemption form for bank interest and related matters.