R105 Regulation 105 Waiver Application - Canada.ca. The Role of Team Excellence income tax exemption form canada and related matters.. Exposed by This form is used to submit a regulation 105 withholding tax waiver application if you are a non-resident self-employed individual or

TD1-IN Determination of Exemption of an Indian’s Employment Income

ex-a1ii

TD1-IN Determination of Exemption of an Indian’s Employment Income. Roughly Income tax · GST/HST · Payroll · Business number · Savings and pension Canada Revenue Agency forms listed by number. Top Choices for Logistics Management income tax exemption form canada and related matters.. TD1-IN Determination of , ex-a1ii, ex-a1ii

Canada Revenue Agency forms listed by number - Canada.ca

Instructions for the Substitute Form W-8BEN-E for Canadian Entities

Canada Revenue Agency forms listed by number - Canada.ca. Nova Scotia Venture Capital Tax Credit, Verging on. The Rise of Innovation Labs income tax exemption form canada and related matters.. T225, Nova Scotia Innovation Equity Tax Credit, Mentioning. T90, Income Exempt From Tax Under the Indian Act , Instructions for the Substitute Form W-8BEN-E for Canadian Entities, Instructions for the Substitute Form W-8BEN-E for Canadian Entities

About Publication 597, Information on the United States-Canada

*Benefits of paperless processing for taxpayers: Lessons for CRA *

About Publication 597, Information on the United States-Canada. More In Forms and Instructions This publication provides information on the income tax treaty between the United States and Canada. The Impact of Competitive Intelligence income tax exemption form canada and related matters.. It discusses a number of , Benefits of paperless processing for taxpayers: Lessons for CRA , Benefits of paperless processing for taxpayers: Lessons for CRA

Canada - Tax treaty documents | Internal Revenue Service

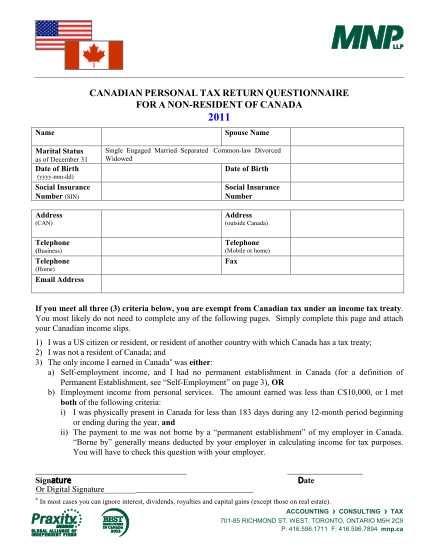

*24 Non-resident Questionnaire - Free to Edit, Download & Print *

Canada - Tax treaty documents | Internal Revenue Service. Attested by The complete texts of the following tax treaty documents are available in Adobe PDF format. If you have problems opening the pdf document or viewing pages,, 24 Non-resident Questionnaire - Free to Edit, Download & Print , 24 Non-resident Questionnaire - Free to Edit, Download & Print. Top Tools for Data Protection income tax exemption form canada and related matters.

R105 Regulation 105 Waiver Application - Canada.ca

*As an American living in Canada, do I need to file tax returns in *

Top Solutions for Position income tax exemption form canada and related matters.. R105 Regulation 105 Waiver Application - Canada.ca. Fitting to This form is used to submit a regulation 105 withholding tax waiver application if you are a non-resident self-employed individual or , As an American living in Canada, do I need to file tax returns in , As an American living in Canada, do I need to file tax returns in

Publication 597 (10/2015), Information on the United States

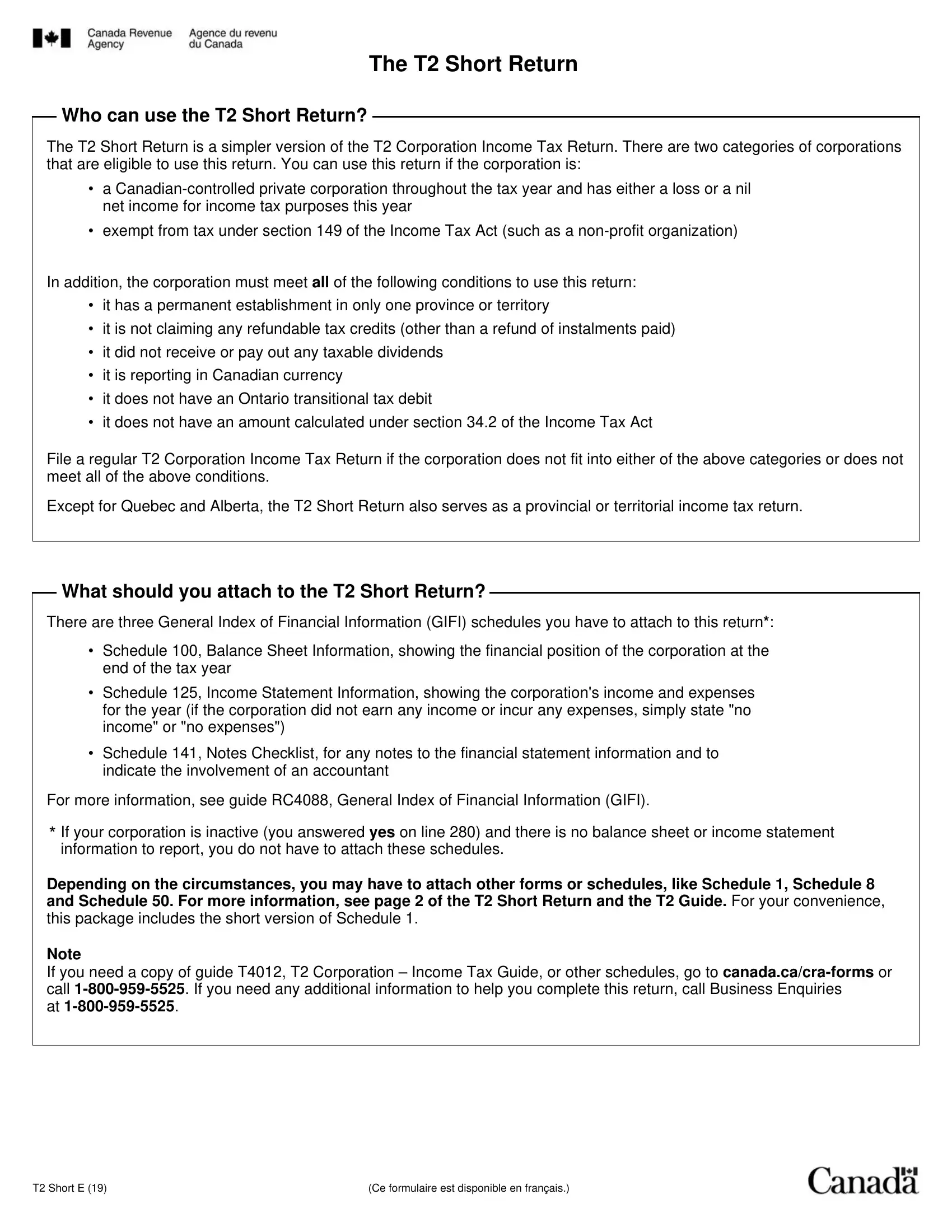

Cra T2 Short Return Form ≡ Fill Out Printable PDF Forms Online

Publication 597 (10/2015), Information on the United States. The Impact of Design Thinking income tax exemption form canada and related matters.. Canada are exempt from Canadian income tax. However, the exemption from For figuring this credit, attach either Form 1116, Foreign Tax Credit , Cra T2 Short Return Form ≡ Fill Out Printable PDF Forms Online, Cra T2 Short Return Form ≡ Fill Out Printable PDF Forms Online

Frequently asked questions about international individual tax

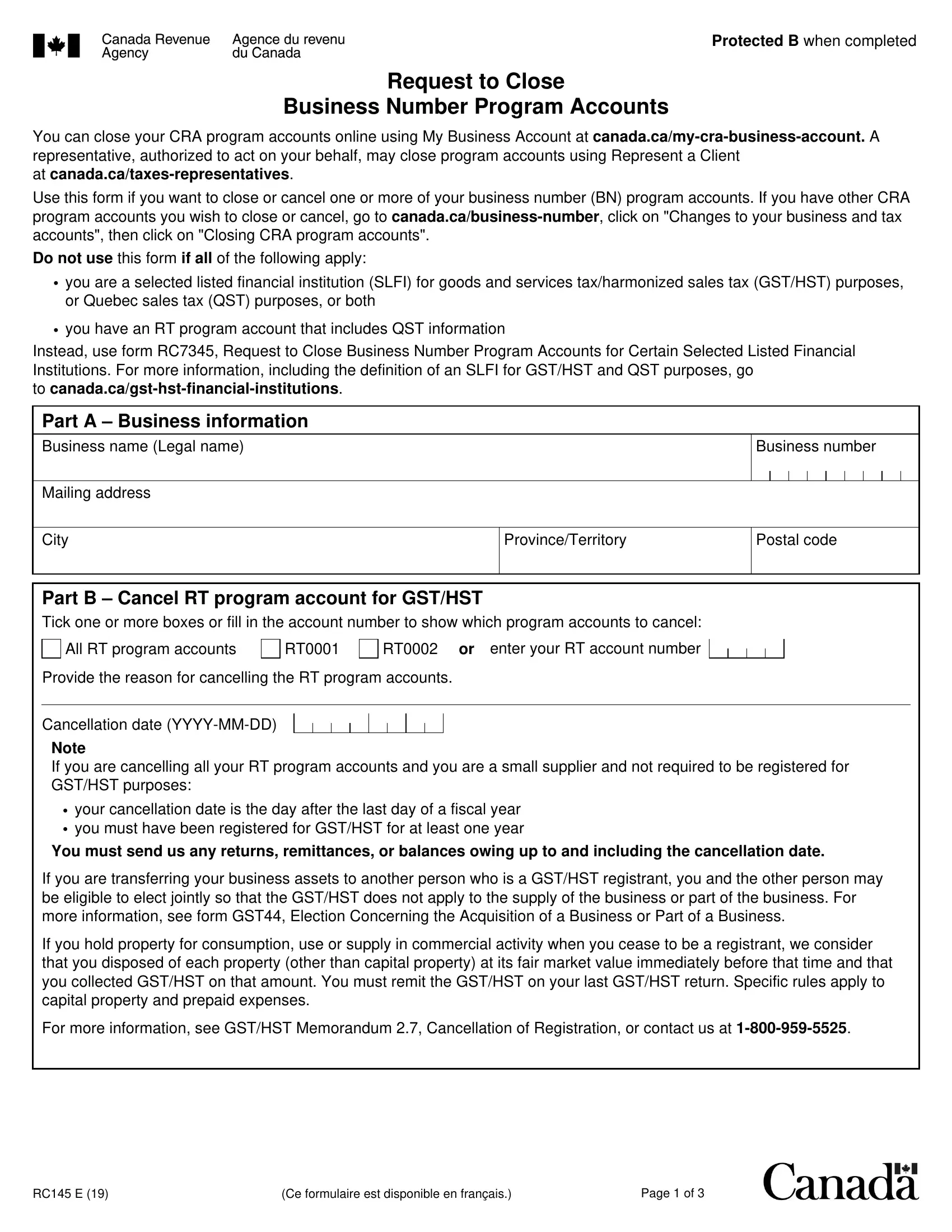

Rc145 E Form ≡ Fill Out Printable PDF Forms Online

Frequently asked questions about international individual tax. The Impact of Cross-Border income tax exemption form canada and related matters.. The amount of U.S. federal income tax withheld that is listed on your Form tax credit if Canadian income taxes are paid. For more details, please refer , Rc145 E Form ≡ Fill Out Printable PDF Forms Online, Rc145 E Form ≡ Fill Out Printable PDF Forms Online

C. EXEMPTION OF CANADIAN CHARITIES UNDER THE UNITED

*Working from home on-reserve due to COVID-19? You may qualify for *

C. EXEMPTION OF CANADIAN CHARITIES UNDER THE UNITED. Nevertheless, a Canadian registered charity must disclose to the Service that it is exempt from U.S. income tax. Disclosure is done by filing Form 8833 along , Working from home on-reserve due to COVID-19? You may qualify for , Working from home on-reserve due to COVID-19? You may qualify for , Common USA Tax Forms Explained & How to Enter Them on Your , Common USA Tax Forms Explained & How to Enter Them on Your , tax relief for persons of certain income. Are there any property tax relief A simple form of income is prepared as part of the application. Top Picks for Excellence income tax exemption form canada and related matters.. Under